- Singapore

- /

- Infrastructure

- /

- SGX:S58

SATS (SGX:S58) Reports Strong Earnings Growth with 15% Revenue Increase and Strategic Asia-Pacific Expansion

Reviewed by Simply Wall St

Dive into the specifics of SATS here with our thorough analysis report.

Competitive Advantages That Elevate SATS

With a remarkable turnaround, SATS Ltd. has reported a profit this year, marking a significant shift in its financial trajectory. The company's earnings are projected to grow at an impressive 12.12% annually, surpassing market expectations. This growth is supported by a revenue increase of 15% year-over-year, as highlighted by CEO Tee Mok. This surge is driven by strong demand in core segments, showcasing effective sales strategies and market presence. Furthermore, the successful launch of new products, contributing to a 20% sales increase in specific categories, underscores SATS's commitment to innovation and responsiveness to market needs.

Challenges Constraining SATS's Potential

While these developments are promising, SATS faces challenges, particularly in financial metrics. The company's Return on Equity (ROE) stands at 8%, below the desirable threshold of 20%, indicating room for improvement in generating shareholder value. Additionally, historical performance issues persist, with earnings declining by 13.6% annually over the past five years. These challenges are compounded by rising operating costs, which have increased by 10%, impacting margins as noted by CFO Manfred Kok Khong Seah. Moreover, competitive pressures in primary markets have led to pricing challenges, necessitating a reassessment of pricing strategies to maintain market share.

Potential Strategies for Leveraging Growth and Competitive Advantage

SATS is actively exploring expansion opportunities in the Asia-Pacific region, where market demand is projected to grow significantly. This strategic focus on geographical expansion presents substantial growth potential. Additionally, the company's investment in digital capabilities aims to streamline operations and enhance customer engagement, as emphasized by CFO Manfred Kok Khong Seah. These initiatives, coupled with the potential benefits from upcoming regulatory changes, position SATS to capitalize on emerging opportunities and strengthen its competitive position.

External Factors Threatening SATS

However, economic headwinds pose a risk, with potential slowdowns impacting consumer spending, as cautioned by CEO Tee Mok. Supply chain disruptions also present vulnerabilities, potentially affecting the company's ability to meet demand. Regulatory hurdles remain a challenge, requiring significant resources for compliance, as highlighted by CMO Carolyn Khiu. These external factors could divert attention from growth initiatives and impact SATS's market position.

To learn about how SATS's valuation metrics are shaping its market position, check out our detailed analysis of SATS's Valuation. Explore the current health of SATS and how it reflects on its financial stability and growth potential.Conclusion

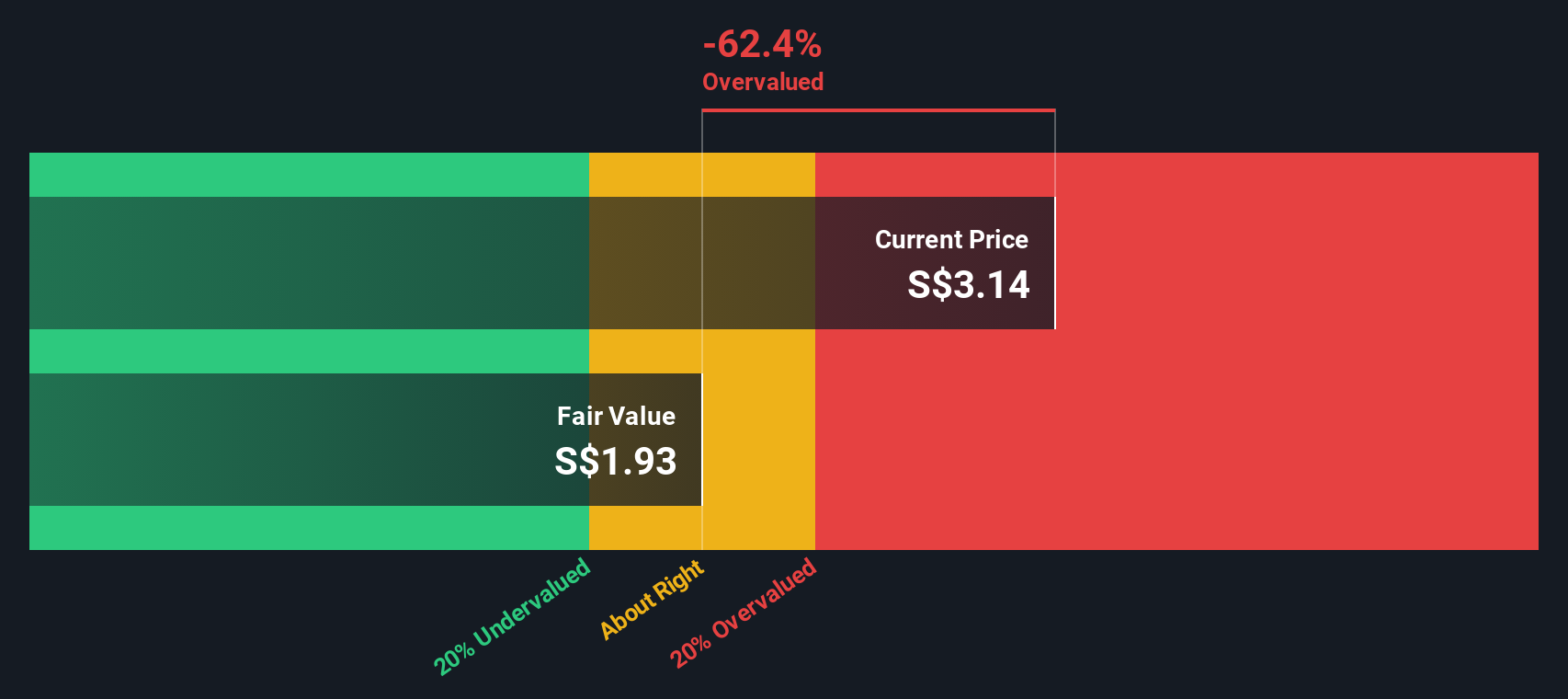

SATS Ltd.'s impressive financial turnaround, marked by a projected 12.12% annual earnings growth and a 15% year-over-year revenue increase, highlights its strong market presence and innovative product strategies. However, challenges such as a Return on Equity of 8% and rising operating costs suggest that the company needs to improve efficiency and shareholder value. SATS's strategic focus on expanding in the Asia-Pacific region and enhancing digital capabilities presents significant growth opportunities, yet external risks like economic headwinds and supply chain disruptions could impact these initiatives. While the company trades below its estimated fair value, its high Price-To-Earnings Ratio compared to industry averages indicates that investors may already be pricing in these growth prospects, suggesting cautious optimism for future performance.

Make It Happen

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SGX:S58

SATS

An investment holding company, provides gateway services and food solutions in Singapore, Asia Pacific, the United States, Europe, Middle East, Africa, and internationally.

Solid track record with limited growth.

Market Insights

Community Narratives