- Thailand

- /

- Oil and Gas

- /

- SET:PTT

Top Dividend Stocks Including Bangkok Dusit Medical Services

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and geopolitical uncertainties, U.S. stock indexes are approaching record highs, driven by growth stocks outpacing value shares. In such a dynamic environment, dividend stocks continue to attract attention for their potential to provide steady income streams, with companies like Bangkok Dusit Medical Services exemplifying the attributes investors often seek in reliable dividend-paying stocks.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

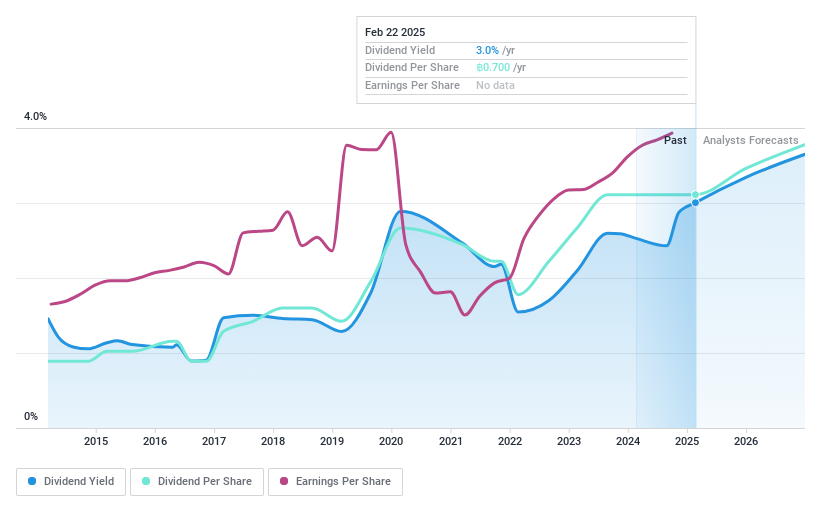

Bangkok Dusit Medical Services (SET:BDMS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bangkok Dusit Medical Services Public Company Limited, along with its subsidiaries, operates hospitals in Thailand and internationally, with a market cap of THB355.98 billion.

Operations: The primary revenue segment for Bangkok Dusit Medical Services Public Company Limited is its hospital operations, generating THB106.99 billion.

Dividend Yield: 3%

Bangkok Dusit Medical Services faces challenges for dividend investors due to a volatile and unreliable dividend history over the past decade. Despite this, the company's dividends are supported by earnings with a payout ratio of 71.2% and cash flows with an 89.6% cash payout ratio, indicating sustainability in payments. However, its 3% yield is low compared to top Thai dividend payers, and analysts expect significant stock price appreciation from current levels.

- Navigate through the intricacies of Bangkok Dusit Medical Services with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Bangkok Dusit Medical Services is priced lower than what may be justified by its financials.

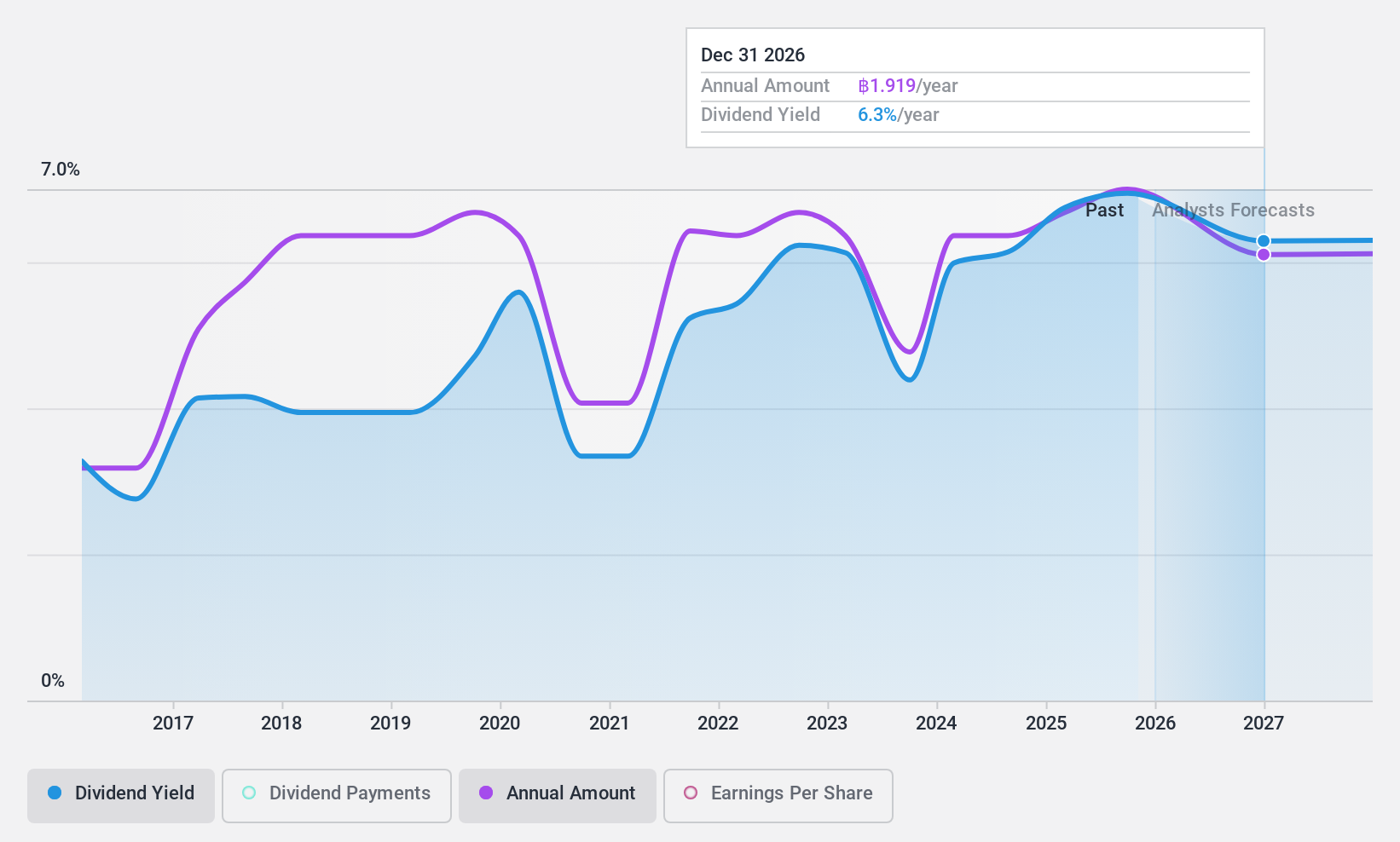

PTT (SET:PTT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PTT Public Company Limited, along with its subsidiaries, operates in the petroleum industry across Thailand and internationally, with a market capitalization of THB885.45 billion.

Operations: PTT Public Company Limited's revenue segments include Downstream Petroleum - International Trading at THB2.07 billion, Downstream Petroleum - Petrochemicals and Refining at THB1.38 billion, Downstream Petroleum - Oil and Retail at THB733.67 million, Upstream Petroleum and Natural Gas - Natural Gas at THB602.37 million, New Business and Sustainability (NBS) at THB120.10 million, and Upstream Petroleum and Natural Gas - Petroleum Exploration and Production at THB315.42 million.

Dividend Yield: 6.4%

PTT's dividends are well-covered, with a 50.2% payout ratio from earnings and 38% from cash flows, suggesting sustainability despite a volatile dividend history over the past decade. The stock trades significantly below its estimated fair value, offering potential upside. However, PTT's dividend yield of 6.4% is modest compared to top Thai payers at 7.58%. Recent board meetings discussed strategic changes and the dissolution of a subsidiary, potentially impacting future financials and dividends.

- Click to explore a detailed breakdown of our findings in PTT's dividend report.

- The analysis detailed in our PTT valuation report hints at an deflated share price compared to its estimated value.

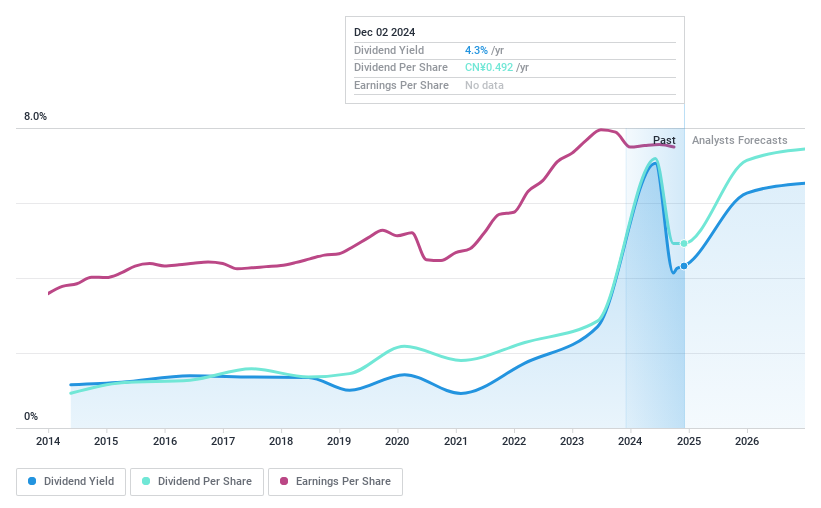

Ping An Bank (SZSE:000001)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ping An Bank Co., Ltd. offers commercial banking products and services to individuals, corporations, government agencies, institutions, and small businesses both in China and internationally with a market cap of CN¥224.14 billion.

Operations: Ping An Bank Co., Ltd.'s revenue segments include commercial banking services for individuals, corporations, government agencies, institutions, and small businesses across China and international markets.

Dividend Yield: 4.2%

Ping An Bank's dividend yield of 4.18% ranks in the top 25% within the CN market, supported by a low payout ratio of 42.9%, indicating sustainable dividends despite historical volatility. The forecasted payout ratio is expected to decrease to 29.8% in three years, further ensuring coverage by earnings. Trading at approximately 29.7% below its estimated fair value suggests potential upside, though investors should consider its unstable dividend track record when assessing reliability.

- Unlock comprehensive insights into our analysis of Ping An Bank stock in this dividend report.

- In light of our recent valuation report, it seems possible that Ping An Bank is trading behind its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 1965 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PTT

PTT

Engages in petroleum business in Thailand, rest of Asia, Europe, the Americas, and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives