- China

- /

- Metals and Mining

- /

- SHSE:600507

UMS Integration And 2 Other Global Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have been experiencing mixed performance, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 posting gains, while larger indexes such as the Dow Jones Industrial Average and Nasdaq Composite faced declines amid ongoing trade tensions and economic uncertainty. In this context, investors are increasingly looking towards alternative investment opportunities that can offer both value and growth potential. Penny stocks, despite their old-fashioned moniker, remain a relevant investment area for those interested in smaller or newer companies with strong financial foundations. In this article, we explore three penny stocks that demonstrate financial strength and may present long-term potential for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.41 | SGD166.17M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.65 | SEK273.7M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.84 | MYR1.31B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.36 | MYR1B | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$681.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.595 | £407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.822 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,614 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

UMS Integration (SGX:558)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UMS Integration Limited, with a market cap of SGD760.27 million, is an investment holding company that manufactures and markets precision machining components while also offering electromechanical assembly and final testing services.

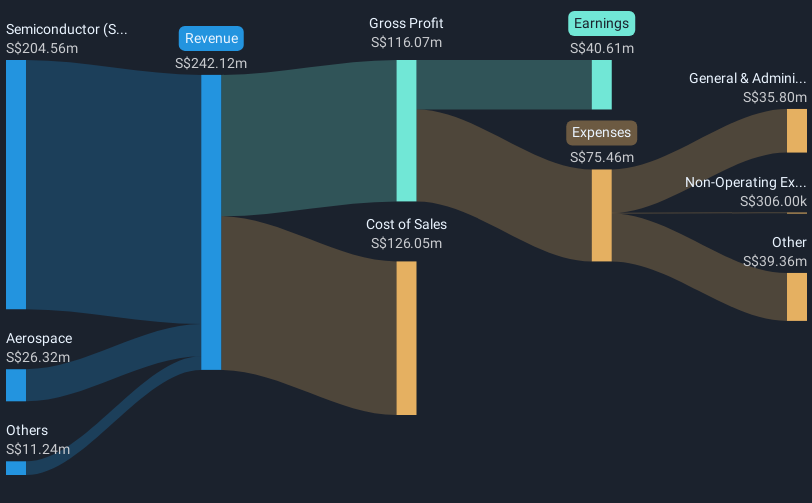

Operations: The company's revenue is primarily derived from its Semiconductor segment, which generated SGD204.56 million, followed by the Aerospace segment with SGD26.32 million.

Market Cap: SGD760.27M

UMS Integration Limited, with a market cap of SGD760.27 million, derives significant revenue from its Semiconductor segment. While earnings are forecast to grow 18.03% annually and the company trades at 79.2% below estimated fair value, recent earnings have declined by 32.3%. The company's robust financial position is highlighted by more cash than total debt and strong operating cash flow coverage of debt (very large). Short-term assets exceed both short and long-term liabilities significantly, but the dividend yield of 4.86% is not well covered by earnings or free cash flows, indicating potential sustainability concerns despite high-quality past earnings.

- Click here to discover the nuances of UMS Integration with our detailed analytical financial health report.

- Understand UMS Integration's earnings outlook by examining our growth report.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

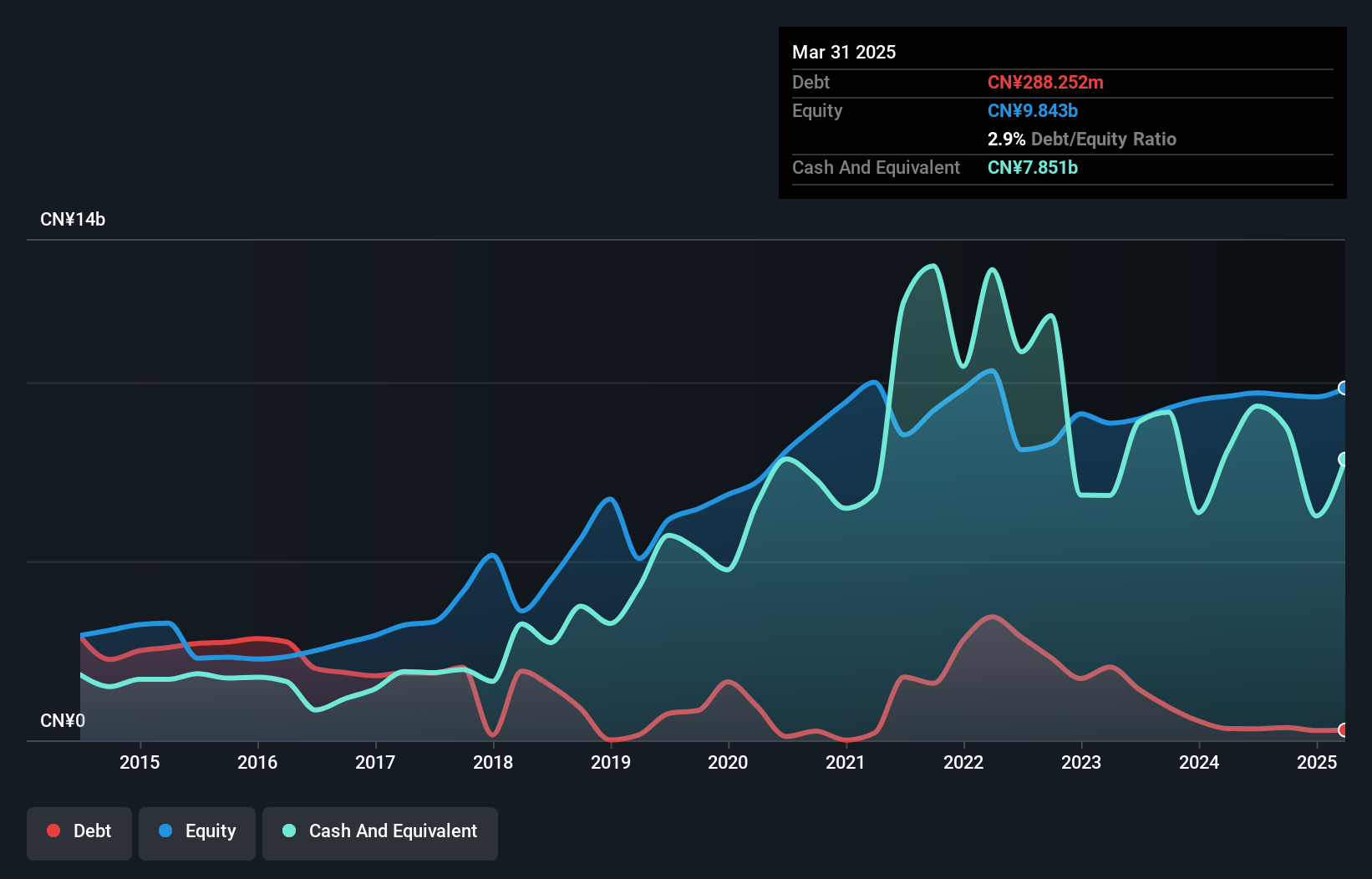

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel manufacturing industry, specializing in the production of special steel products, with a market cap of approximately CN¥9.35 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥9.35B

Fangda Special Steel Technology, with a market cap of CN¥9.35 billion, has faced challenges with negative earnings growth of 38% over the past year and a 32.5% annual decline over five years. Despite this, the company reported improved net income in Q1 2025 at CN¥250.34 million compared to CN¥93.41 million the previous year, indicating potential recovery signs. While short-term assets cover both short and long-term liabilities, operating cash flow remains negative, affecting debt coverage capabilities. The dividend yield is modest at 0.74%, not well supported by free cash flows, and management's inexperience may pose additional risks to investors focused on stability and growth prospects in penny stocks.

- Click to explore a detailed breakdown of our findings in Fangda Special Steel Technology's financial health report.

- Evaluate Fangda Special Steel Technology's prospects by accessing our earnings growth report.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

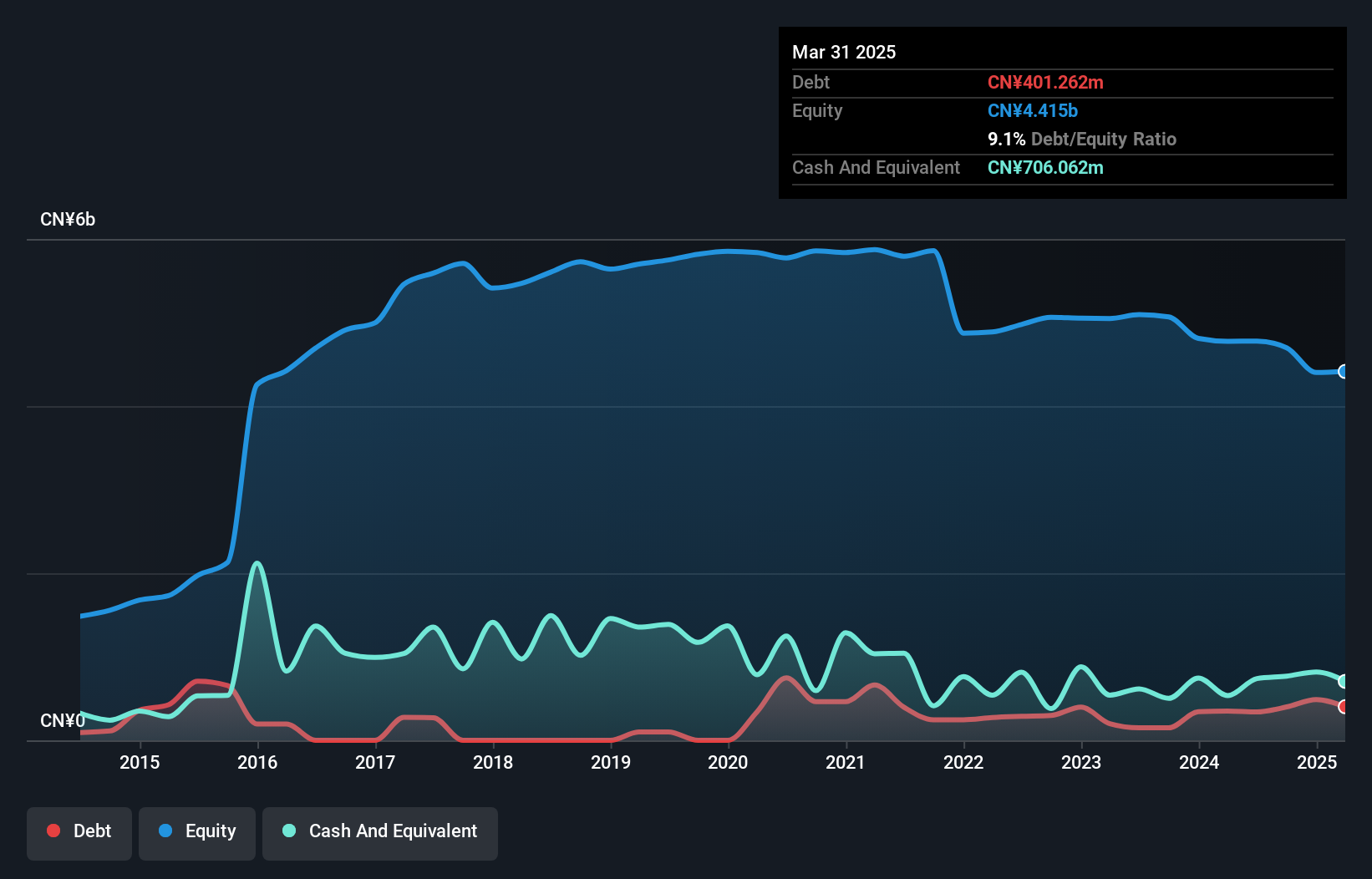

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd is engaged in the manufacturing and sale of APIs, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥5.36 billion.

Operations: Hunan Er-Kang Pharmaceutical Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥5.36B

Hunan Er-Kang Pharmaceutical, with a market cap of CN¥5.36 billion, reported a decrease in annual sales to CN¥1.14 billion from CN¥1.78 billion, alongside an increased net loss of CN¥373.37 million for 2024. Despite this, the company showed improvement in Q1 2025 with sales rising to CN¥353.55 million and net income reaching CN¥28.11 million compared to the previous year’s figures. While short-term assets exceed liabilities and debt is well-covered by cash flow, profitability remains elusive as losses have grown over five years at 25.9% annually, posing challenges for investors seeking stability in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Hunan Er-Kang Pharmaceutical.

- Learn about Hunan Er-Kang Pharmaceutical's historical performance here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 5,614 Global Penny Stocks by using our screener here.

- Ready For A Different Approach? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600507

Fangda Special Steel Technology

Fangda Special Steel Technology Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives