- Slovenia

- /

- Electric Utilities

- /

- LJSE:ECEG

Elektro Celje d.d (LJSE:ECEG) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Elektro Celje, d.d. (LJSE:ECEG) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Elektro Celje d.d

What Is Elektro Celje d.d's Net Debt?

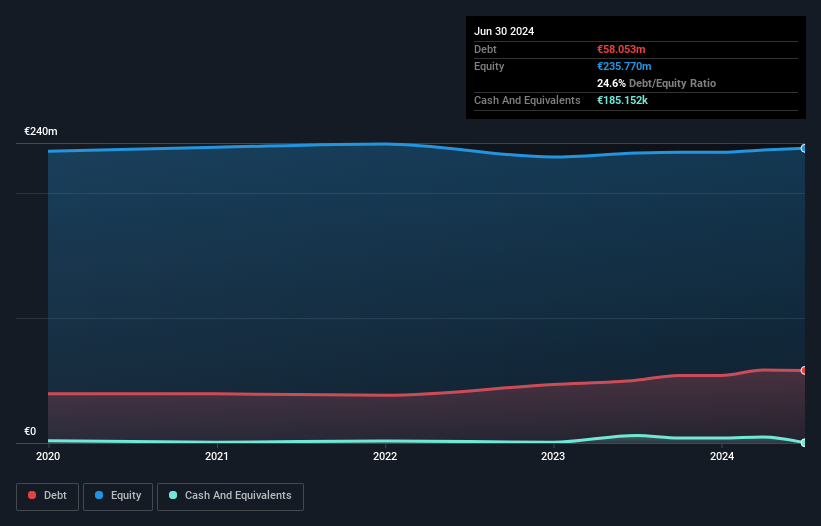

As you can see below, at the end of June 2024, Elektro Celje d.d had €58.1m of debt, up from €50.2m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Elektro Celje d.d's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Elektro Celje d.d had liabilities of €20.6m due within 12 months and liabilities of €76.6m due beyond that. Offsetting these obligations, it had cash of €185.2k as well as receivables valued at €15.5m due within 12 months. So its liabilities total €81.5m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of €63.0m, we think shareholders really should watch Elektro Celje d.d's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Elektro Celje d.d's debt to EBITDA ratio (2.6) suggests that it uses some debt, its interest cover is very weak, at 2.2, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. One redeeming factor for Elektro Celje d.d is that it turned last year's EBIT loss into a gain of €3.9m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Elektro Celje d.d will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Considering the last year, Elektro Celje d.d actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both Elektro Celje d.d's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its EBIT growth rate is not so bad. It's also worth noting that Elektro Celje d.d is in the Electric Utilities industry, which is often considered to be quite defensive. Overall, it seems to us that Elektro Celje d.d's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Elektro Celje d.d (including 2 which shouldn't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Elektro Celje d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:ECEG

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026