- Singapore

- /

- Retail Distributors

- /

- SGX:BPF

December 2024's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with major indices like the S&P 500 and Nasdaq Composite reaching record highs while others like the Russell 2000 experience setbacks, investors are keenly observing opportunities that may arise. Penny stocks, often seen as relics from earlier market days, continue to offer potential value in today's market by highlighting smaller or less-established companies. By focusing on those with robust financials and clear growth trajectories, investors can uncover promising opportunities within this niche segment.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.56B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.13B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,696 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Shenzhen Pagoda Industrial (Group) (SEHK:2411)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Pagoda Industrial (Group) Corporation Limited is a fruit retailer operating in China, Indonesia, Singapore, Hong Kong, and internationally with a market cap of HK$1.92 billion.

Operations: The company's revenue is primarily derived from its franchising segment, which generated CN¥9.88 billion, followed by trading activities contributing CN¥1.15 billion.

Market Cap: HK$1.92B

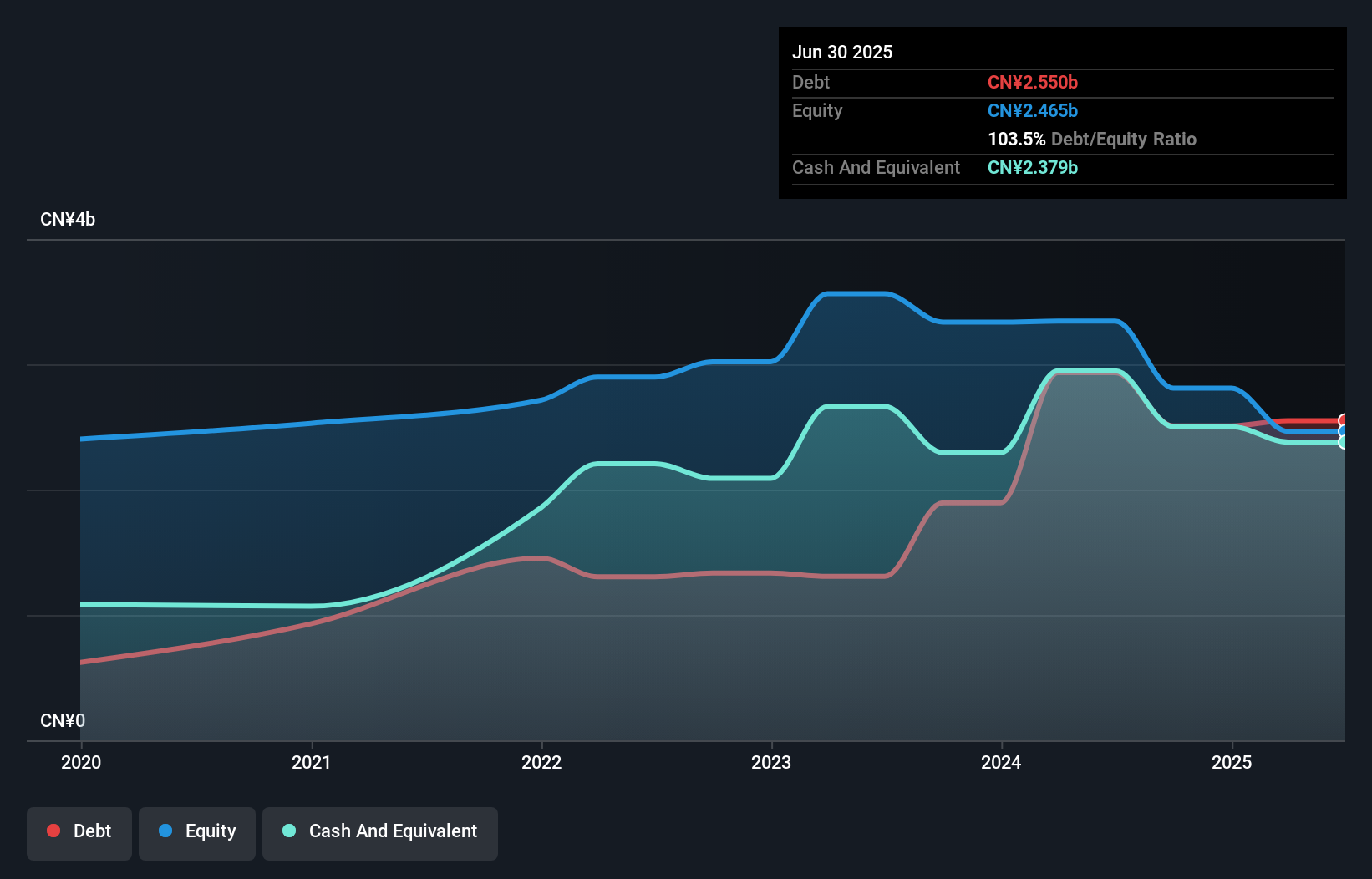

Shenzhen Pagoda Industrial (Group) Corporation Limited, with a market cap of HK$1.92 billion, has recently initiated a share buyback program aimed at enhancing net asset value per share and earnings per share. Despite negative earnings growth over the past year, the company has seen an average annual profit increase of 12.3% over five years. While its profit margins have declined to 1.8% from last year's 3.3%, it maintains more cash than total debt and covers interest payments well with EBIT (9.6x). Trading at a price-to-earnings ratio of 10x, it is considered good value compared to industry peers.

- Click here and access our complete financial health analysis report to understand the dynamics of Shenzhen Pagoda Industrial (Group).

- Review our growth performance report to gain insights into Shenzhen Pagoda Industrial (Group)'s future.

Sino-Ocean Group Holding (SEHK:3377)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino-Ocean Group Holding Limited is an investment holding company involved in property investment and development in the People's Republic of China, with a market capitalization of HK$2.21 billion.

Operations: The company's revenue is primarily derived from property development across various regions in China, with CN¥8.39 billion from Eastern China, CN¥7.53 billion from the Bohai Rim Region, CN¥6.93 billion from Central China, CN¥5.66 billion from Southern China, and CN¥1.83 billion from Beijing; additionally, it earns CN¥429.57 million in property investment and CN¥2.77 billion in property management services.

Market Cap: HK$2.21B

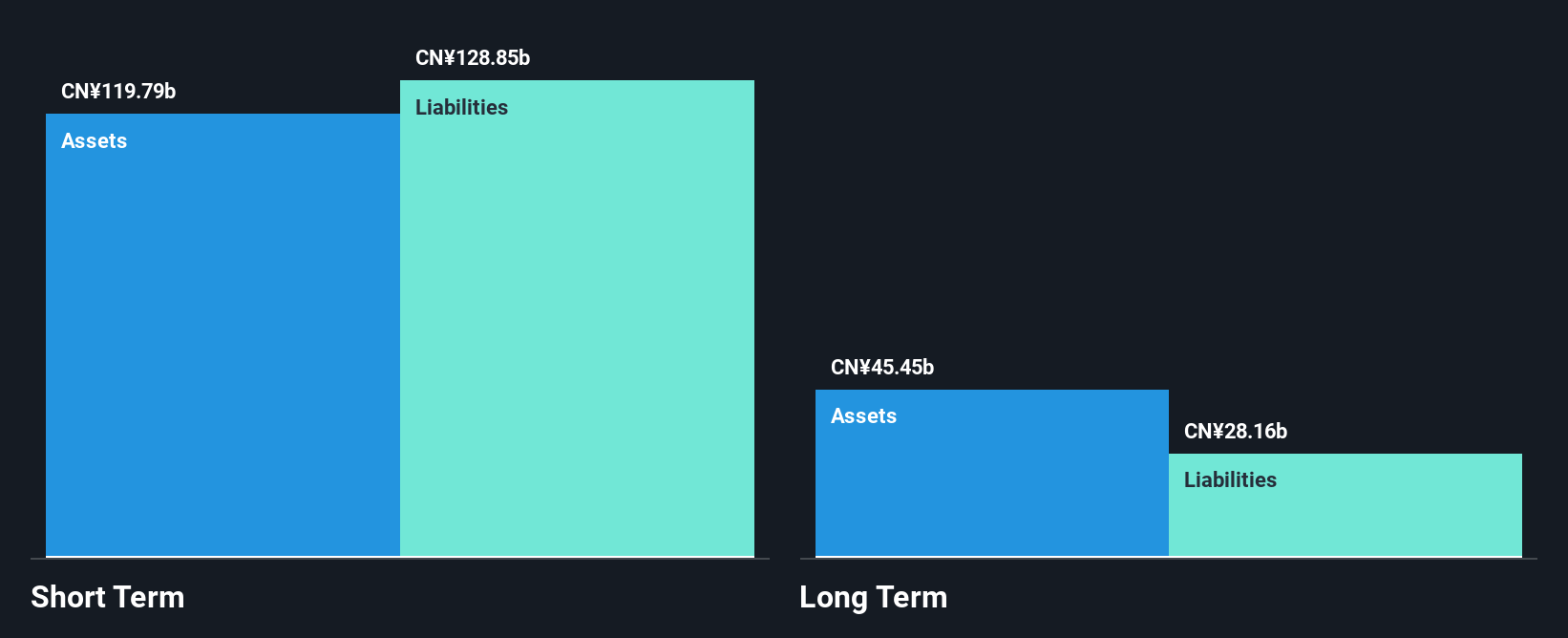

Sino-Ocean Group Holding, with a market cap of HK$2.21 billion, faces challenges typical of penny stocks. The company is currently unprofitable, with a negative return on equity (-56.51%) and an increasing debt-to-equity ratio now at 683.4%. Despite these financial hurdles, Sino-Ocean's short-term assets exceed both its short- and long-term liabilities, providing some balance sheet strength. Recent sales data shows contracted sales reaching RMB26.87 billion from January to October 2024, indicating active operations in property development across China. However, the company's share price has been highly volatile recently, reflecting investor uncertainty amidst its financial struggles and new board composition.

- Unlock comprehensive insights into our analysis of Sino-Ocean Group Holding stock in this financial health report.

- Gain insights into Sino-Ocean Group Holding's historical outcomes by reviewing our past performance report.

YHI International (SGX:BPF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and other international markets; it has a market cap of SGD145.86 million.

Operations: YHI International's revenue is derived from its distribution activities in ASEAN (SGD119.40 million), Oceania (SGD140.24 million), North East Asia (SGD17.99 million), and other regions (SGD33.31 million), as well as its manufacturing operations in ASEAN (SGD55.05 million) and North East Asia excluding rental income (SGD57.20 million).

Market Cap: SGD145.86M

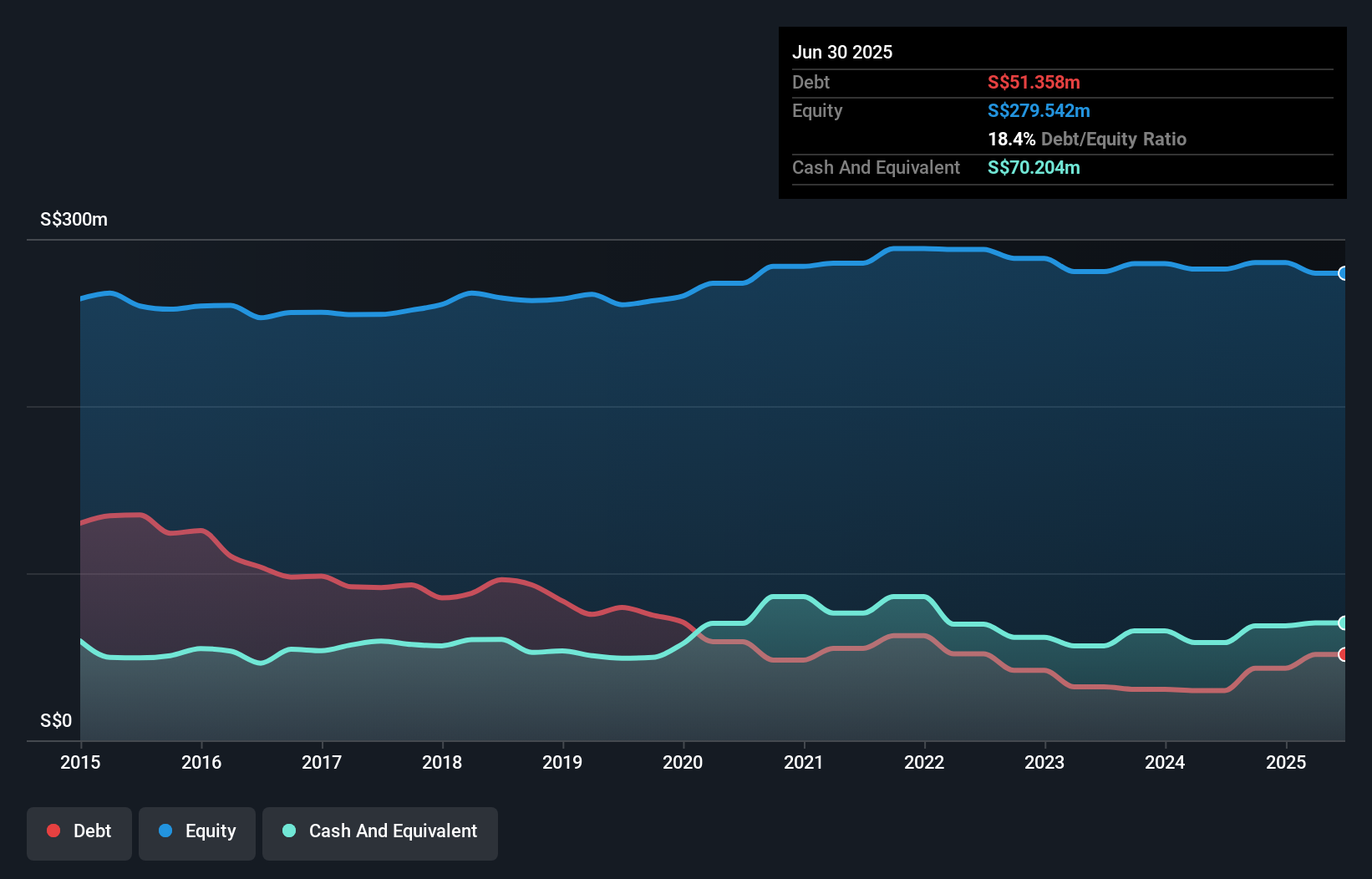

YHI International Limited, with a market cap of SGD145.86 million, demonstrates financial stability with short-term assets (SGD263.3M) exceeding both short- and long-term liabilities, and debt levels well covered by operating cash flow. Earnings growth has accelerated to 6.4% over the past year, surpassing industry averages, while interest payments are adequately covered by EBIT. The company recently faced operational disruptions due to a fire at its Kuala Lumpur distribution warehouse affecting inventory worth MYR15.6 million; however, most losses are insured and recovery efforts are underway to resume normal operations promptly.

- Click to explore a detailed breakdown of our findings in YHI International's financial health report.

- Review our historical performance report to gain insights into YHI International's track record.

Make It Happen

- Unlock our comprehensive list of 5,696 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BPF

YHI International

An investment holding company, together with its subsidiaries, distributes automotive and industrial products in Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives