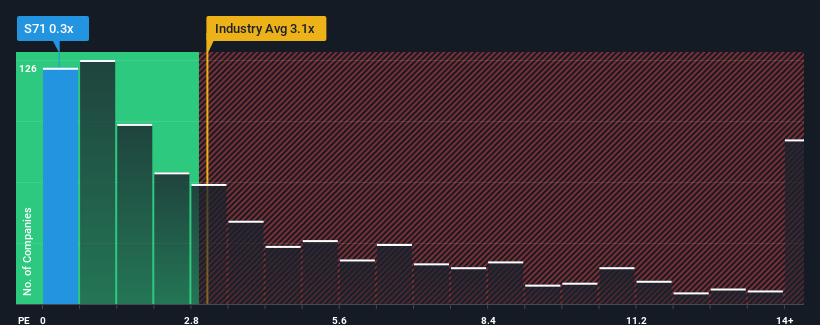

Sunright Limited's (SGX:S71) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Singapore have P/S ratios greater than 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sunright

How Has Sunright Performed Recently?

Revenue has risen at a steady rate over the last year for Sunright, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sunright will help you shine a light on its historical performance.How Is Sunright's Revenue Growth Trending?

Sunright's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 20% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9,095% shows it's an unpleasant look.

With this information, we are not surprised that Sunright is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Sunright revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Sunright has 2 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S71

Sunright

An investment holding company, provides semiconductor test and burn-in services to semiconductor and electronics manufacturers in Singapore, Malaysia, Mainland China, the United States, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026