As global markets experience a surge, with U.S. stock indexes nearing record highs and European indices buoyed by positive economic signals, investors are closely monitoring inflation data that could influence future rate policies. In this dynamic environment, dividend stocks like Kasikornbank offer potential stability and income generation, making them an attractive consideration for those looking to balance growth with consistent returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Kasikornbank (SET:KBANK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kasikornbank Public Company Limited, along with its subsidiaries, offers commercial banking products and services both in Thailand and internationally, with a market cap of THB385.02 billion.

Operations: Kasikornbank's revenue segments include Retail Business at THB69.98 billion, Corporate Business at THB87.72 billion, Muang Thai Group Holding Business at THB13.42 billion, and Treasury and Capital Markets Business and World Business Group at THB32.99 billion.

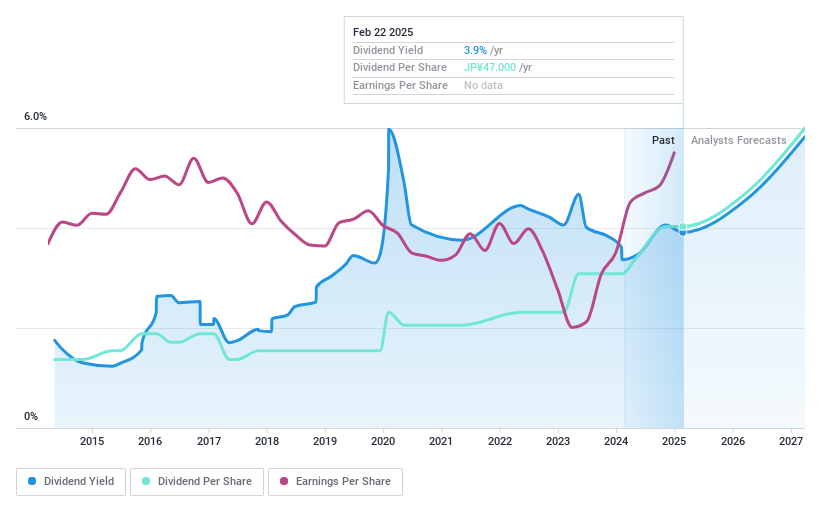

Dividend Yield: 4.6%

Kasikornbank's dividend payments are well covered by its earnings, with a current payout ratio of 37.4%, projected to remain sustainable at 44.2% in three years. Although the bank's dividends have increased over the past decade, they have been volatile with occasional drops over 20%. Despite trading below estimated fair value and offering good relative value compared to peers, its dividend yield of 4.62% is lower than top-tier payers in Thailand.

- Navigate through the intricacies of Kasikornbank with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Kasikornbank is priced lower than what may be justified by its financials.

Torigoe (TSE:2009)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Torigoe Co., Ltd. manufactures and sells flours and related products in Japan, with a market capitalization of ¥17.97 billion.

Operations: Torigoe Co., Ltd.'s revenue primarily comes from its Food Products segment, which generated ¥26.17 billion.

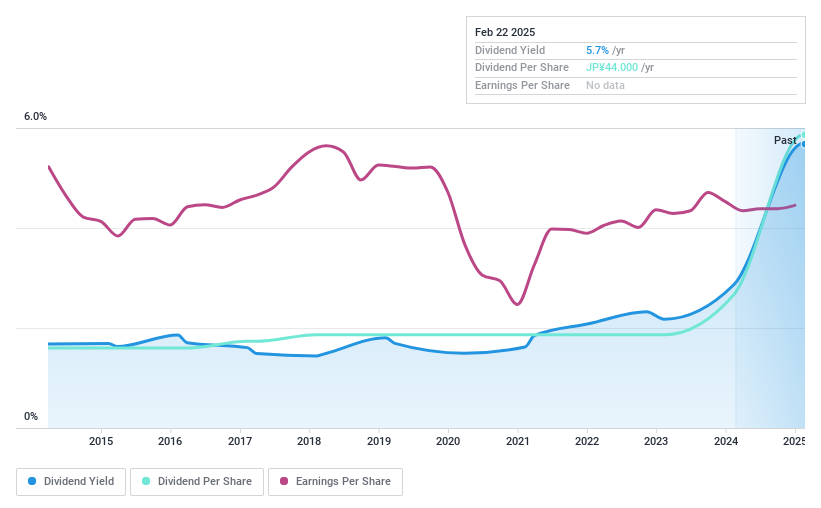

Dividend Yield: 5.7%

Torigoe's dividend yield of 5.7% ranks in the top 25% of Japanese dividend payers, yet its sustainability is questionable with a payout ratio exceeding earnings at 100.5%. Although dividends have been stable and growing over the past decade, recent share price volatility poses risks. The cash payout ratio stands at 78.7%, indicating coverage by cash flows but not earnings. Trading significantly below estimated fair value suggests potential for capital appreciation amidst these challenges.

- Take a closer look at Torigoe's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Torigoe shares in the market.

Hirogin Holdings (TSE:7337)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hirogin Holdings, Inc. is a bank holding company for The Hiroshima Bank, Ltd., with a market cap of ¥366.87 billion.

Operations: Hirogin Holdings, Inc. generates its revenue primarily through its operations as a bank holding company for The Hiroshima Bank, Ltd.

Dividend Yield: 3.8%

Hirogin Holdings plans to increase its annual dividend to ¥23.50 per share from ¥19.00, reflecting growth but with a history of volatility and unreliability over the past decade. The payout ratio is a manageable 38.6%, suggesting dividends are covered by earnings, though sustainability concerns remain due to insufficient data on future coverage. With earnings projected at ¥35 billion and a P/E ratio of 12.5x below the market average, Hirogin presents an attractive valuation despite these challenges.

- Click to explore a detailed breakdown of our findings in Hirogin Holdings' dividend report.

- Our expertly prepared valuation report Hirogin Holdings implies its share price may be too high.

Seize The Opportunity

- Delve into our full catalog of 1984 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasikornbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KBANK

Kasikornbank

Provides commercial banking products and services in Thailand and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives