Should You Reassess Singtel’s Value After Its 35.9% Share Price Jump?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Singapore Telecommunications stock right now? You are hardly alone! After all, the share price has jumped a huge 35.9% this year and is up an eye-catching 141.4% over five years. These numbers are enough to make anyone wonder if more upside lies ahead, or if it is time to lock in profits. But before you rush in or out, it is worth digging deeper into what has really been driving these moves and whether the market is giving the company the value it deserves.

Despite a recent 4.3% dip in the last month, Singapore Telecommunications has performed strongly over the longer term, weathering market shifts and changes in investor sentiment. The past year alone has delivered a 39.3% return, suggesting strong support for the company. The narrative around growth in digital infrastructure and ongoing regional telecom expansions has kept optimism high, hinting that investors might be seeing both stability and long-term growth potential here.

So what about valuation? Are you getting in at a good price? Based on a comprehensive six-factor checklist that looks at different angles of undervaluation, Singapore Telecommunications scores a 5 out of 6. That suggests there is real value to uncover, even after substantial gains. In the next section, I will break down these different valuation methods and unpack how this nearly top score gives some confidence in the stock. Plus, stick around, as I will be sharing an even better way to assess valuation after we look at the main approaches analysts use today.

Approach 1: Singapore Telecommunications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. This approach helps investors look beyond short-term earnings and instead focus on underlying long-term financial strength and growth potential.

For Singapore Telecommunications, analysts estimate the current Free Cash Flow at around SGD 1.66 billion. Looking ahead, projections suggest this could grow to approximately SGD 4.22 billion by the fiscal year ending March 2029. While analysts typically provide forecasts for the next five years, additional years beyond that are extrapolated out to 10 years by Simply Wall St to provide a more comprehensive long-range outlook.

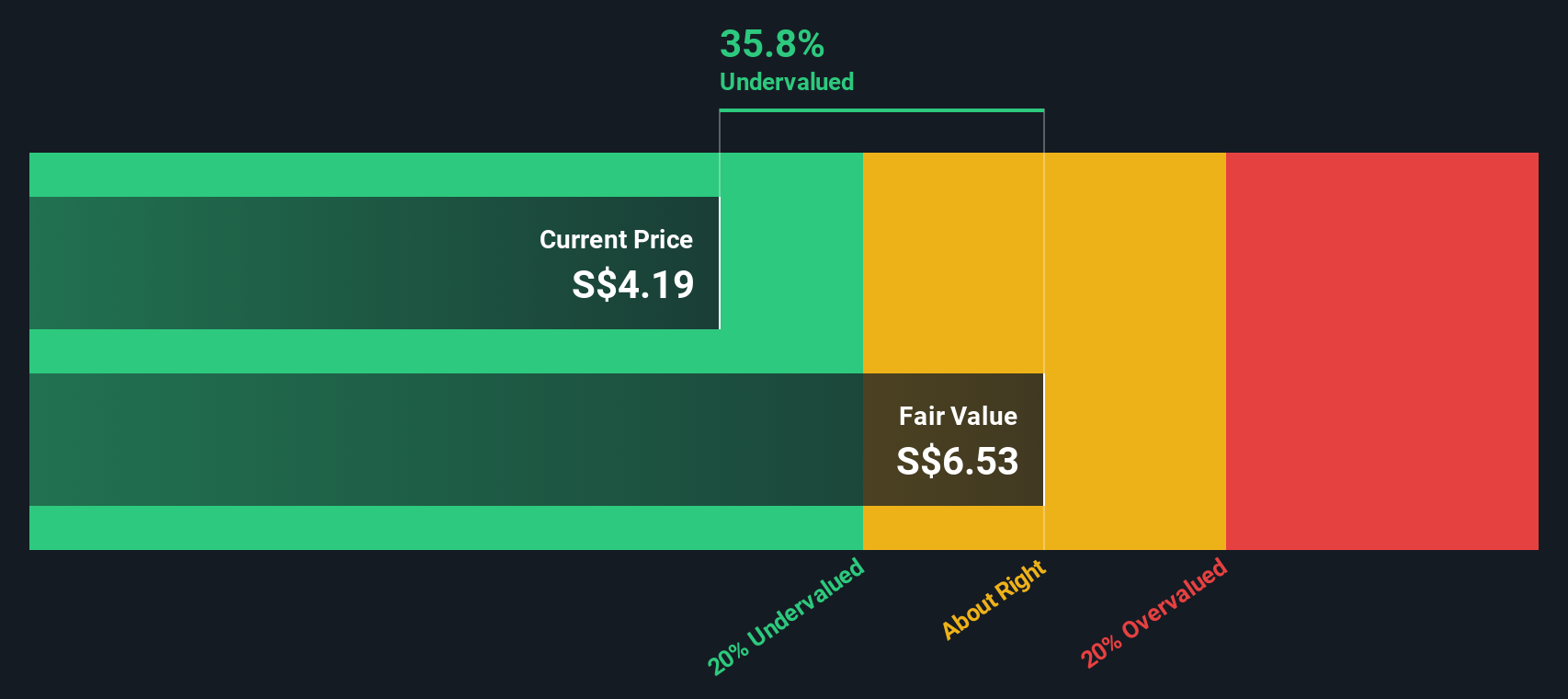

Using the 2 Stage Free Cash Flow to Equity model, these projected cash flows are discounted back to their present value by factoring in the time value of money. The DCF analysis here arrives at an intrinsic value of SGD 6.53 per share for Singapore Telecommunications. Notably, this implies the stock is trading at a 35.6% discount to its estimated fair value and may signal that the market is undervaluing the underlying business strength revealed in these cash flow forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Singapore Telecommunications is undervalued by 35.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Singapore Telecommunications Price vs Earnings

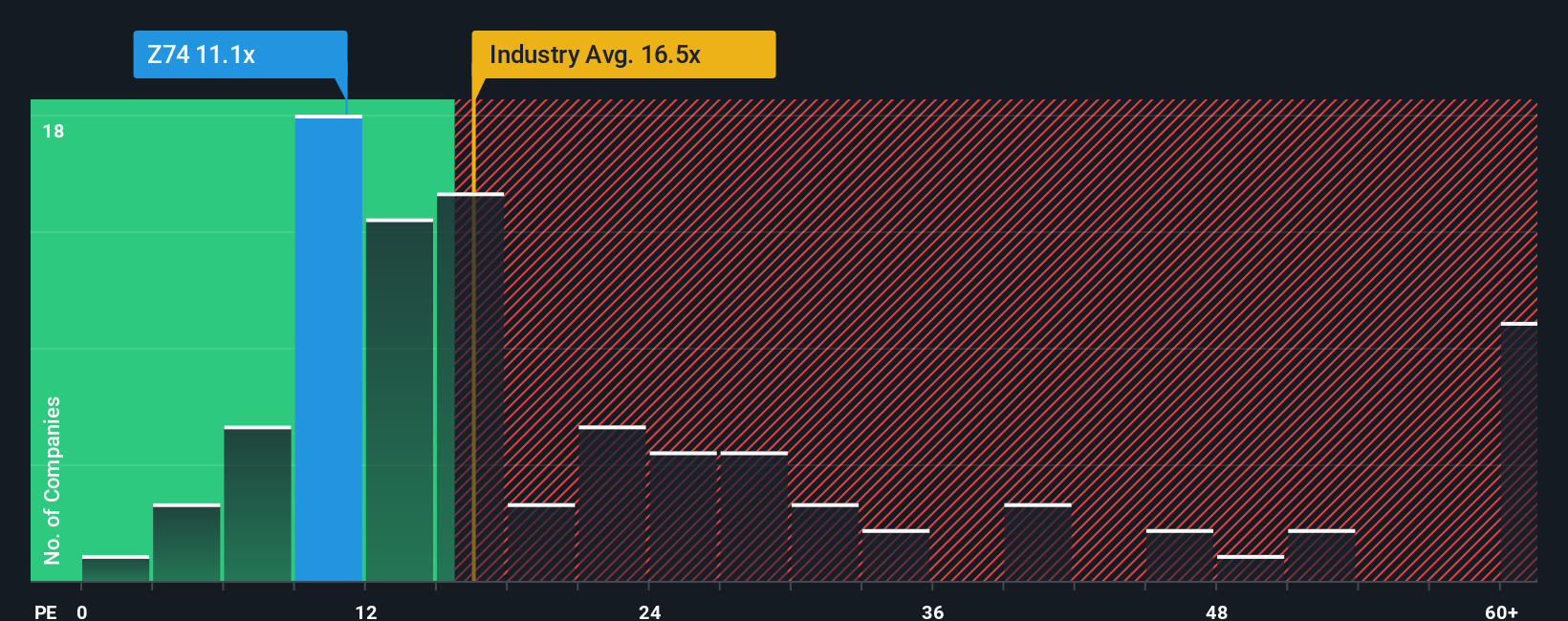

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Singapore Telecommunications, as it directly compares the market value of the company to its actual earnings. This makes it especially relevant for investors who care about what they are paying for each dollar of profit, rather than relying solely on revenues or book values.

It is important to remember that the "right" PE ratio can vary. Companies with higher expected growth or lower risk often trade at higher multiples, while riskier or slower-growing businesses tend to be valued at lower ones. Context such as market trends and company-specific prospects also plays a significant role in what is considered fair.

Currently, Singapore Telecommunications trades at an attractive PE ratio of 11.2x. This stands well below both the telecom industry average of 17.0x and the peer average of 22.8x, suggesting the stock may be overlooked from a traditional benchmark perspective. However, Simply Wall St’s proprietary "Fair Ratio," which adjusts for earnings growth, profit margins, risk factors and market capitalization, sets a fair PE for the company at 18.4x. Since this approach takes into account all the nuances the company and its industry face, it provides a more accurate picture than simply comparing with peers or industry averages.

With the current PE ratio meaningfully below the Fair Ratio, the stock still looks undervalued by this measure, reinforcing the earlier discounted cash flow findings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

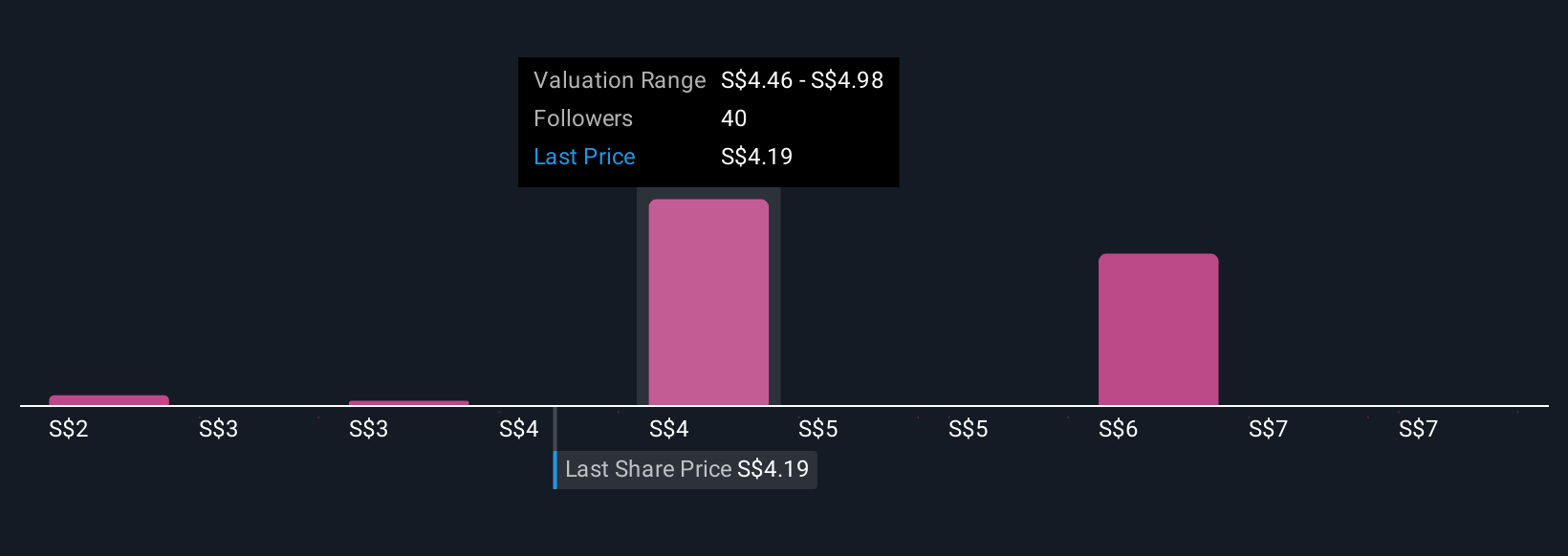

Upgrade Your Decision Making: Choose your Singapore Telecommunications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, tying together your fair value assumptions, estimates of future revenue, earnings, and margins to build a complete picture that goes beyond just numbers. This approach connects the bigger story around Singapore Telecommunications to financial forecasts, and then straight to a fair value that actually reflects your beliefs. Narratives are easy to create and use right within Simply Wall St's Community page, enabling millions of investors to make smarter calls.

With Narratives, you can compare your fair value with the current price to decide whether to buy, hold, or sell. Since Narratives dynamically update with new news or earnings, your investment decision is always based on the latest information. For example, one investor might set a higher fair value for Singapore Telecommunications by assuming faster digital expansion, while another expects slower growth and uses a lower fair value. Your Narrative can reflect your unique outlook and help guide your next move.

Do you think there's more to the story for Singapore Telecommunications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Z74

Singapore Telecommunications

Provides telecommunication services to consumers and small businesses in Singapore, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives