Singapore Airlines Limited's (SGX:C6L) Business Is Trailing The Market But Its Shares Aren't

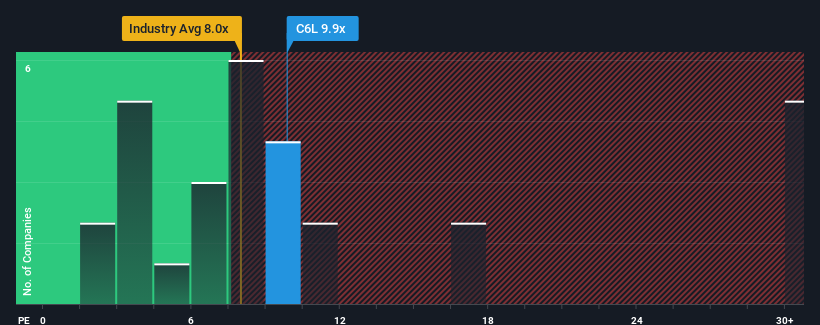

There wouldn't be many who think Singapore Airlines Limited's (SGX:C6L) price-to-earnings (or "P/E") ratio of 9.9x is worth a mention when the median P/E in Singapore is similar at about 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Singapore Airlines certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Singapore Airlines

How Is Singapore Airlines' Growth Trending?

The only time you'd be comfortable seeing a P/E like Singapore Airlines' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 317% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 6.0% per year as estimated by the eleven analysts watching the company. That's not great when the rest of the market is expected to grow by 7.1% each year.

In light of this, it's somewhat alarming that Singapore Airlines' P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Singapore Airlines' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Singapore Airlines (including 1 which shouldn't be ignored).

Of course, you might also be able to find a better stock than Singapore Airlines. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa.

Established dividend payer and good value.