TeleChoice International Limited (SGX:T41) Investors Are Less Pessimistic Than Expected

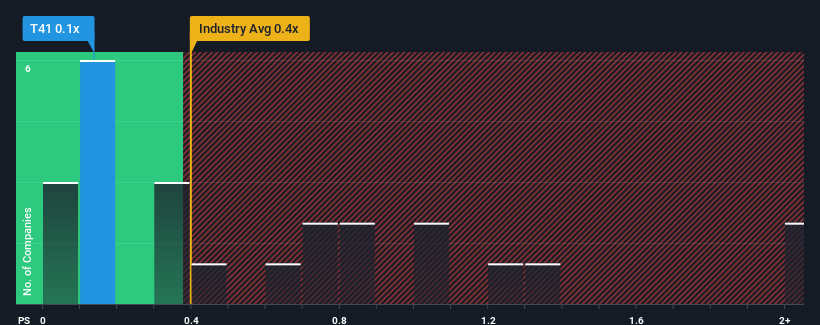

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Electronic industry in Singapore, you could be forgiven for feeling indifferent about TeleChoice International Limited's (SGX:T41) P/S ratio of 0.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for TeleChoice International

What Does TeleChoice International's Recent Performance Look Like?

TeleChoice International has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TeleChoice International will help you shine a light on its historical performance.How Is TeleChoice International's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TeleChoice International's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. The strong recent performance means it was also able to grow revenue by 45% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that TeleChoice International is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On TeleChoice International's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that TeleChoice International's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 3 warning signs for TeleChoice International (1 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on TeleChoice International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TeleChoice International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:T41

TeleChoice International

An investment holding company, provides various info-communications services and solutions for the consumer and enterprise markets in Singapore, Indonesia, Malaysia, the Philippines, Hong Kong, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives