- Taiwan

- /

- Auto Components

- /

- TWSE:6605

Undiscovered Gems to Explore This November 2024

Reviewed by Simply Wall St

As global markets react to shifting policies under the new Trump administration, with sectors like financials and energy seeing gains while others face uncertainty, small-cap stocks have shown mixed performance amid these broader economic developments. With the S&P 600 and other indices reflecting this volatility, investors may find opportunities in lesser-known companies that demonstrate resilience and potential for growth despite current market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shree Digvijay Cement | 21.42% | 13.22% | 13.00% | ★★★★★☆ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

DREAMTECH (KOSE:A192650)

Simply Wall St Value Rating: ★★★★★★

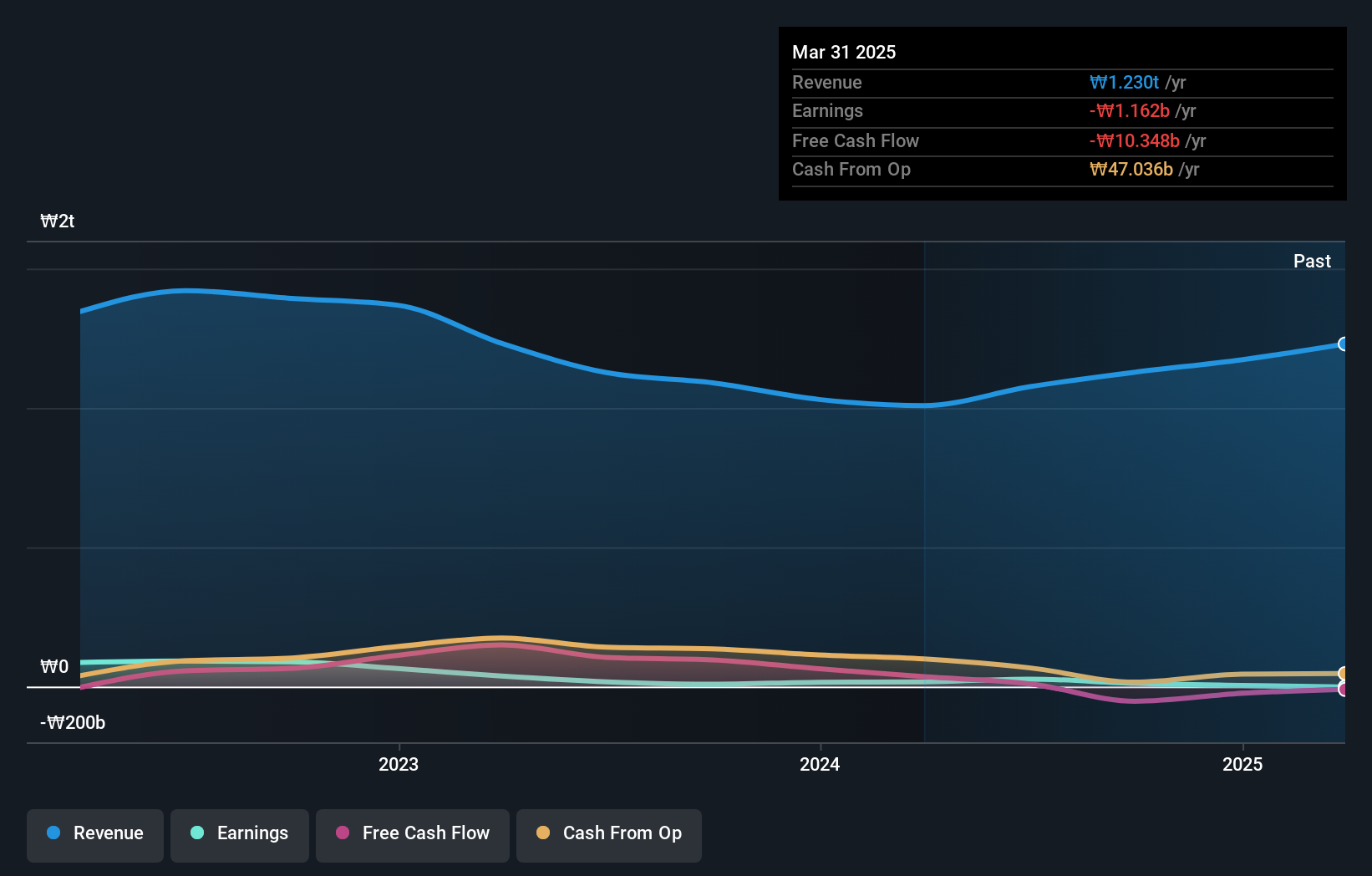

Overview: DREAMTECH Co., Ltd. is involved in the design, development, and manufacture of modules both in South Korea and internationally, with a market capitalization of ₩566.99 billion.

Operations: DREAMTECH generates revenue primarily from IT & Mobile Communications and Compact Camera Module (CCM) segments, contributing ₩438.89 billion and ₩395.34 billion respectively. The Biometrics, Healthcare & Convergence segment adds ₩240.81 billion to the revenue stream.

DREAMTECH is capturing attention with its impressive financial metrics and recent strategic moves. The company boasts a net debt to equity ratio of 2.4%, which is deemed satisfactory, while its earnings have grown by 58.6% in the past year, outpacing the overall electronic industry growth of 0.5%. Trading at 67.5% below estimated fair value, DREAMTECH appears undervalued, offering potential for investors seeking hidden opportunities. Additionally, it has completed a share repurchase program worth KRW 547.63 million for 60,850 shares recently, signaling confidence in its own prospects and commitment to shareholder value enhancement.

- Click here to discover the nuances of DREAMTECH with our detailed analytical health report.

Examine DREAMTECH's past performance report to understand how it has performed in the past.

Sri Trang Gloves (Thailand) (SET:STGT)

Simply Wall St Value Rating: ★★★★★★

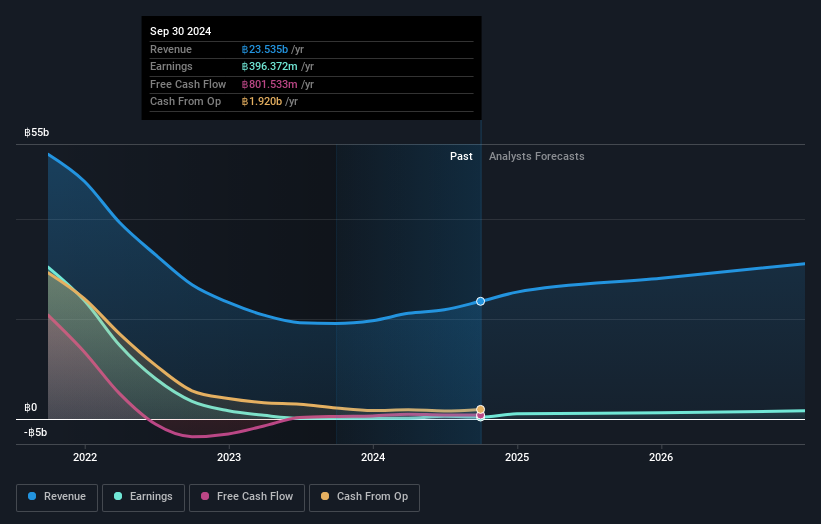

Overview: Sri Trang Gloves (Thailand) Public Company Limited, along with its subsidiaries, is involved in the production and global distribution of rubber gloves, with a market capitalization of THB28.22 billion.

Operations: The primary revenue stream for Sri Trang Gloves (Thailand) comes from its glove segment, generating THB23.30 billion. The company has a market capitalization of THB28.22 billion and operates internationally across several key markets.

Sri Trang Gloves, a notable player in the medical equipment sector, has shown impressive financial resilience despite recent volatility. Over the past year, earnings surged by 153%, outpacing industry averages. The company's debt to equity ratio significantly improved from 155% to 19% over five years, showcasing prudent financial management. Although recent results reported a third-quarter net loss of THB 86 million compared to last year's profit, nine-month figures paint a brighter picture with net income reaching THB 439 million. With high-quality earnings and satisfactory debt levels at just 4%, Sri Trang seems poised for continued growth within its niche market.

- Navigate through the intricacies of Sri Trang Gloves (Thailand) with our comprehensive health report here.

Understand Sri Trang Gloves (Thailand)'s track record by examining our Past report.

Depo Auto Parts Industrial (TWSE:6605)

Simply Wall St Value Rating: ★★★★★★

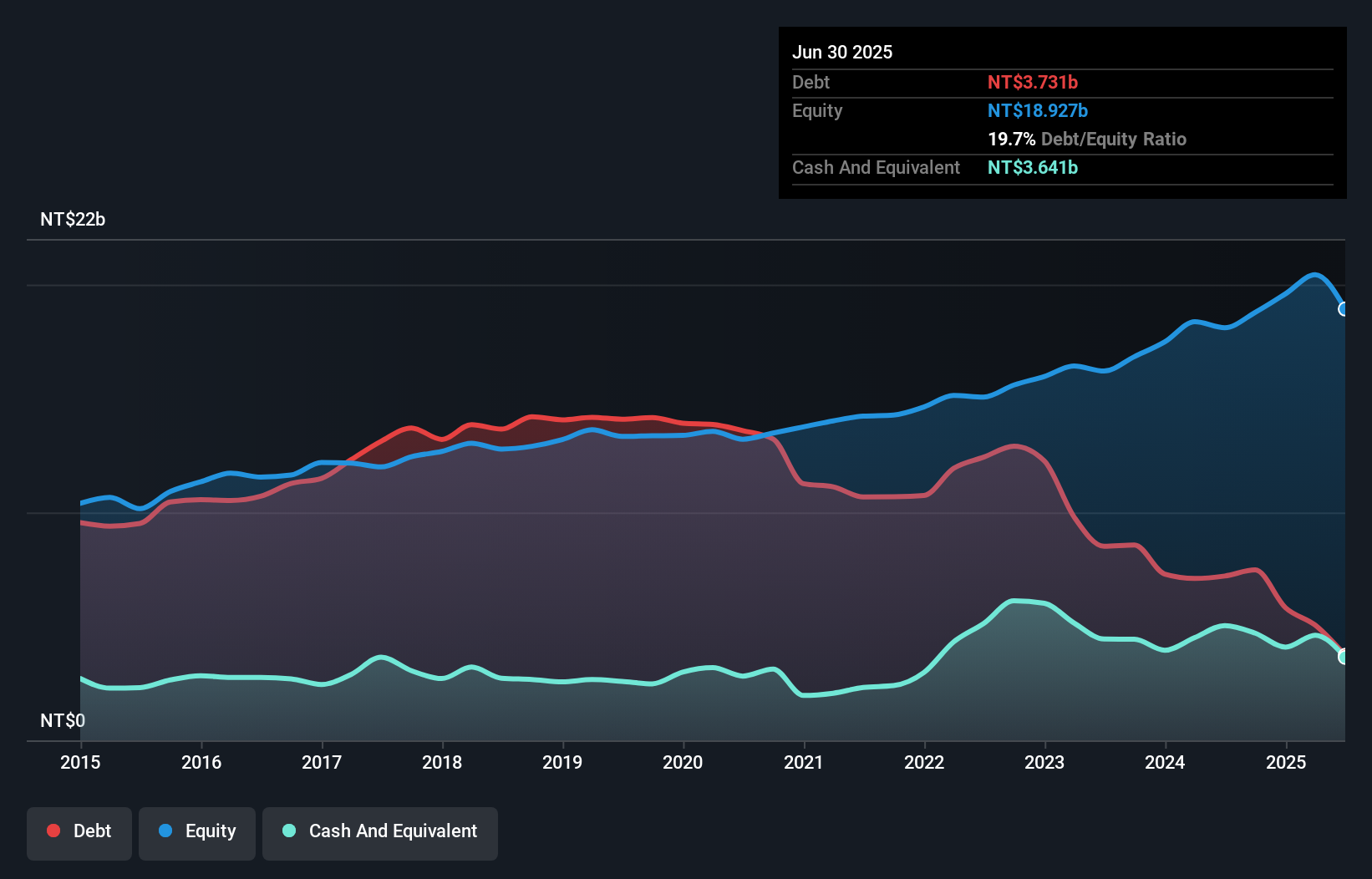

Overview: Depo Auto Parts Industrial Co., Ltd. specializes in the manufacturing and sale of automotive and related lighting products, with a market cap of NT$37.31 billion.

Operations: Depo Auto Parts Industrial generates revenue primarily from the sale of automotive and related lighting products. The company reported a market capitalization of NT$37.31 billion.

Depo Auto Parts Industrial, a nimble player in the auto components sector, showcases robust financial health with a net debt to equity ratio of 14.6%, deemed satisfactory. Its earnings growth of 43% outpaced the industry's 11.4% rise over the past year, highlighting its competitive edge. The company reported Q3 sales of TWD 4,948 million and net income of TWD 639 million, reflecting steady progress from last year's figures. With high-quality earnings and interest payments well-covered by EBIT at a multiple of 9.9x, Depo appears undervalued by about 35% against fair market estimates, suggesting potential upside for investors seeking value opportunities in this space.

Make It Happen

- Click through to start exploring the rest of the 4643 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6605

Depo Auto Parts Industrial

Manufactures and sells automotive and other related lighting products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives