As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cut and ongoing political uncertainties, investors are keeping a close eye on economic indicators and central bank policies. With U.S. stocks experiencing volatility amid these developments, dividend stocks can offer stability through consistent income streams, making them an attractive option for those looking to weather market fluctuations while potentially benefiting from long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

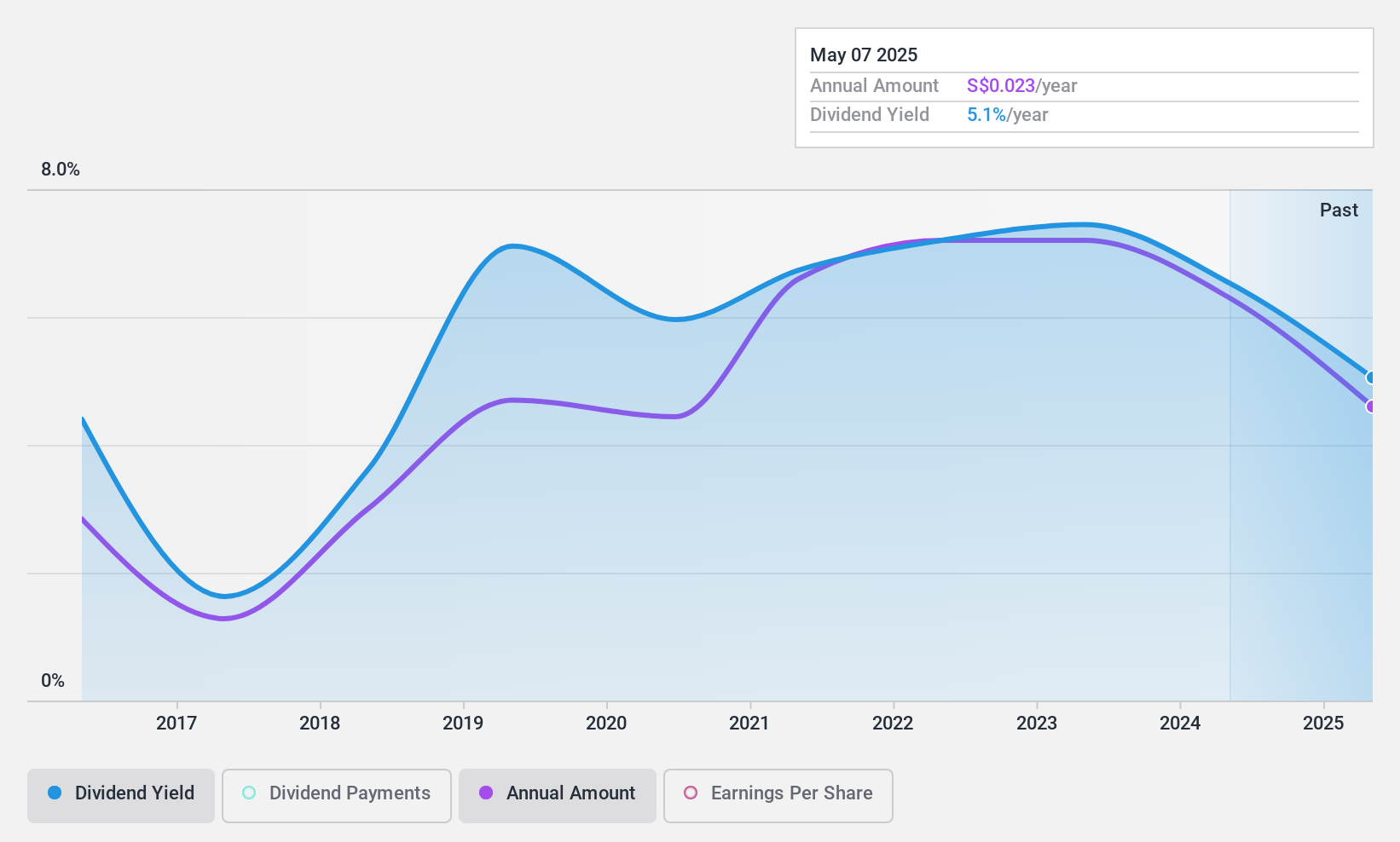

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and internationally; it has a market cap of SGD148.77 million.

Operations: YHI International Limited generates revenue through its segments, including Distribution in ASEAN (SGD119.40 million), Distribution in Oceania (SGD140.24 million), Manufacturing in ASEAN (SGD55.05 million), Distribution in Other regions (SGD33.31 million), Distribution in North East Asia (SGD17.99 million), and Manufacturing in North East Asia excluding rental income (SGD57.20 million).

Dividend Yield: 6.2%

YHI International's dividend profile is mixed. While the dividend yield of 6.18% places it in the top 25% of Singapore's market, its payments have been volatile over the past decade despite recent growth. The payout ratio of 68.9% suggests dividends are covered by earnings, and a cash payout ratio of 43.3% indicates coverage by cash flows is solid. However, a recent fire incident affecting inventory valued at MYR 15.6 million may impact short-term operations and financial stability.

- Dive into the specifics of YHI International here with our thorough dividend report.

- Our valuation report here indicates YHI International may be undervalued.

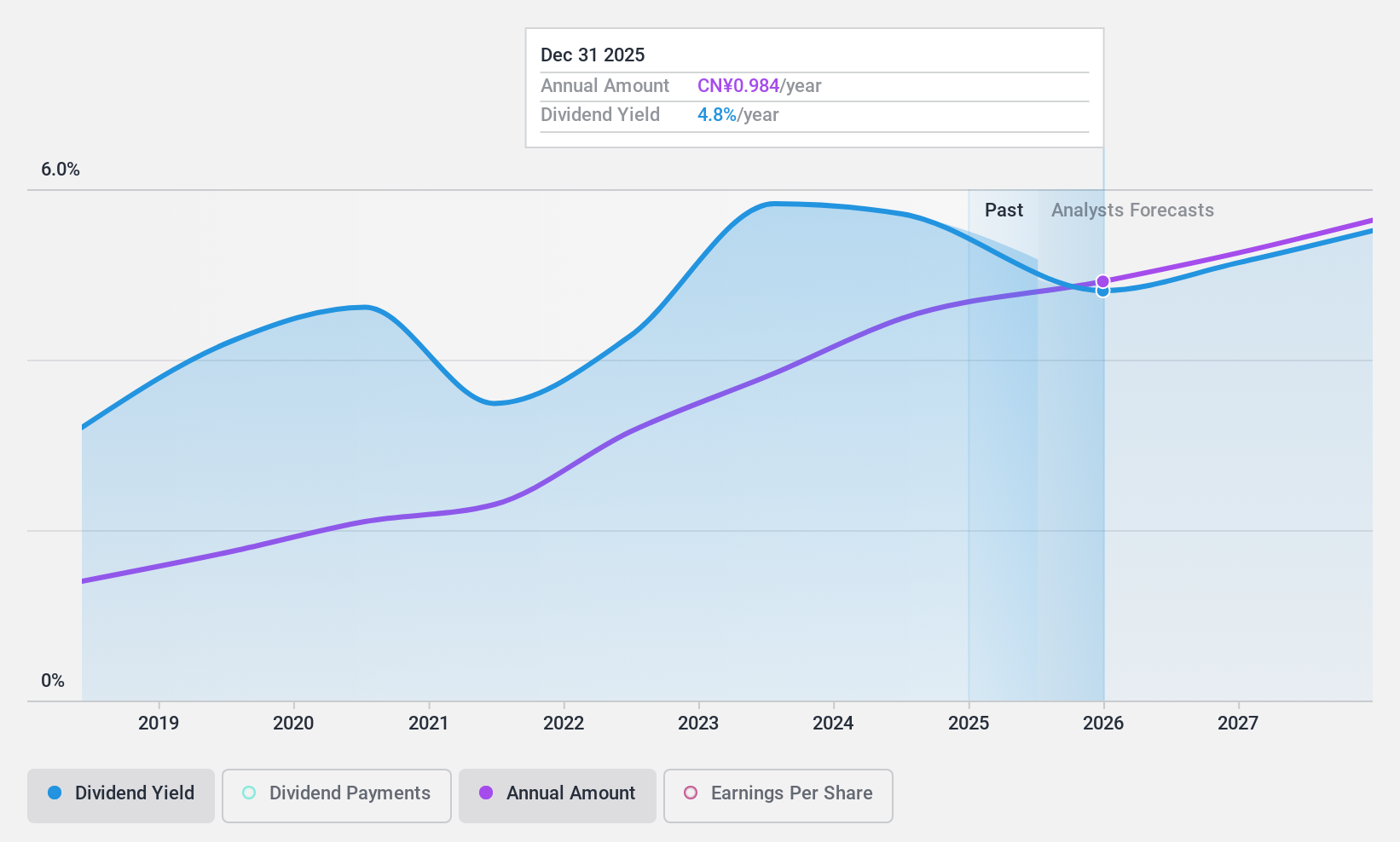

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chengdu Co., Ltd. offers a range of commercial banking products and services in China with a market capitalization of CN¥64.72 billion.

Operations: Bank of Chengdu Co., Ltd. generates revenue through its diverse commercial banking operations in China, focusing on a variety of financial products and services.

Dividend Yield: 5.3%

Bank of Chengdu offers a compelling dividend profile with a payout ratio of 27.9%, indicating dividends are well covered by earnings. The bank's dividend yield is among the top 25% in China's market, and its earnings have grown by 9.9% over the past year, supporting sustainable payouts. Although dividends have been stable, they've only been paid for seven years. Recent earnings show net income growth to CNY 9 billion, reinforcing financial health and potential for future dividend stability.

- Navigate through the intricacies of Bank of Chengdu with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Bank of Chengdu's share price might be too pessimistic.

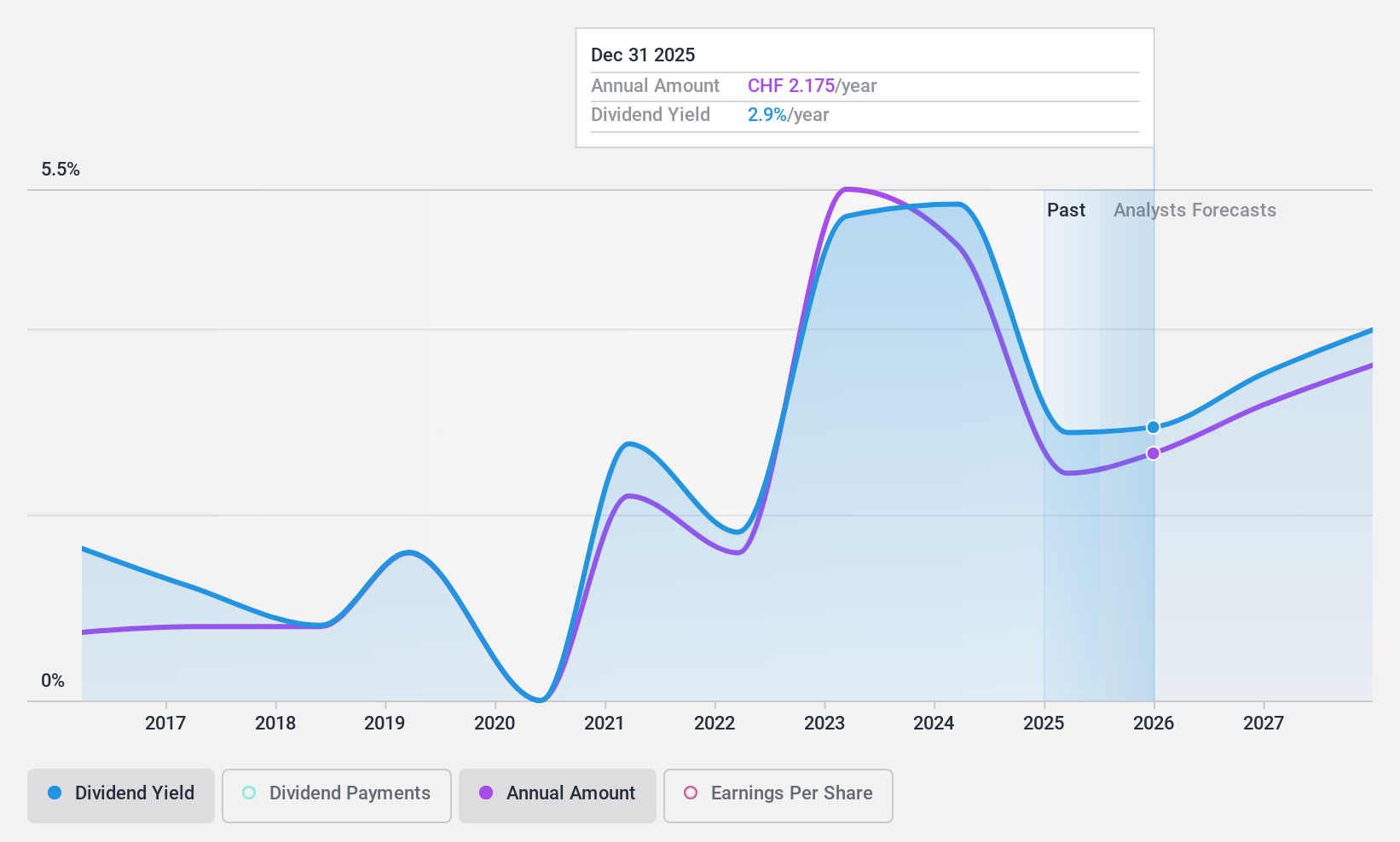

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG, with a market cap of CHF443.64 million, operates in the manufacture and sale of chemicals and packaging films across Switzerland, Europe, the Americas, Asia, and other international markets.

Operations: CPH Group AG's revenue is primarily derived from three segments: Chemistry (CHF128.62 million), Packaging (CHF219.70 million), and Spun-off divisions (Paper) (CHF245.37 million).

Dividend Yield: 5.4%

CPH Group's dividend yield of 5.41% ranks it among the top 25% in the Swiss market, yet its sustainability is questionable due to a high payout ratio (249.1%) not covered by earnings. Despite this, dividends are well-covered by cash flows with a low cash payout ratio (47%). The company's dividend history is marked by volatility and unreliability over the past decade, though there has been growth in payments during that time.

- Click to explore a detailed breakdown of our findings in CPH Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of CPH Group shares in the market.

Seize The Opportunity

- Access the full spectrum of 1951 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Chengdu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601838

Bank of Chengdu

Provides various commercial banking products and services in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives