Here's Why We're Wary Of Buying CSE Global's (SGX:544) For Its Upcoming Dividend

It looks like CSE Global Limited (SGX:544) is about to go ex-dividend in the next 3 days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase CSE Global's shares on or after the 25th of April, you won't be eligible to receive the dividend, when it is paid on the 11th of June.

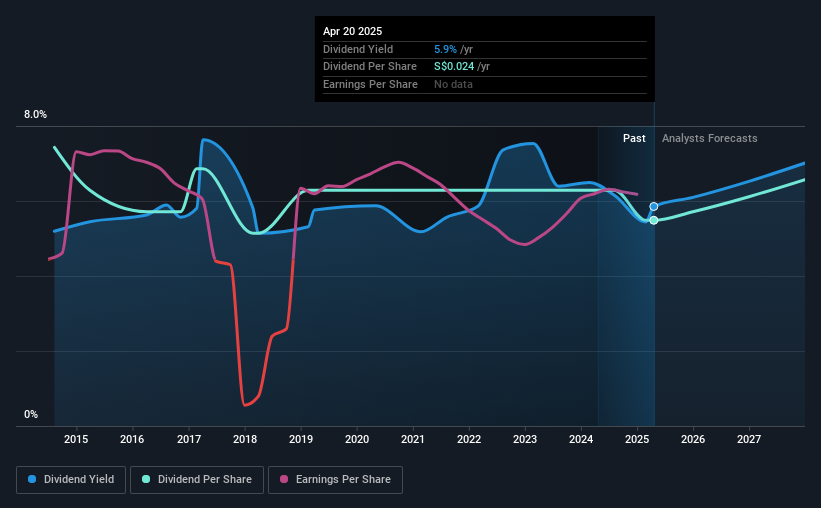

The company's next dividend payment will be S$0.0115 per share. Last year, in total, the company distributed S$0.024 to shareholders. Last year's total dividend payments show that CSE Global has a trailing yield of 5.9% on the current share price of S$0.41. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. CSE Global paid out more than half (61%) of its earnings last year, which is a regular payout ratio for most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Dividends consumed 61% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for CSE Global

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that CSE Global's earnings are down 4.8% a year over the past five years.

CSE Global also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. It's hard to grow dividends per share when a company keeps creating new shares.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. CSE Global's dividend payments per share have declined at 3.0% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

Should investors buy CSE Global for the upcoming dividend? While earnings per share are shrinking, it's encouraging to see that at least CSE Global's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. It's not that we think CSE Global is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with CSE Global. In terms of investment risks, we've identified 1 warning sign with CSE Global and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:544

CSE Global

An investment holding company, engages in the provision of integrated industrial automation, information technology, and intelligent transport solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)