- Thailand

- /

- Auto Components

- /

- SET:STA

3 Stocks Estimated To Be Undervalued By Up To 43.3% Offering Intriguing Opportunities

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic uncertainties, U.S. indexes have shown resilience with broad-based gains, buoyed by positive labor market data and home sales reports. In this environment, identifying stocks that are potentially undervalued can present intriguing opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.44 | CN¥18.82 | 49.8% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.11 | CN¥124.15 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.27 | 49.9% |

| Insyde Software (TPEX:6231) | NT$463.00 | NT$923.49 | 49.9% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| EnomotoLtd (TSE:6928) | ¥1470.00 | ¥2936.12 | 49.9% |

| DUG Technology (ASX:DUG) | A$1.67 | A$3.40 | 50.8% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.83 | A$17.54 | 49.7% |

Here's a peek at a few of the choices from the screener.

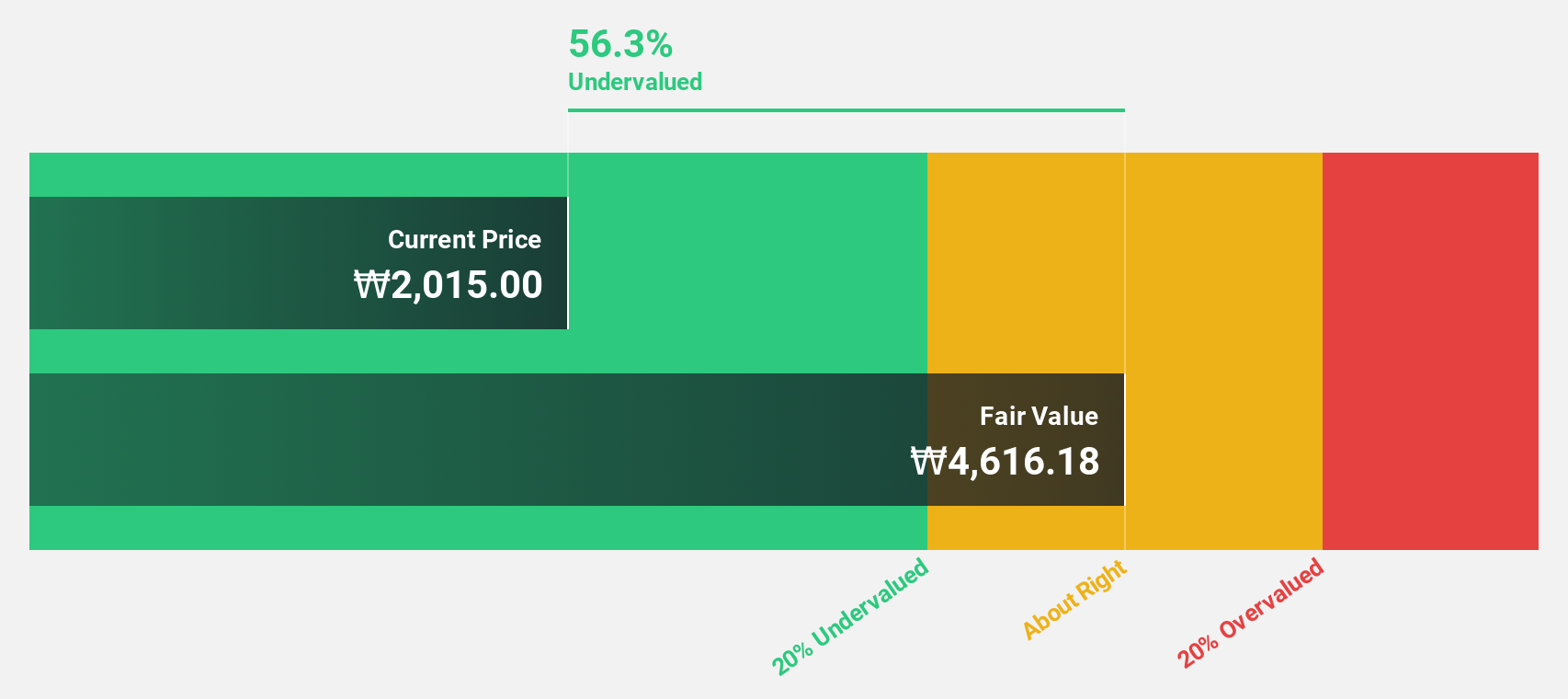

T'Way Air (KOSE:A091810)

Overview: T'Way Air Co., Ltd. offers air transportation services both domestically in South Korea and internationally, with a market cap of approximately ₩647.67 billion.

Operations: T'Way Air Co., Ltd. generates revenue primarily through its domestic and international air transportation services.

Estimated Discount To Fair Value: 43.3%

T'Way Air is trading at ₩3010, significantly undervalued by 43.3% compared to its estimated fair value of ₩5311.47. Despite recent shareholder dilution and high share price volatility, the company's earnings are forecast to grow significantly at 29.8% annually, outpacing the broader KR market's growth rate of 29.3%. However, profit margins have decreased from 7.8% to 3.2%, indicating potential challenges in operational efficiency despite strong revenue growth prospects.

- Our expertly prepared growth report on T'Way Air implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on T'Way Air's balance sheet by reading our health report here.

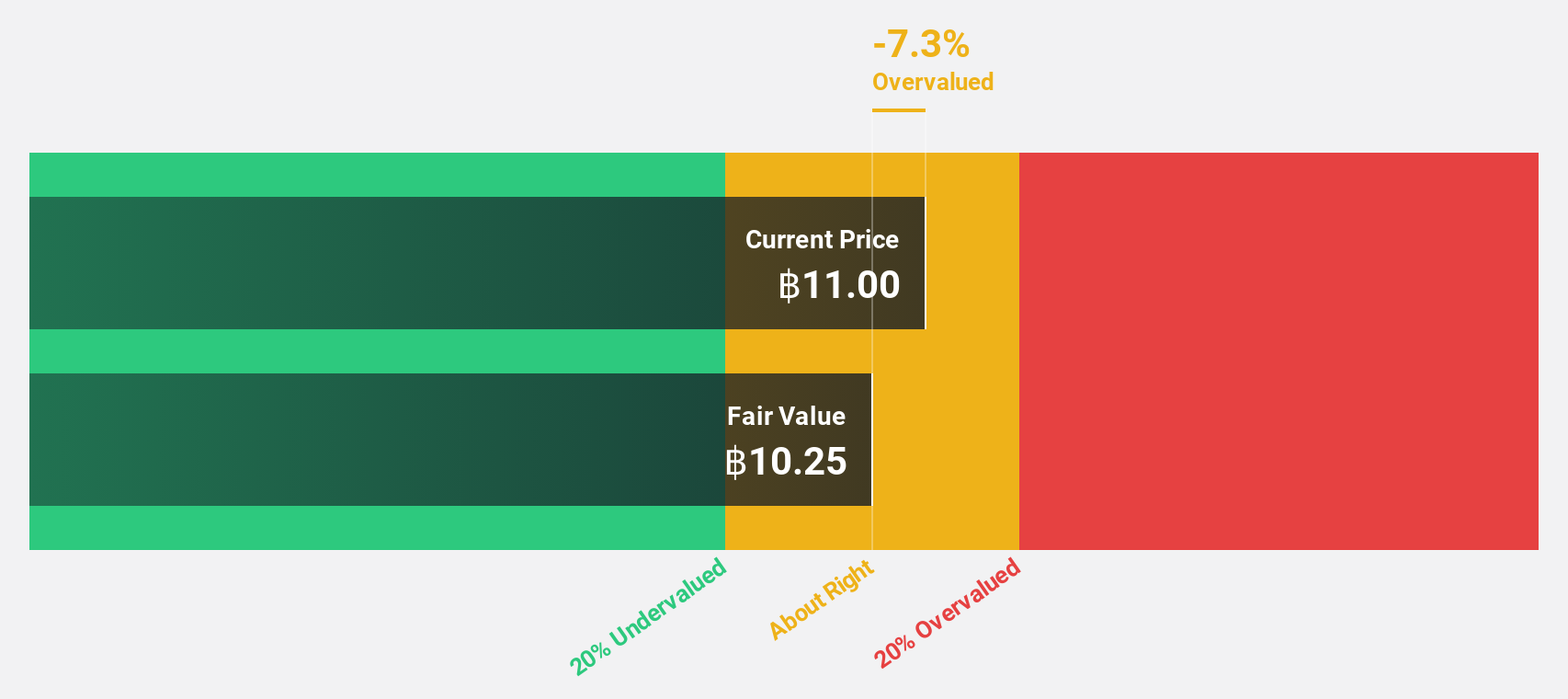

Sri Trang Agro-Industry (SET:STA)

Overview: Sri Trang Agro-Industry Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of natural rubber products across Thailand, China, the United States, Singapore, Japan, and other international markets; it has a market cap of THB28.42 billion.

Operations: The company generates revenue from its segments, with THB23.30 billion from gloves and THB86.85 billion from natural rubbers.

Estimated Discount To Fair Value: 30.6%

Sri Trang Agro-Industry is trading at THB18.5, 30.6% below its estimated fair value of THB26.64, highlighting significant undervaluation based on discounted cash flow analysis. The company reported a net income turnaround in the third quarter with THB 517.29 million compared to a loss last year, although profit margins remain low at 0.4%. While revenue and earnings growth forecasts are robust, interest payments are poorly covered by earnings, reflecting potential financial strain.

- Insights from our recent growth report point to a promising forecast for Sri Trang Agro-Industry's business outlook.

- Unlock comprehensive insights into our analysis of Sri Trang Agro-Industry stock in this financial health report.

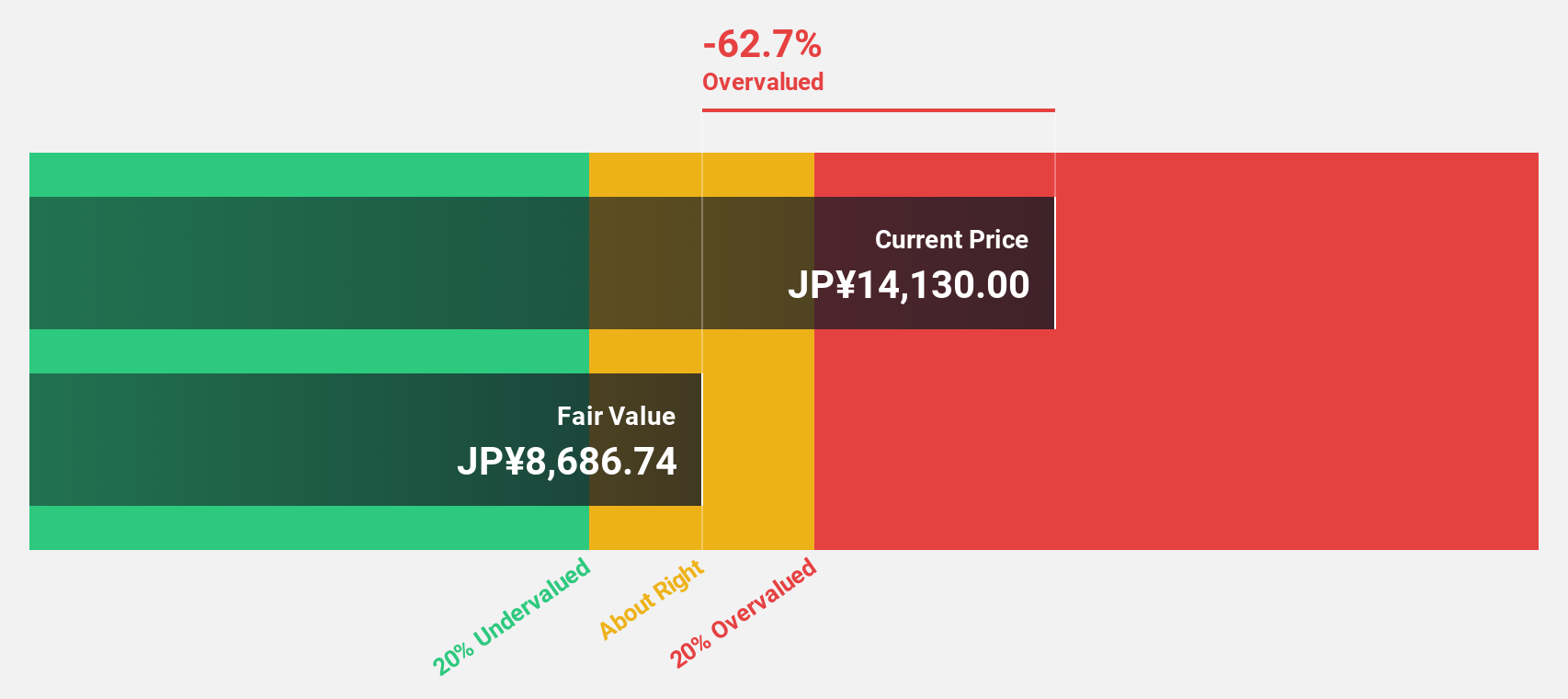

Kasumigaseki CapitalLtd (TSE:3498)

Overview: Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan with a market capitalization of ¥125.56 billion.

Operations: The company generates revenue of ¥65.69 billion from its real estate consulting business in Japan.

Estimated Discount To Fair Value: 28.6%

Kasumigaseki Capital Ltd. is trading at ¥12,760, significantly undervalued compared to its estimated fair value of ¥17,862.41. Despite a volatile share price recently and shareholder dilution over the past year, the company shows strong revenue and earnings growth forecasts exceeding 30% annually. However, debt coverage by operating cash flow is weak and dividends are not well supported by free cash flows, indicating potential financial challenges ahead.

- Upon reviewing our latest growth report, Kasumigaseki CapitalLtd's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Kasumigaseki CapitalLtd's balance sheet health report.

Where To Now?

- Gain an insight into the universe of 920 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:STA

Sri Trang Agro-Industry

Manufactures and distributes natural rubber products in Thailand, China, the United States, Japan, Korea, India, Germany, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives