- Poland

- /

- Construction

- /

- WSE:EBX

3 Penny Stocks With Growth Potential And Market Caps Over US$10M

Reviewed by Simply Wall St

Global markets have been buoyed by optimism surrounding potential trade deals and a rally in AI-related stocks, pushing major indices like the S&P 500 to new highs. In such a climate, investors often seek opportunities beyond well-known large-cap stocks, turning their attention to smaller firms that can offer unique growth prospects. While the term "penny stock" might seem outdated, these investments remain relevant today as they can reveal hidden value in companies with solid financial foundations and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Thai Wah (SET:TWPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thai Wah Public Company Limited manufactures and distributes vermicelli, starch, and other food and agricultural products across Thailand, Vietnam, Cambodia, and internationally with a market cap of THB2.27 billion.

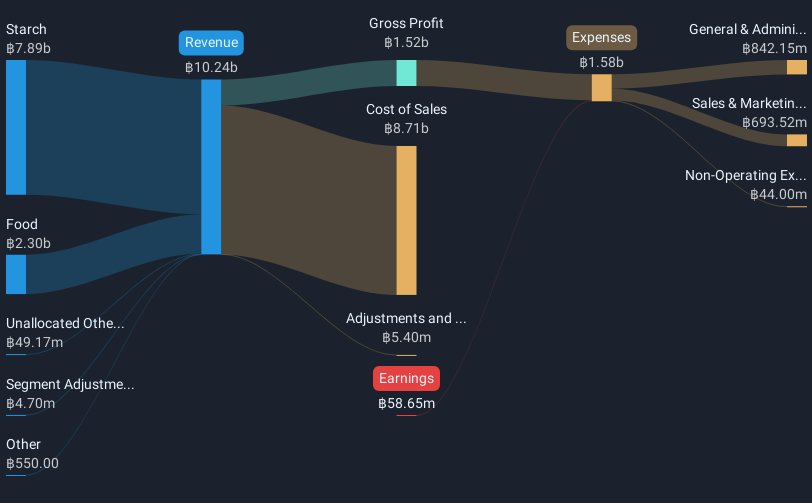

Operations: The company's revenue primarily comes from its Starch segment, generating THB7.89 billion, followed by the Food segment with THB2.30 billion.

Market Cap: THB2.27B

Thai Wah Public Company Limited, with a market cap of THB2.27 billion, primarily generates revenue from its Starch segment (THB7.89 billion) and Food segment (THB2.30 billion). Recent earnings show a net loss of THB73.55 million for Q3 2024, reflecting increased losses over the past five years at 4.1% annually. Despite unprofitability, Thai Wah's short-term assets exceed both short-term and long-term liabilities, indicating financial stability in covering obligations. The management team is experienced with an average tenure of four years, while the board averages 9.3 years, suggesting seasoned leadership amidst challenges in profitability and growth.

- Unlock comprehensive insights into our analysis of Thai Wah stock in this financial health report.

- Assess Thai Wah's previous results with our detailed historical performance reports.

Vibrant Group (SGX:BIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vibrant Group Limited is an investment holding company involved in integrated logistics, real estate, and financial services globally, with a market cap of SGD49.75 million.

Operations: Vibrant Group Limited does not have any reported revenue segments available.

Market Cap: SGD49.75M

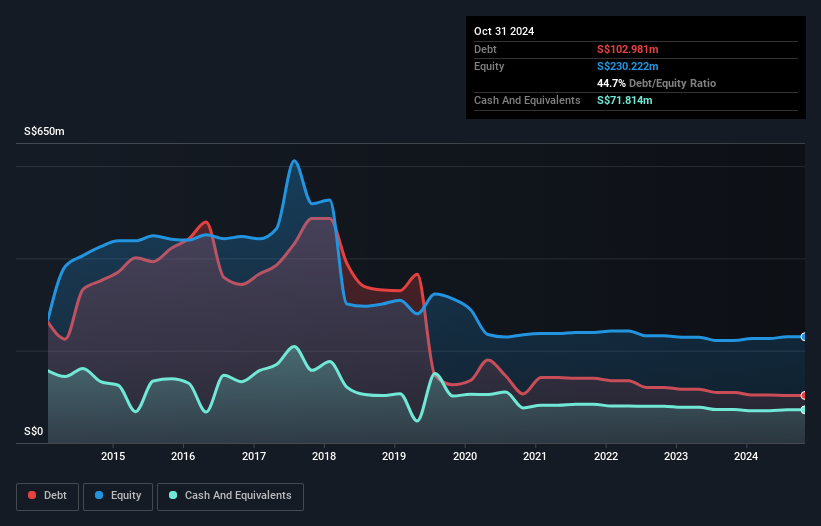

Vibrant Group Limited, with a market cap of SGD49.75 million, has shown recent profitability with net income of SGD3.31 million for the half year ended October 2024, reversing a prior loss. Despite this turnaround, earnings growth remains challenging due to significant one-off gains and an unstable dividend track record. The company's debt is well-covered by operating cash flow at 27.9%, yet its interest payments are not fully covered by EBIT, indicating financial pressure in servicing debt obligations. Additionally, Vibrant's stock price has been highly volatile recently and its return on equity is low at 3.9%.

- Take a closer look at Vibrant Group's potential here in our financial health report.

- Examine Vibrant Group's past performance report to understand how it has performed in prior years.

Ekobox (WSE:EBX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ekobox S.A. is an engineering company based in Poland with a market capitalization of PLN44.13 million.

Operations: The company generates revenue from its Heavy Construction segment, amounting to PLN37.67 million.

Market Cap: PLN44.13M

Ekobox S.A., with a market capitalization of PLN44.13 million, has demonstrated solid financial management despite recent declines in revenue and net income. The company reported third-quarter revenue of PLN14.54 million, down from PLN16.12 million the previous year, while net income decreased to PLN0.072329 million from PLN0.609617 million. Ekobox's debt levels are satisfactory with a net debt to equity ratio of 15.2%, and its interest payments are well covered by EBIT at 33.8 times coverage, though operating cash flow remains negative. Short-term assets comfortably exceed both short- and long-term liabilities, indicating sound liquidity management amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Ekobox.

- Learn about Ekobox's historical performance here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 5,718 companies within our Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ekobox might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:EBX

Excellent balance sheet with proven track record.

Market Insights

Community Narratives