- China

- /

- Metals and Mining

- /

- SZSE:000923

3 Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, marked by inflation concerns and political uncertainties, investors are increasingly seeking stability amid volatile conditions. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

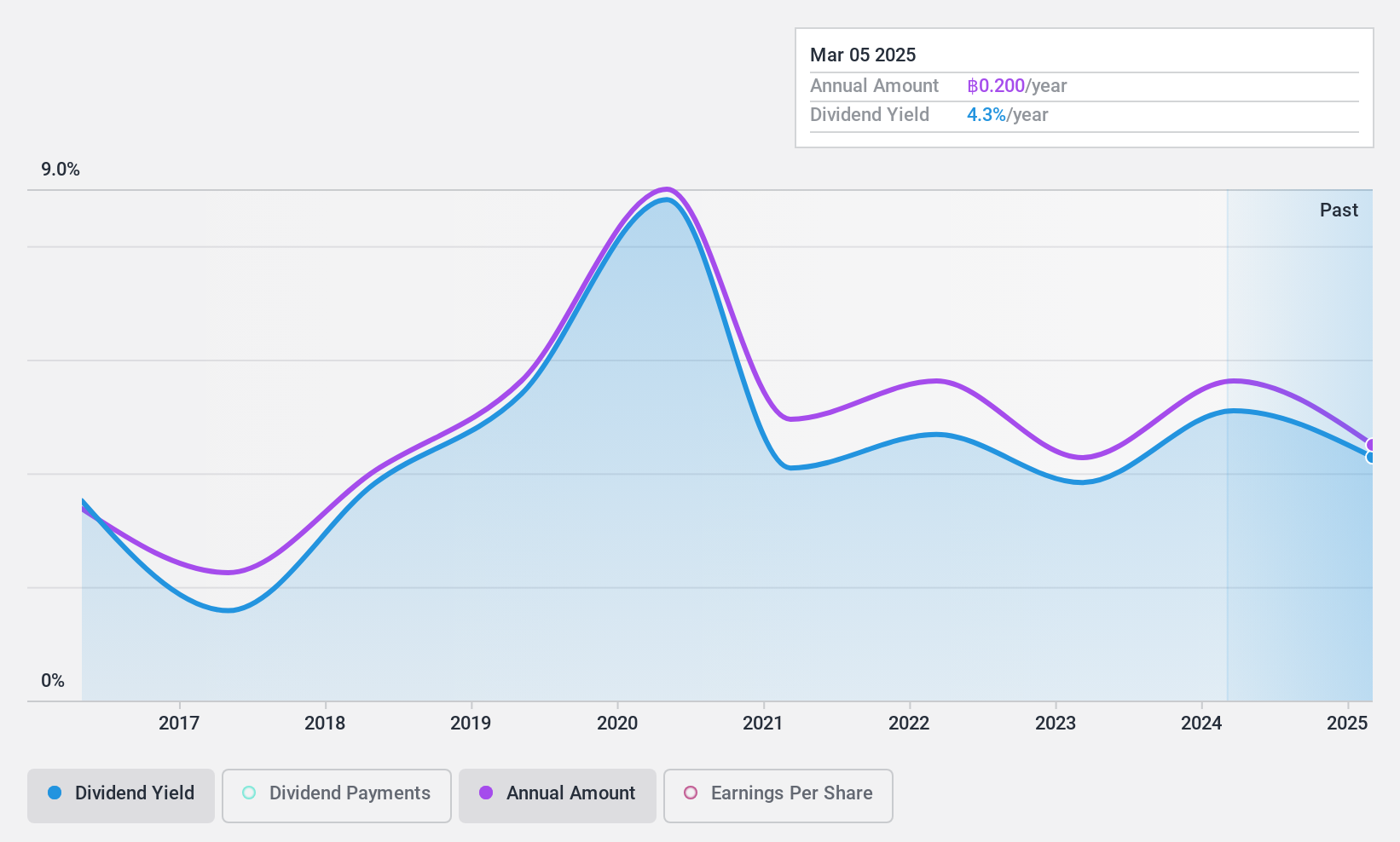

Lam Soon (Thailand) (SET:LST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lam Soon (Thailand) Public Company Limited manufactures and distributes palm oil in Thailand with a market cap of THB3.99 billion.

Operations: Lam Soon (Thailand) Public Company Limited generates revenue primarily from palm oil, amounting to THB9.20 billion, and also from processed fruits and vegetables, contributing THB2.90 billion.

Dividend Yield: 5.1%

Lam Soon (Thailand) offers a mixed dividend profile, with dividends covered by earnings and cash flows due to payout ratios of 40% and 51.5%, respectively. Despite trading at 38% below its estimated fair value, the company has an unstable dividend track record marked by volatility over the past decade. Recent earnings showed improved quarterly performance with THB 184.09 million in net income, but nine-month figures remained flat year-over-year at THB 385.89 million.

- Dive into the specifics of Lam Soon (Thailand) here with our thorough dividend report.

- The valuation report we've compiled suggests that Lam Soon (Thailand)'s current price could be quite moderate.

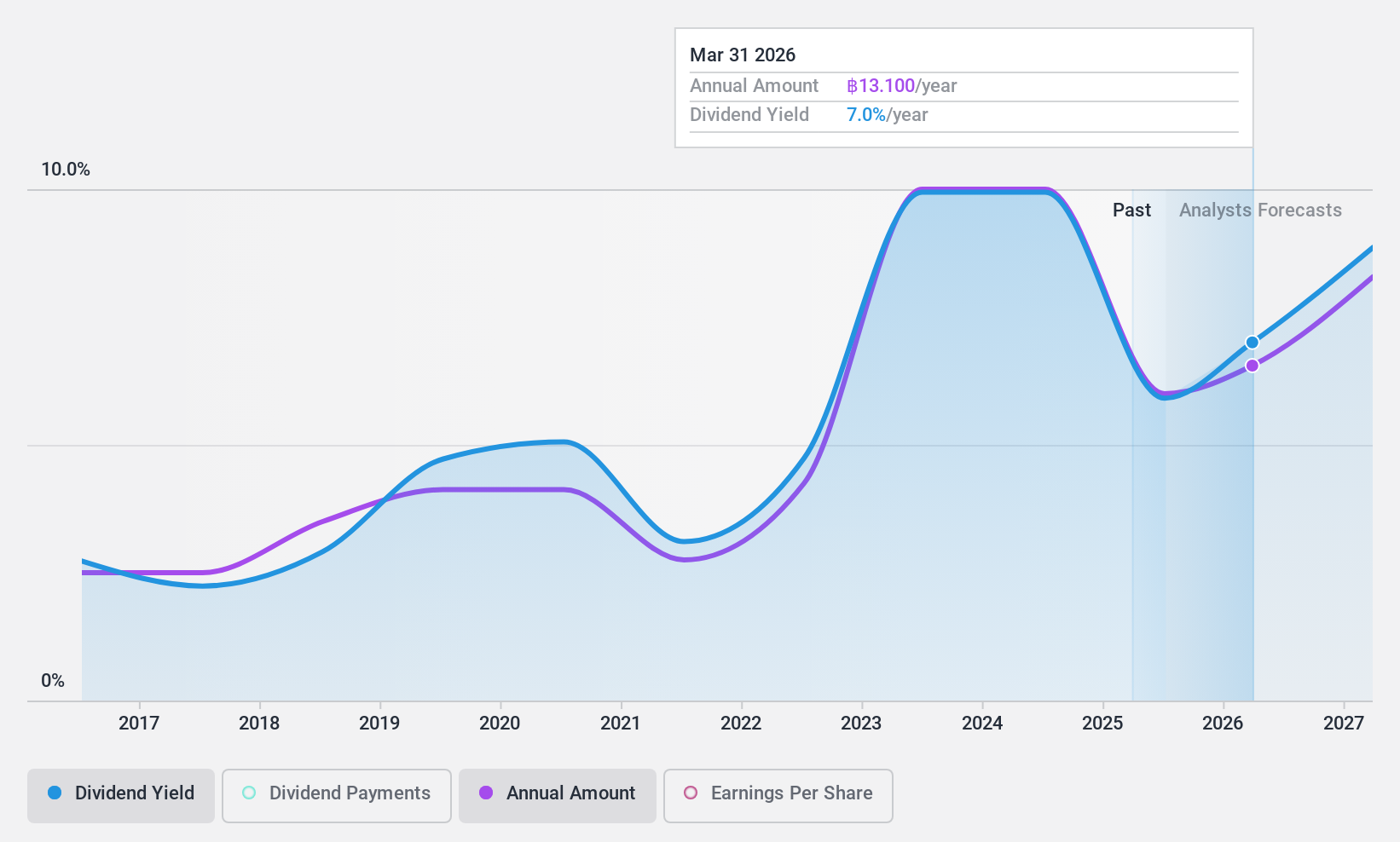

Thai Stanley Electric (SET:STANLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Stanley Electric Public Company Limited operates in Thailand, manufacturing and selling automotive bulbs, lighting equipment, molds and dies, and product designs with a market cap of THB16.70 billion.

Operations: Thai Stanley Electric's revenue primarily comes from its automotive bulbs, lighting equipment, molds and dies, and product designs segments, totaling THB13.56 billion.

Dividend Yield: 9.2%

Thai Stanley Electric's dividend yield of 9.17% ranks in the top 25% of Thai market payers, but its sustainability is questionable due to a high payout ratio of 96.9%. Despite cash flow coverage with an 83.5% cash payout ratio, dividends have been volatile over the past decade and not reliably growing. Recent earnings showed a decline, with net income dropping to THB 327.16 million from THB 495.48 million year-over-year for Q2 2024.

- Take a closer look at Thai Stanley Electric's potential here in our dividend report.

- Upon reviewing our latest valuation report, Thai Stanley Electric's share price might be too optimistic.

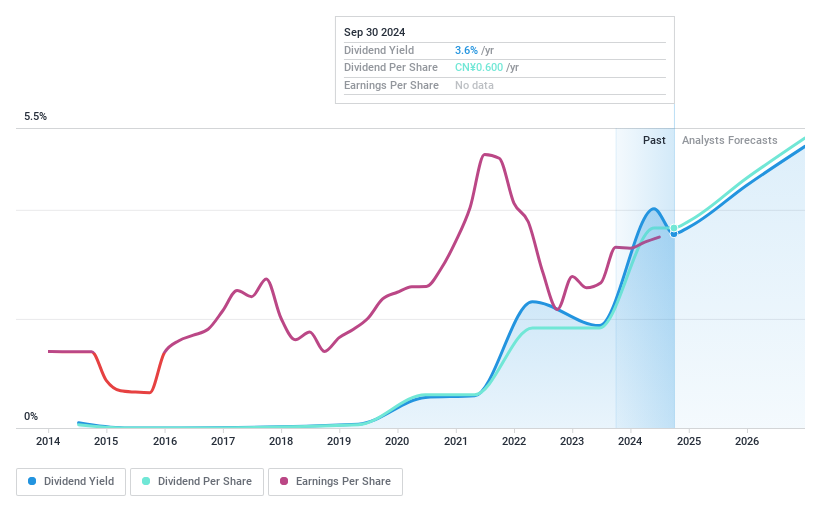

HBIS Resources (SZSE:000923)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HBIS Resources Co., Ltd. operates in the mining, processing, selling, and servicing of mineral products across Asia, Africa, Europe, and the Americas with a market cap of CN¥8.90 billion.

Operations: HBIS Resources Co., Ltd.'s revenue segments include the mining, processing, selling, and servicing of mineral products across various global regions.

Dividend Yield: 4.4%

HBIS Resources' dividend yield of 4.4% is among the top 25% in the CN market, supported by a low payout ratio of 47.6%, indicating dividends are well covered by earnings despite an 89.2% cash payout ratio. However, dividends have been volatile over the past decade, raising concerns about reliability and stability. Recent earnings showed a decline in net income to CNY 577.59 million for nine months ending September 2024, down from CNY 666.77 million year-over-year.

- Get an in-depth perspective on HBIS Resources' performance by reading our dividend report here.

- According our valuation report, there's an indication that HBIS Resources' share price might be on the cheaper side.

Turning Ideas Into Actions

- Access the full spectrum of 2016 Top Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HBIS Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HBIS Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000923

HBIS Resources

Engages in the mining, processing, selling, and servicing of mineral products in Asia, Africa, Europe, and the Americas.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives