COSCO Shipping International (Singapore)'s(SGX:F83) Share Price Is Down 45% Over The Past Five Years.

It is a pleasure to report that the COSCO Shipping International (Singapore) Co., Ltd. (SGX:F83) is up 37% in the last quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 45%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for COSCO Shipping International (Singapore)

While COSCO Shipping International (Singapore) made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years COSCO Shipping International (Singapore) saw its revenue shrink by 72% per year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 8% per year in that time. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

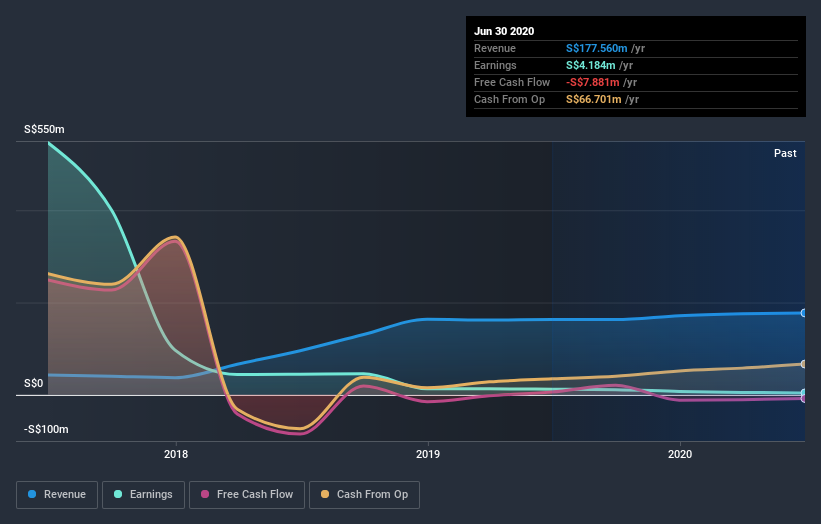

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on COSCO Shipping International (Singapore)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 9.4% in the twelve months, COSCO Shipping International (Singapore) shareholders did even worse, losing 19%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for COSCO Shipping International (Singapore) (1 makes us a bit uncomfortable) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade COSCO Shipping International (Singapore), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:F83

COSCO SHIPPING International (Singapore)

An investment holding company, provides integrated logistics services in South and Southeast Asia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives