- United Arab Emirates

- /

- Banks

- /

- ADX:ADIB

Three Compelling Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by climbing U.S. stock indexes and heightened inflation expectations, investors are increasingly seeking stable income sources amid economic uncertainties. In this environment, dividend stocks stand out as an attractive option, offering the potential for regular income while also benefiting from the overall market's upward momentum.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1989 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Abu Dhabi Islamic Bank PJSC (ADX:ADIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Islamic Bank PJSC offers banking, financing, and investing services across the United Arab Emirates, the Middle East, and internationally with a market cap of AED58.91 billion.

Operations: Abu Dhabi Islamic Bank PJSC's revenue is primarily derived from Global Retail Banking (AED5.28 billion), Global Wholesale Banking (AED1.67 billion), Associates & Subsidiaries (AED1.43 billion), Private Banking (AED243.41 million), Real Estate (AED166.53 million), and Treasury operations (AED163.80 million).

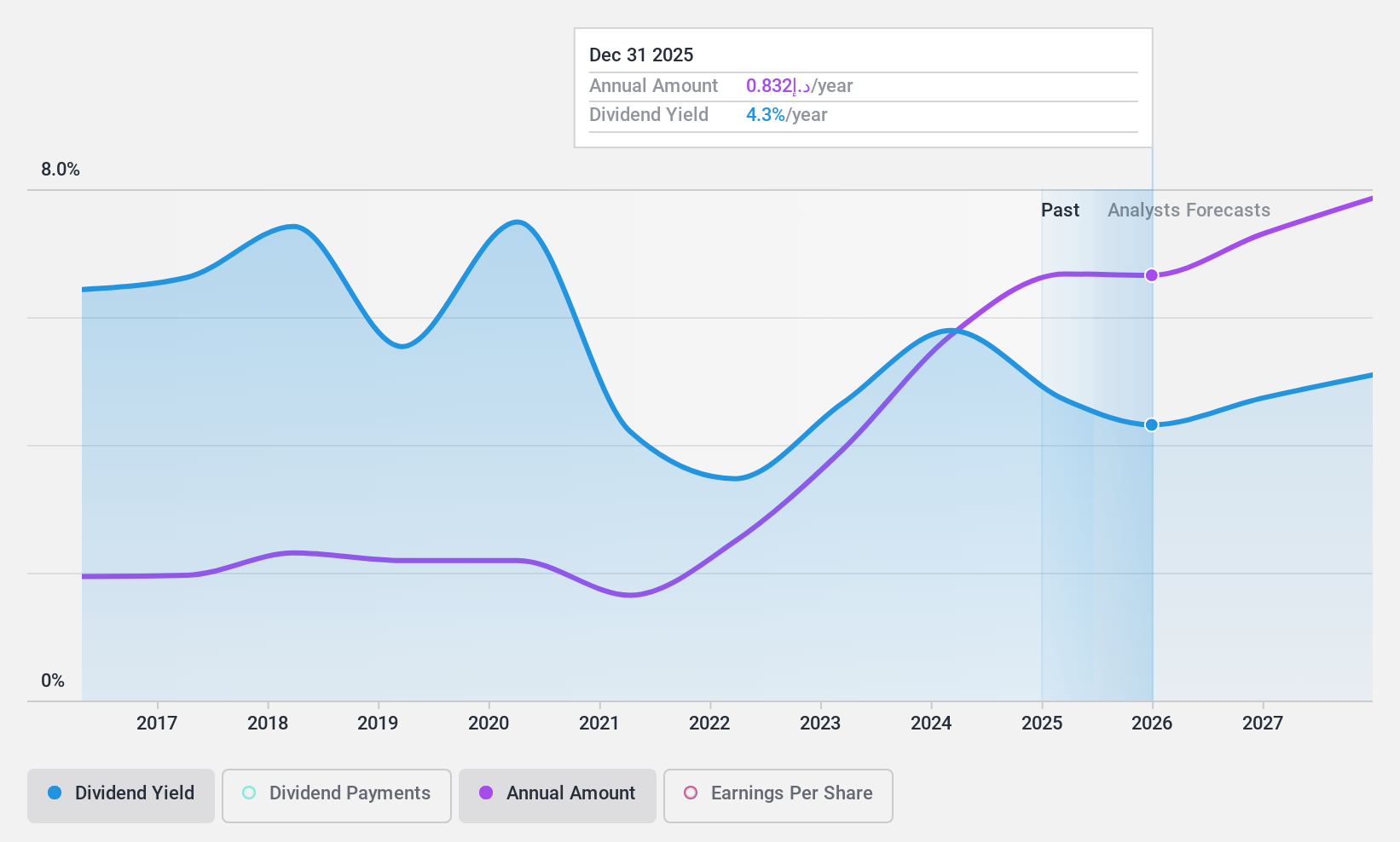

Dividend Yield: 4.9%

Abu Dhabi Islamic Bank PJSC's dividend is covered by earnings with a payout ratio of 55.9%, and this coverage is forecast to remain sustainable over the next three years at 52.5%. Despite a history of volatile dividends, payments have grown over the past decade. The bank faces challenges with a high bad loan ratio of 3.6% and offers a lower dividend yield (4.95%) compared to top AE market payers (6.27%). Recent earnings show growth in net income for 2024, indicating potential stability in financial performance.

- Dive into the specifics of Abu Dhabi Islamic Bank PJSC here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Abu Dhabi Islamic Bank PJSC shares in the market.

JMT Network Services (SET:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JMT Network Services Public Company Limited, along with its subsidiaries, offers debt tracking and collection services for financial institutions and entrepreneurs in Thailand, with a market cap of THB20.73 billion.

Operations: JMT Network Services Public Company Limited generates revenue primarily from its Non-Performing Accounts Receivable Management Business at THB4.33 billion, followed by its Debt Collection Business at THB263 million and Insurance Business at THB232 million.

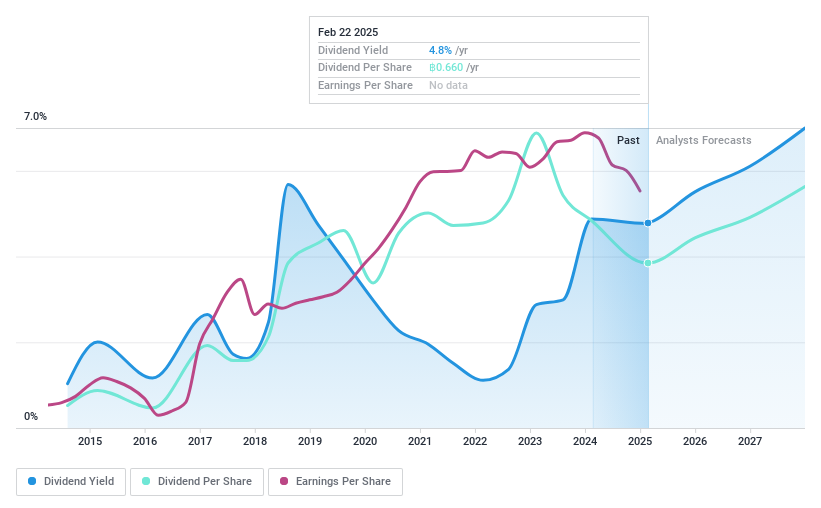

Dividend Yield: 4.7%

JMT Network Services' dividend payments are covered by earnings, with a payout ratio of 59.6%, and cash flows at 87.6%. However, the company has a history of volatile and unreliable dividends over the past decade. Recent financial results show a decline in net income to THB 1.62 billion for 2024, down from THB 2.01 billion in the previous year, which may impact future dividend stability despite ongoing growth initiatives like its joint venture with Axinan (Thailand).

- Click here and access our complete dividend analysis report to understand the dynamics of JMT Network Services.

- Our comprehensive valuation report raises the possibility that JMT Network Services is priced higher than what may be justified by its financials.

Forcelead Technology (TPEX:6996)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Forcelead Technology Corp. is an IC design company focused on the research, development, and sale of display driver chips and touch integrated driver chips both in Taiwan and internationally, with a market cap of NT$9.20 billion.

Operations: Forcelead Technology Corp. generates revenue primarily from its Semiconductors segment, amounting to NT$2.96 billion.

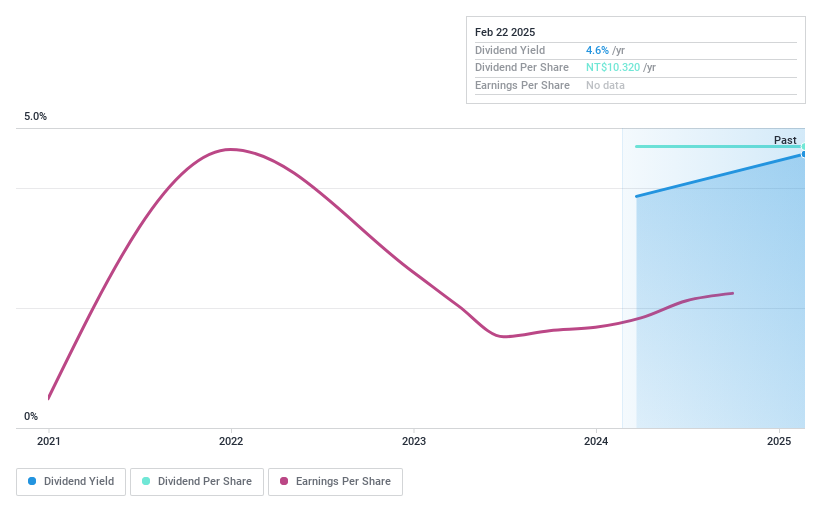

Dividend Yield: 4.6%

Forcelead Technology's dividend payments are newly initiated, making it premature to assess their growth or reliability. However, the dividends are covered by earnings and cash flows with payout ratios of 65.7% and 74.4%, respectively. The company's dividend yield of 4.6% ranks in the top quartile of Taiwan's market, while its P/E ratio of 15.8x suggests good value relative to the market average of 21.6x. Recent equity offerings raised TWD 864 million, potentially supporting future growth initiatives.

- Click to explore a detailed breakdown of our findings in Forcelead Technology's dividend report.

- The analysis detailed in our Forcelead Technology valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Click through to start exploring the rest of the 1986 Top Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ADIB

Abu Dhabi Islamic Bank PJSC

Provides banking, financing, and investing services in the United Arab Emirates, rest of the Middle East, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives