A Fresh Look at Singtel (SGX:Z74) Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

Singapore Telecommunications (SGX:Z74) has seen its stock price move in recent sessions, prompting investors to reassess its current valuation. With notable shifts over the past month, market watchers are curious about what may come next.

See our latest analysis for Singapore Telecommunications.

Singapore Telecommunications’ recent price dip comes after a period of robust upward momentum. Investors reacted to changing expectations around growth and risk. Despite some short-term volatility, the company’s 38.97% total shareholder return over the past year stands out as a strong long-term performance signal.

If you’re curious where else positive momentum might be building, this is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

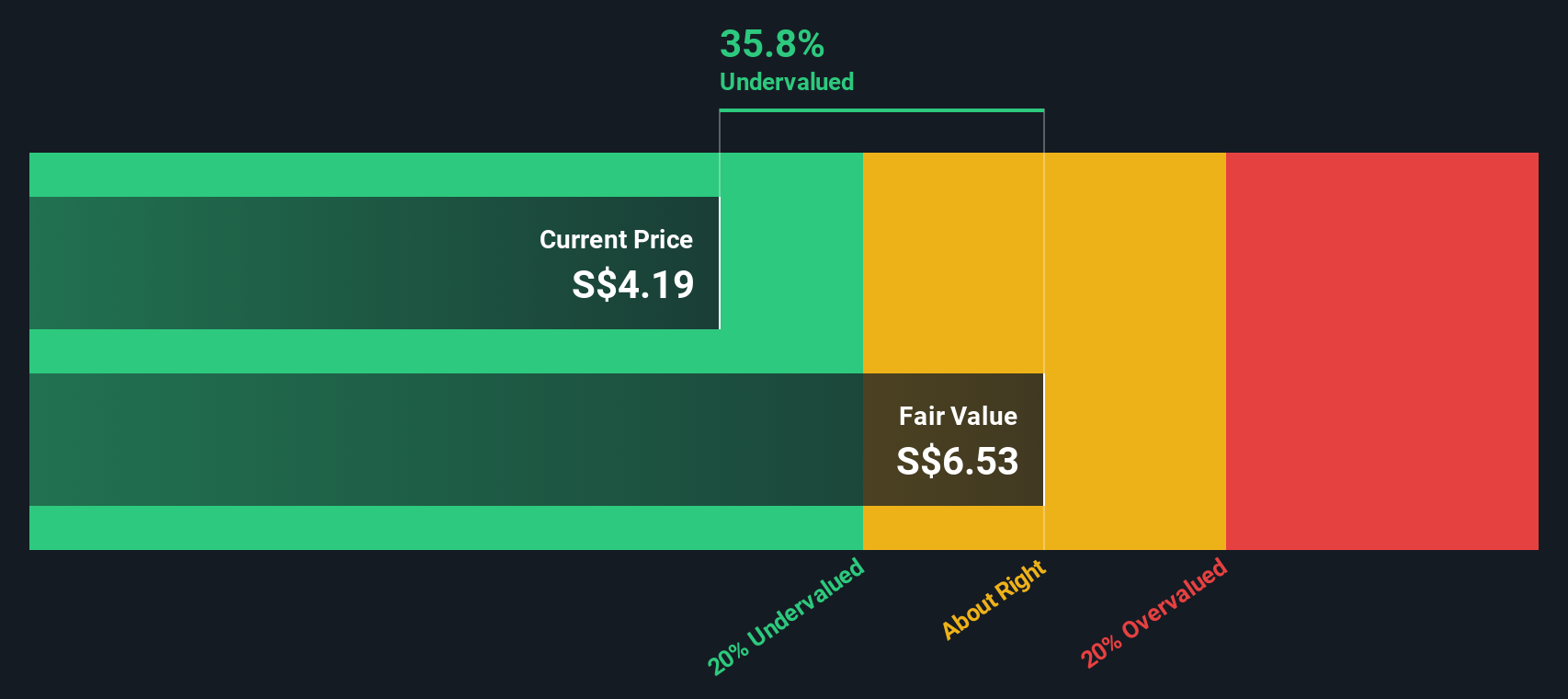

With shares trading at a 12 percent discount to analyst price targets and a larger 36 percent gap to some intrinsic value estimates, investors may wonder whether Singapore Telecommunications is an undervalued opportunity or if the market has already accounted for future growth.

Price-to-Earnings of 11.1x: Is it justified?

Singapore Telecommunications trades at a price-to-earnings (P/E) ratio of 11.1x, notably below peer companies and broader industry levels. At a last close of SGD4.19, this low multiple signals the market may be underestimating the company’s recent performance run or future earnings outlook.

The P/E ratio compares the company’s share price to its per-share earnings. In the telecom sector, this multiple can highlight how investors view a company’s profit potential versus the competition. A lower P/E is often seen where growth prospects appear limited or recent results include unusual gains.

Currently, Singapore Telecommunications not only trades at a lower P/E than its peers (22.9x) and the Asian Telecom industry average (16.7x), but also versus its estimated fair P/E of 18.4x. These metrics suggest considerable headroom if the market begins to reprice for recent profit growth momentum or reevaluates the outlook in light of future earnings swings.

Explore the SWS fair ratio for Singapore Telecommunications

Result: Price-to-Earnings of 11.1x (UNDERVALUED)

However, weaker annual net income growth and recent share price volatility could present risks. These factors may dampen optimism and reshape future investor sentiment.

Find out about the key risks to this Singapore Telecommunications narrative.

Another View: Discounted Cash Flow Perspective

While multiples show Singapore Telecommunications as undervalued, our DCF model provides a similar perspective from a different angle. According to this method, the company’s shares appear to trade at a significant discount to estimated fair value. However, do the cash flow assumptions in this model really stand up to scrutiny?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Singapore Telecommunications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Singapore Telecommunications Narrative

Keep in mind, the numbers and opinions above are just one way to look at Singapore Telecommunications. If you prefer a hands-on approach or want to follow your own reasoning, you can build your own analysis and perspective in just a few minutes with Do it your way.

A great starting point for your Singapore Telecommunications research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their watchlist. Take the next step and energize your portfolio with unique opportunities you may not have considered yet.

- Find new ways to grow your wealth with higher yields by reviewing these 19 dividend stocks with yields > 3% offering attractive returns for income-focused investors.

- Tap into future breakthroughs by checking out these 26 quantum computing stocks, featuring companies transforming industries through quantum computing innovation.

- Capitalize on market mispricing by starting your search with these 898 undervalued stocks based on cash flows and uncover businesses that look compelling against fundamental benchmarks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Z74

Singapore Telecommunications

Provides telecommunication services to consumers and small businesses in Singapore, Australia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.