- Singapore

- /

- Industrials

- /

- SGX:C07

SGX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As Singapore grapples with urban challenges, including the widespread issue of abandoned vehicles cluttering public spaces, the broader market continues to navigate its own complexities. In such an environment, dividend stocks can offer a sense of stability and income potential, making them an appealing option for investors seeking consistent returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.69% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.41% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.38% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.43% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.07% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.99% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.90% | ★★★★☆☆ |

| Genting Singapore (SGX:G13) | 4.73% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.71% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.54% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across various countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.10 billion.

Operations: The Hour Glass Limited generates revenue of SGD1.13 billion from its operations in the retailing and distribution of watches, jewelry, and other luxury products.

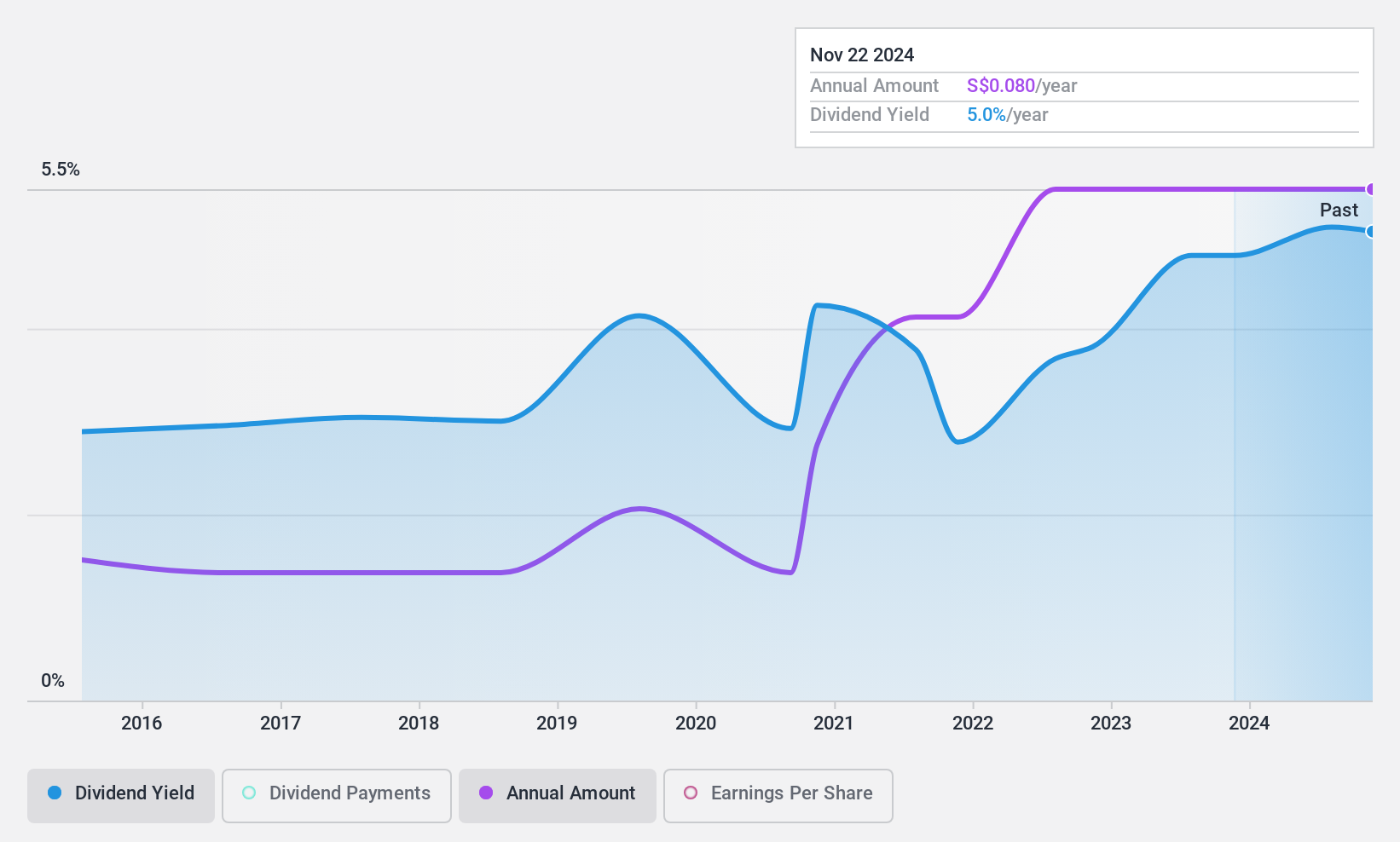

Dividend Yield: 4.7%

The Hour Glass offers a dividend yield of 4.73%, which is below the top quartile in Singapore's market. However, its dividends are well-covered by earnings and cash flows, with payout ratios of 33.5% and 46.2%, respectively. Despite a history of volatility in dividend payments over the last decade, recent approvals for a final dividend payment indicate ongoing shareholder returns. Additionally, its low price-to-earnings ratio suggests potential value for investors seeking growth alongside dividends (S$).

- Click to explore a detailed breakdown of our findings in Hour Glass' dividend report.

- The valuation report we've compiled suggests that Hour Glass' current price could be inflated.

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors in Indonesia and internationally with a market cap of SGD10.77 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue from its diverse operations across financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors.

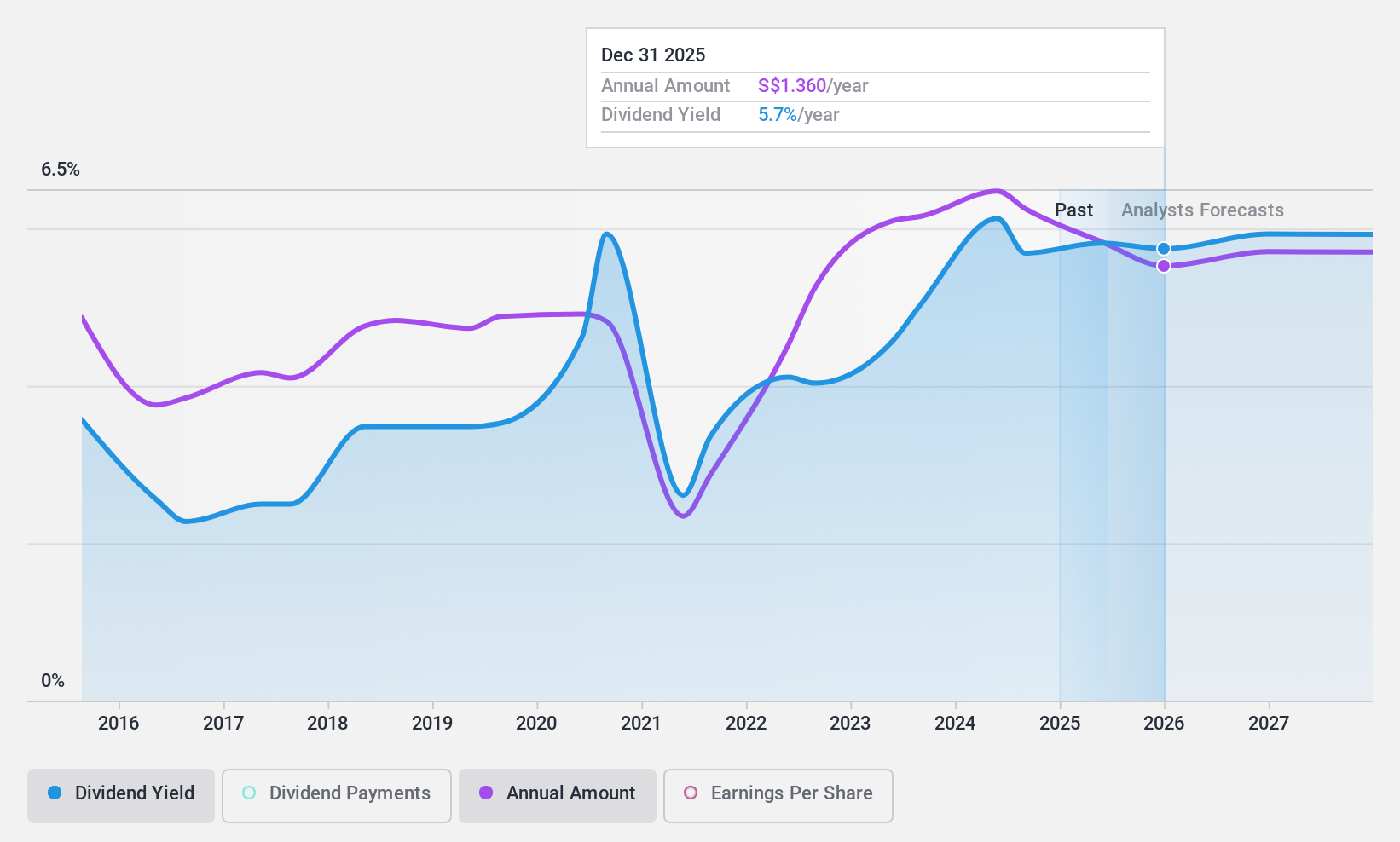

Dividend Yield: 5.7%

Jardine Cycle & Carriage declared an interim dividend of US$0.28 per share, with a payout ratio of 44.4%, indicating dividends are well-covered by earnings and cash flows. Although the dividend yield is slightly below Singapore's top quartile, the company trades at a good value compared to peers. Despite past volatility in dividends, recent earnings growth and stable cash flow coverage suggest potential for consistent shareholder returns amidst its current valuation discount.

- Click here and access our complete dividend analysis report to understand the dynamics of Jardine Cycle & Carriage.

- Our valuation report here indicates Jardine Cycle & Carriage may be undervalued.

Singapore Airlines (SGX:C6L)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited, along with its subsidiaries, offers passenger and cargo air transportation services across various global regions under the Singapore Airlines and Scoot brands, with a market cap of SGD23.17 billion.

Operations: Singapore Airlines Limited generates revenue through its Full Service Carrier (SGD16.18 billion), Low-Cost Carrier (SGD2.45 billion), and Engineering Services (SGD1.09 billion) segments.

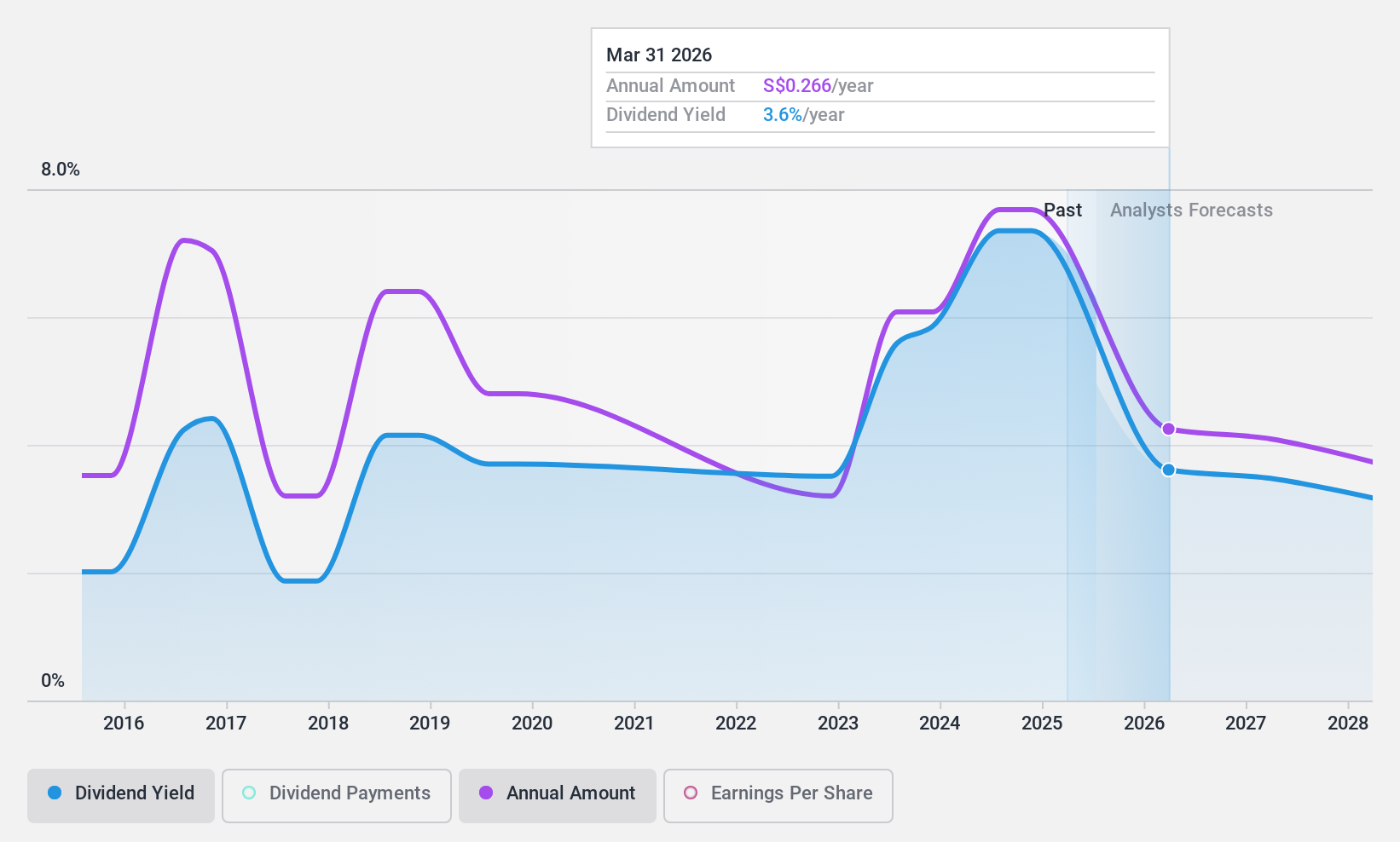

Dividend Yield: 7.4%

Singapore Airlines recently approved a final dividend of S$0.38 per share, with dividends covered by earnings at a 75.9% payout ratio and cash flows at 45.9%. While the dividend yield is among the top in Singapore, past payments have been volatile. Despite trading significantly below estimated fair value and recent increases in passenger and cargo metrics, projected earnings declines may impact future dividend sustainability.

- Take a closer look at Singapore Airlines' potential here in our dividend report.

- Upon reviewing our latest valuation report, Singapore Airlines' share price might be too pessimistic.

Make It Happen

- Dive into all 19 of the Top SGX Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C07

Jardine Cycle & Carriage

An investment holding company, engages in the financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses in Indonesia and internationally.

Flawless balance sheet, undervalued and pays a dividend.