Additional Considerations Required While Assessing COSCO SHIPPING International (Singapore)'s (SGX:F83) Strong Earnings

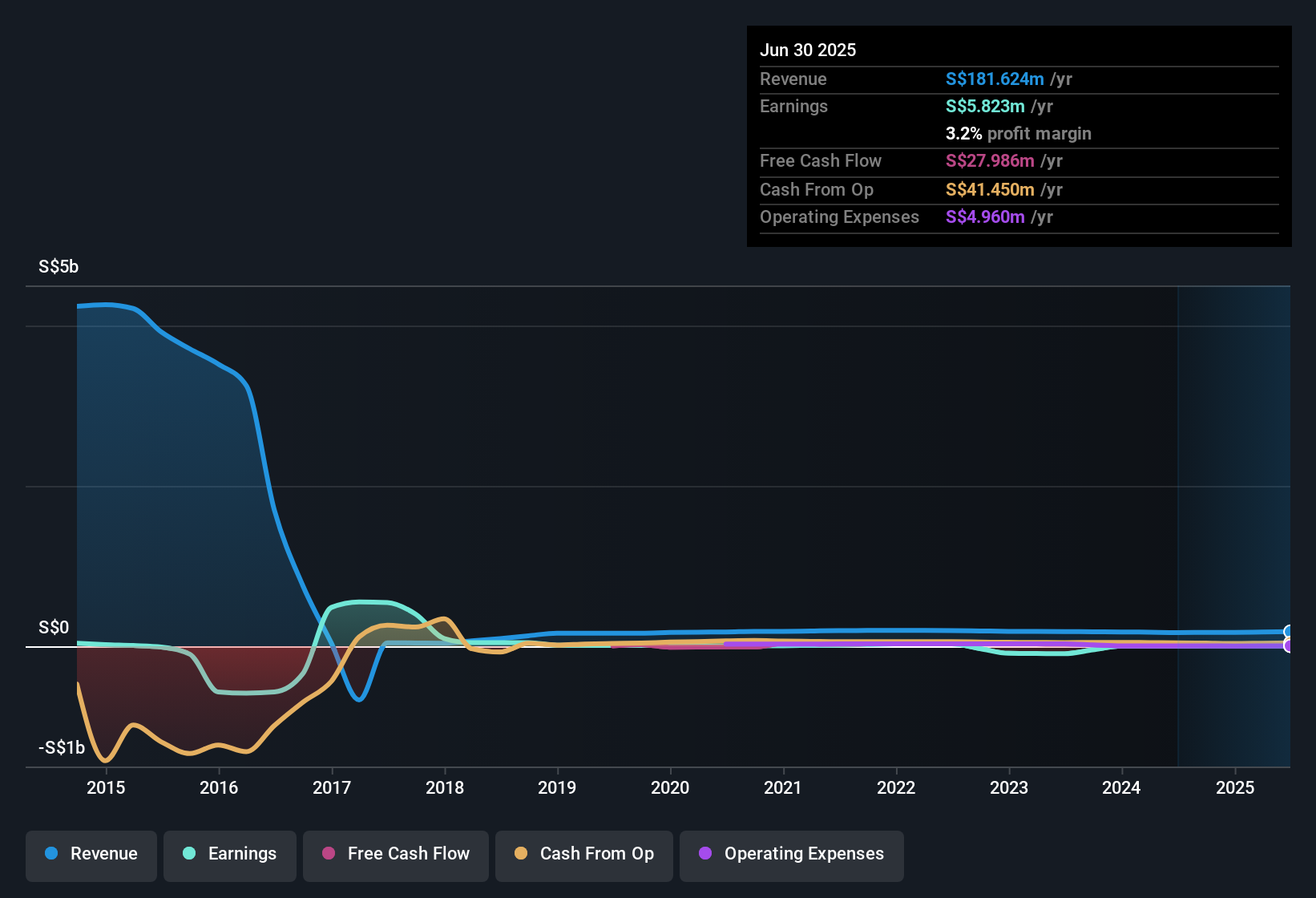

COSCO SHIPPING International (Singapore) Co., Ltd. (SGX:F83) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. COSCO SHIPPING International (Singapore) expanded the number of shares on issue by 100% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of COSCO SHIPPING International (Singapore)'s EPS by clicking here.

A Look At The Impact Of COSCO SHIPPING International (Singapore)'s Dilution On Its Earnings Per Share (EPS)

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. On the bright side, in the last twelve months it grew profit by 163%. But EPS was less impressive, up only 163% in that time. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if COSCO SHIPPING International (Singapore) can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of COSCO SHIPPING International (Singapore).

Our Take On COSCO SHIPPING International (Singapore)'s Profit Performance

As we discussed above, COSCO SHIPPING International (Singapore)'s dilution over the last year has a major impact on its per-share earnings. As a result, we think it may well be the case that COSCO SHIPPING International (Singapore)'s underlying earnings power is lower than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of COSCO SHIPPING International (Singapore).

This note has only looked at a single factor that sheds light on the nature of COSCO SHIPPING International (Singapore)'s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F83

COSCO SHIPPING International (Singapore)

An investment holding company, provides integrated logistics services in South and Southeast Asia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)