If You Like EPS Growth Then Check Out Multi-Chem (SGX:AWZ) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Multi-Chem (SGX:AWZ). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Multi-Chem

How Fast Is Multi-Chem Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Multi-Chem has managed to grow EPS by 17% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

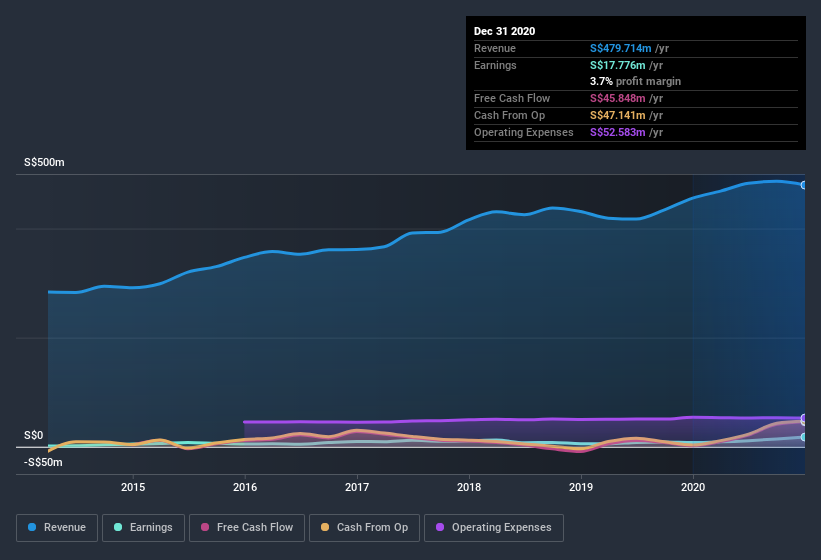

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Multi-Chem's EBIT margins were flat over the last year, revenue grew by a solid 5.2% to S$480m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Multi-Chem isn't a huge company, given its market capitalization of S$124m. That makes it extra important to check on its balance sheet strength.

Are Multi-Chem Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Multi-Chem insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the S$107k that Founder Suan Sai Foo spent buying shares (at an average price of about S$1.18).

And the insider buying isn't the only sign of alignment between shareholders and the board, since Multi-Chem insiders own more than a third of the company. In fact, they own 83% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about S$104m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Multi-Chem Worth Keeping An Eye On?

You can't deny that Multi-Chem has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. We should say that we've discovered 2 warning signs for Multi-Chem that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Multi-Chem isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Multi-Chem, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology (IT) products in Singapore, Australia, India, Vietnam, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion