- Slovenia

- /

- Electric Utilities

- /

- LJSE:EGKG

Elektro Gorenjska, d. d. (LJSE:EGKG) Investors Are Less Pessimistic Than Expected

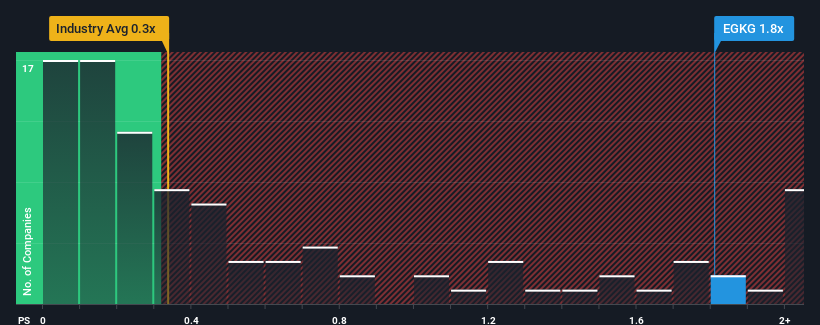

When close to half the companies in the Electric Utilities industry in Slovenia have price-to-sales ratios (or "P/S") below 0.3x, you may consider Elektro Gorenjska, d. d. (LJSE:EGKG) as a stock to potentially avoid with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Elektro Gorenjska d. d

What Does Elektro Gorenjska d. d's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Elektro Gorenjska d. d over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Elektro Gorenjska d. d, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Elektro Gorenjska d. d's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. As a result, revenue from three years ago have also fallen 11% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It turns out the industry is also predicted to shrink 2.8% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

With this in mind, we find it a bit intriguing that Elektro Gorenjska d. d's P/S exceeds that of its industry peers. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Based on our analysis, it's clear that Elektro Gorenjska d. d is trading at a higher-than-average P/S ratio despite its recent three-year revenue growth rate only matching the industry forecasts for a struggling sector. Given the high P/S in the context of an average revenue decline, we suspect the share price is at risk of tanking, sending the high P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 5 warning signs for Elektro Gorenjska d. d (2 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Elektro Gorenjska d. d's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Elektro Gorenjska d. d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:EGKG

Elektro Gorenjska d. d

Produces and distributes electricity in northwestern part of Slovenia.

Good value with adequate balance sheet.