- Singapore

- /

- Professional Services

- /

- SGX:CHZ

SGX Dividend Stocks To Watch In October 2024

Reviewed by Simply Wall St

As the Singapore market navigates through a period of economic uncertainty, investors are increasingly focusing on stability and income generation, making dividend stocks an attractive option. In such times, selecting stocks with a strong track record of consistent dividend payouts can be a prudent strategy for those seeking to balance risk and reward.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.72% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.25% | ★★★★★☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.91% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.38% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.16% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.99% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.71% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.55% | ★★★★☆☆ |

| Tai Sin Electric (SGX:500) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. is involved in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets with a market cap of SGD794.95 million.

Operations: Aztech Global Ltd. generates revenue through its operations in IoT devices, data-communication products, and LED lighting products across various international markets.

Dividend Yield: 9.7%

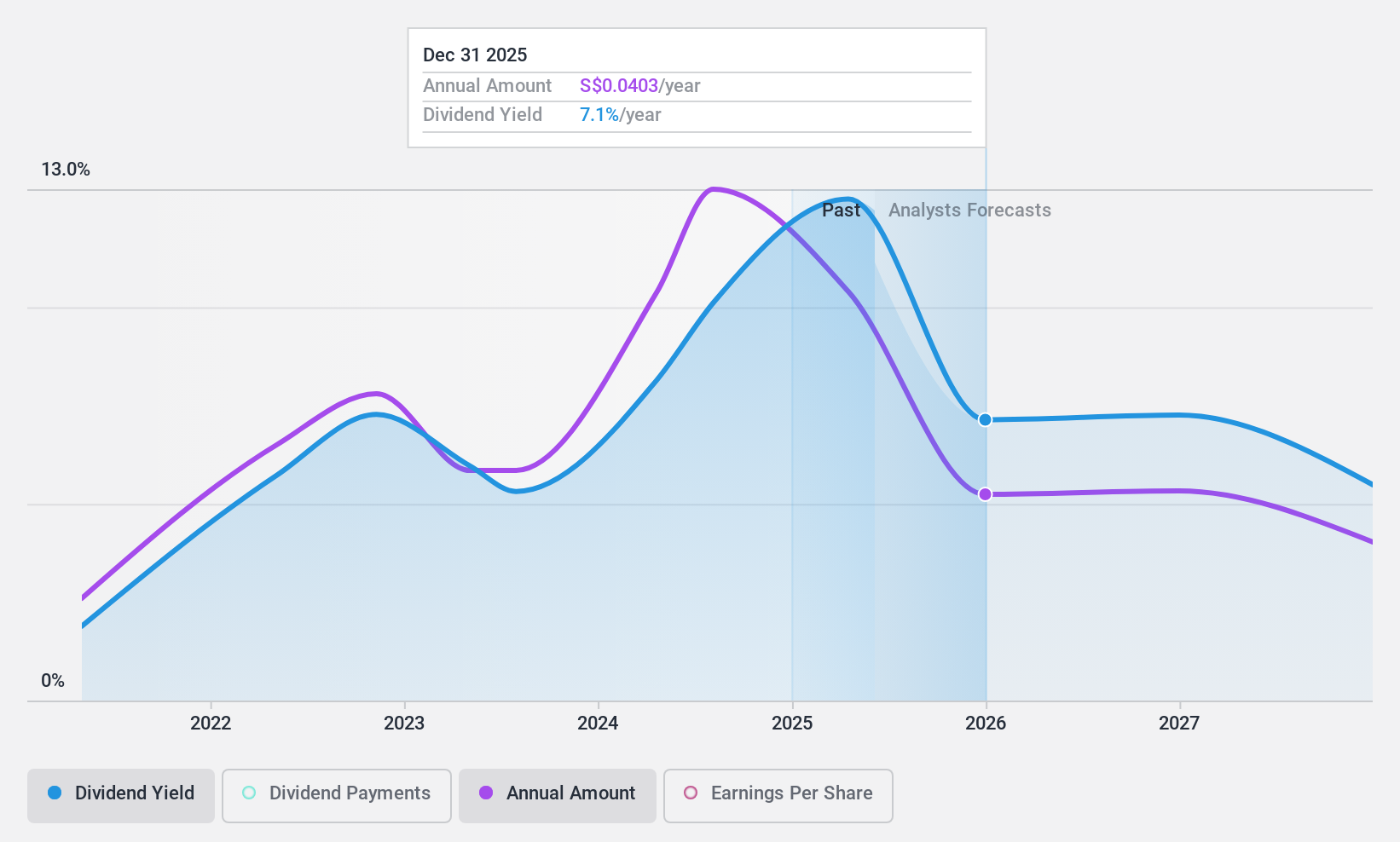

Aztech Global's dividend prospects show a mixed picture. The company recently increased its interim dividend to S$0.05, supported by a payout ratio of 74.4% and cash flow coverage of 62.1%. Despite strong earnings growth and trading at good value, the company's dividend track record is unstable with only three years of payments and volatility in payouts. Additionally, Aztech has initiated a share buyback program, which may impact future dividends depending on funding sources used.

- Delve into the full analysis dividend report here for a deeper understanding of Aztech Global.

- Our comprehensive valuation report raises the possibility that Aztech Global is priced lower than what may be justified by its financials.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and internationally; it has a market cap of SGD144.40 million.

Operations: YHI International Limited generates revenue from several segments, including Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental (SGD57.20 million).

Dividend Yield: 6.4%

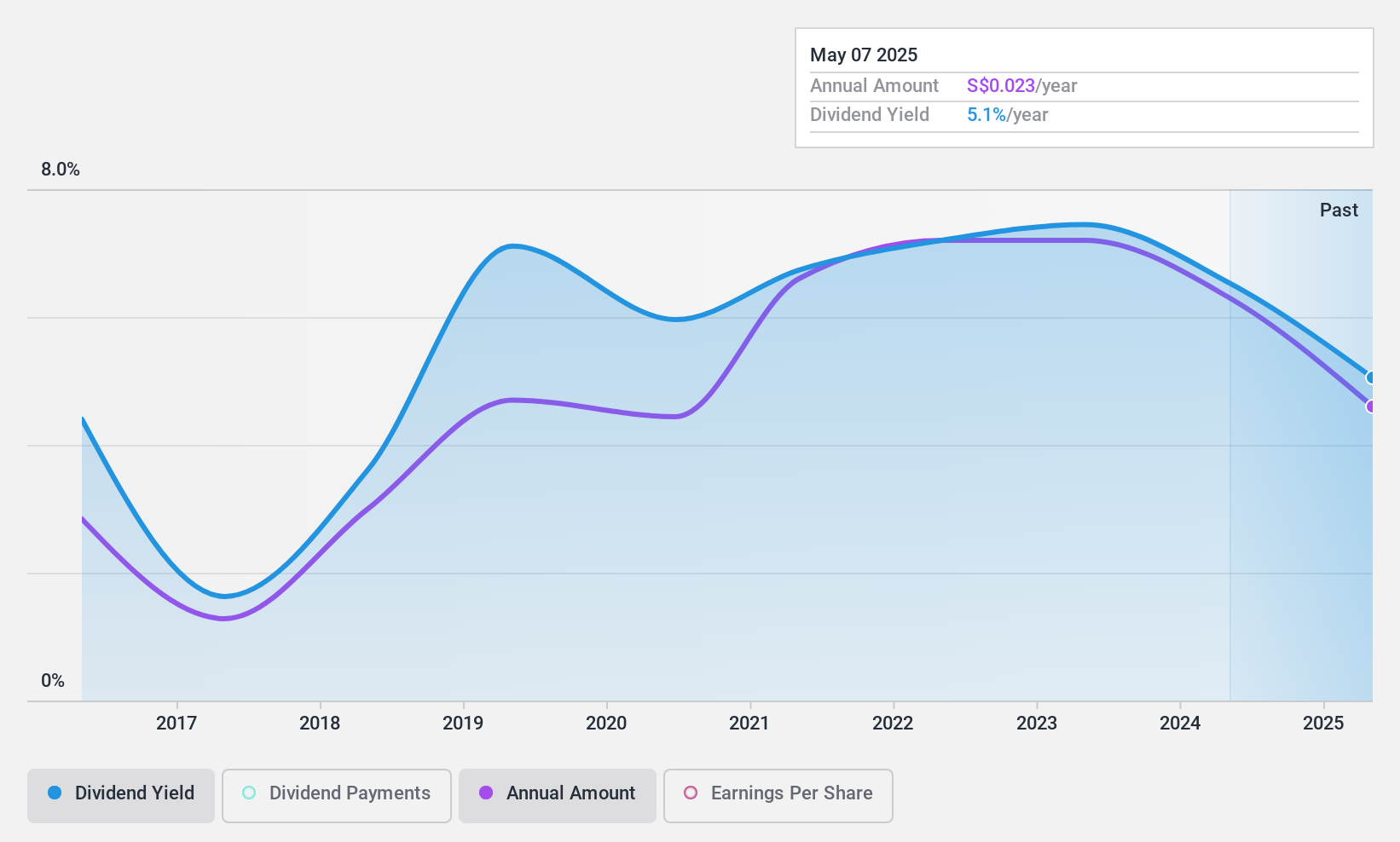

YHI International's dividend profile is marked by volatility over the past decade, though it offers a high yield at 6.36%, placing it in the top 25% of Singapore's market. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios of 68.9% and 43.3%, respectively. Recent financials show modest growth, with half-year sales reaching S$198.61 million and net income increasing to S$7.71 million, supporting dividend sustainability for now.

- Get an in-depth perspective on YHI International's performance by reading our dividend report here.

- Our expertly prepared valuation report YHI International implies its share price may be lower than expected.

HRnetGroup (SGX:CHZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HRnetGroup Limited is an investment holding company that operates in the recruitment and staffing industry across several Asian countries, with a market cap of SGD661.93 million.

Operations: HRnetGroup Limited generates revenue primarily through its Flexible Staffing segment, which accounts for SGD505.60 million, and its Professional Recruitment segment, contributing SGD59.92 million.

Dividend Yield: 5.9%

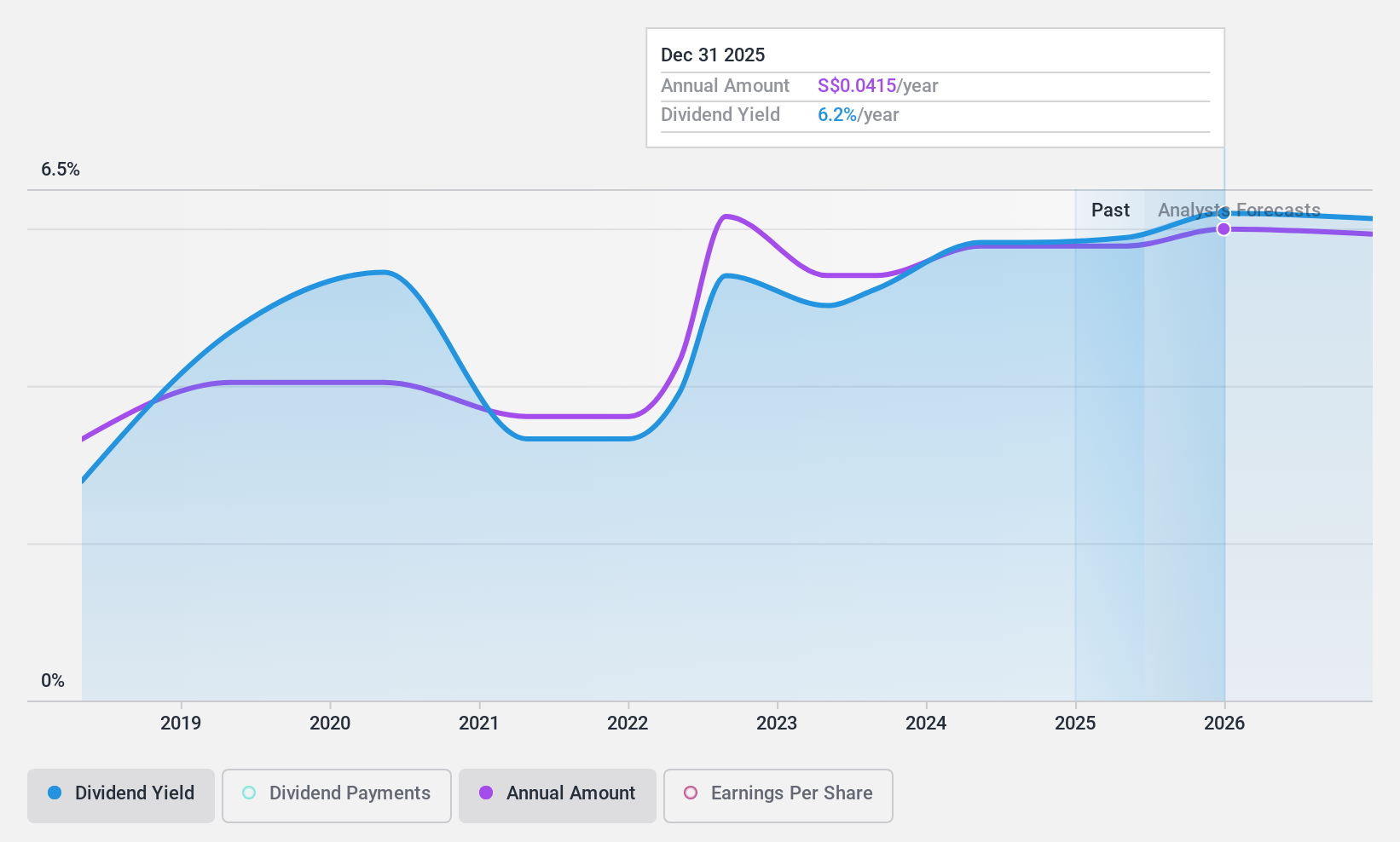

HRnetGroup's dividend yield is competitive, ranking in the top 25% of Singapore's market. Dividends are covered by earnings and cash flows, with payout ratios of 69% and 74.5%, respectively. However, the company's dividend history is relatively short at six years. Recent financials show a decline in half-year sales to S$285.91 million and net income to S$21.68 million, potentially impacting future dividend sustainability despite a recent interim dividend declaration of 1.87 Singapore cents per share.

- Take a closer look at HRnetGroup's potential here in our dividend report.

- Our valuation report unveils the possibility HRnetGroup's shares may be trading at a discount.

Key Takeaways

- Get an in-depth perspective on all 21 Top SGX Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HRnetGroup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:CHZ

HRnetGroup

An investment holding company, engages in the recruitment and staffing business in Singapore, Hong Kong, Taiwan, the People’s Republic of China, Japan, South Korea, Malaysia, Thailand, and Indonesia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives