The Returns On Capital At Cinkarna Celje d. d (LJSE:CICG) Don't Inspire Confidence

What underlying fundamental trends can indicate that a company might be in decline? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. On that note, looking into Cinkarna Celje d. d (LJSE:CICG), we weren't too upbeat about how things were going.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Cinkarna Celje d. d is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.053 = €12m ÷ (€259m - €24m) (Based on the trailing twelve months to September 2023).

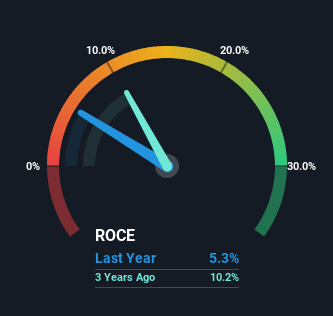

So, Cinkarna Celje d. d has an ROCE of 5.3%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 11%.

View our latest analysis for Cinkarna Celje d. d

Historical performance is a great place to start when researching a stock so above you can see the gauge for Cinkarna Celje d. d's ROCE against it's prior returns. If you're interested in investigating Cinkarna Celje d. d's past further, check out this free graph covering Cinkarna Celje d. d's past earnings, revenue and cash flow.

So How Is Cinkarna Celje d. d's ROCE Trending?

There is reason to be cautious about Cinkarna Celje d. d, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 19% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Cinkarna Celje d. d to turn into a multi-bagger.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 89% return. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Cinkarna Celje d. d does come with some risks though, we found 3 warning signs in our investment analysis, and 2 of those are a bit concerning...

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:CICG

Cinkarna Celje d. d

A chemical-processing company, produces and markets titanium dioxide pigments in Slovenia, the European Union, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026