Singapore Airlines Limited's (SGX:C6L) Popularity With Investors Is Under Threat From Overpricing

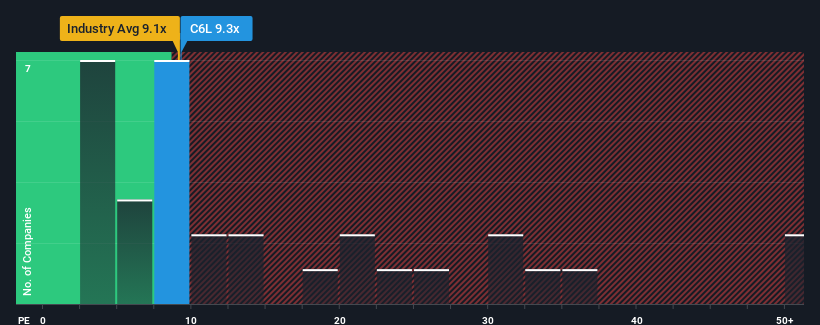

With a median price-to-earnings (or "P/E") ratio of close to 11x in Singapore, you could be forgiven for feeling indifferent about Singapore Airlines Limited's (SGX:C6L) P/E ratio of 9.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Singapore Airlines' and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

See our latest analysis for Singapore Airlines

Does Growth Match The P/E?

In order to justify its P/E ratio, Singapore Airlines would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 7.5% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 10% per year during the coming three years according to the twelve analysts following the company. Meanwhile, the broader market is forecast to expand by 7.9% per year, which paints a poor picture.

In light of this, it's somewhat alarming that Singapore Airlines' P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Singapore Airlines' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Singapore Airlines currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with Singapore Airlines (including 1 which is a bit concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives