Ban Leong Technologies' (SGX:B26) Promising Earnings May Rest On Soft Foundations

Ban Leong Technologies Limited (SGX:B26) just reported some strong earnings, and the market rewarded them with a positive share price move. However, our analysis suggests that shareholders may be missing some factors that indicate the earnings result was not as good as it looked.

Check out our latest analysis for Ban Leong Technologies

How Do Unusual Items Influence Profit?

For anyone who wants to understand Ban Leong Technologies' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from S$1.2m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. If Ban Leong Technologies doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ban Leong Technologies.

Our Take On Ban Leong Technologies' Profit Performance

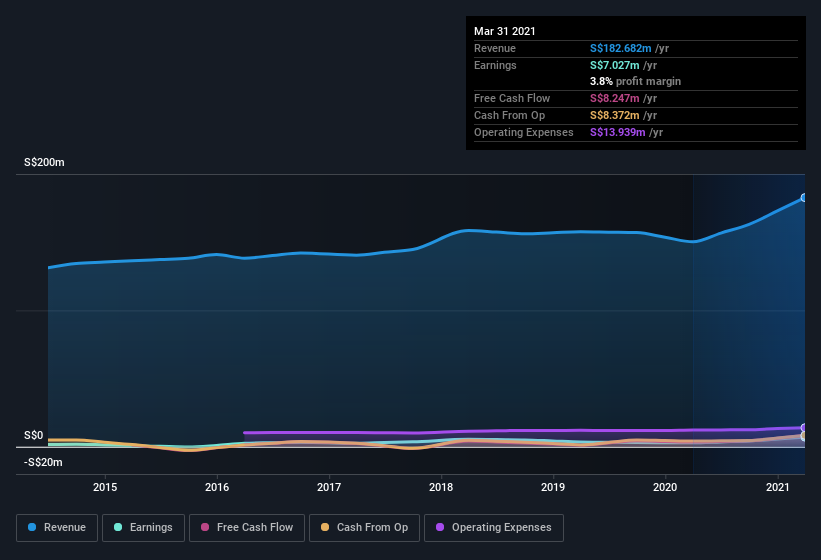

Arguably, Ban Leong Technologies' statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Ban Leong Technologies' true underlying earnings power is actually less than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Ban Leong Technologies.

Today we've zoomed in on a single data point to better understand the nature of Ban Leong Technologies' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Ban Leong Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Ban Leong Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:B26

Ban Leong Technologies

Engages in the wholesale and distribution of computer peripherals, accessories, and other multimedia products in Singapore, Malaysia, Thailand, Asia, and internationally.

Flawless balance sheet moderate and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion