Singapore Telecommunications' (SGX:Z74) Dividend Will Be Increased To SGD0.089

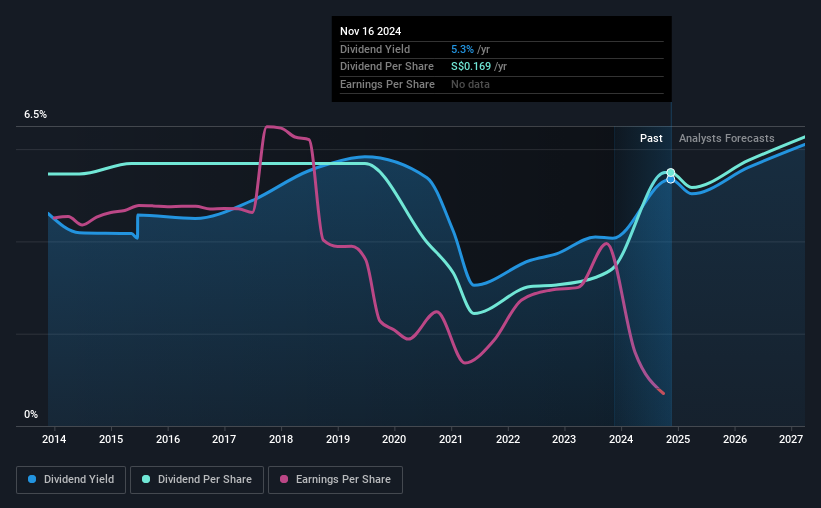

Singapore Telecommunications Limited (SGX:Z74) will increase its dividend from last year's comparable payment on the 9th of December to SGD0.089. This makes the dividend yield about the same as the industry average at 5.3%.

View our latest analysis for Singapore Telecommunications

Singapore Telecommunications' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Singapore Telecommunications' Could Struggle to Maintain Dividend Payments In The Future

Singapore Telecommunications' Future Dividends May Potentially Be At Risk

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Singapore Telecommunications isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This is quite a strong warning sign that the dividend may not be sustainable.

Earnings per share is forecast to rise by 158.1% over the next year. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was SGD0.168 in 2014, and the most recent fiscal year payment was SGD0.169. Dividend payments have grown at less than 1% a year over this period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Singapore Telecommunications hasn't seen much change in its earnings per share over the last five years. With no profits, we don't think Singapore Telecommunications has much potential to grow the dividend in the future.

Singapore Telecommunications' Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Singapore Telecommunications' payments are rock solid. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Singapore Telecommunications that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:Z74

Singapore Telecommunications

Provides telecommunication services to consumers and small businesses in Singapore, Australia, China, and internationally.

Moderate growth potential with mediocre balance sheet.