- Singapore

- /

- Retail Distributors

- /

- SGX:BPF

3 SGX Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

As the Singapore market navigates a period of economic adjustments and global uncertainties, investors are keenly observing opportunities within the SGX for stable returns. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth with consistent payouts.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.87% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.25% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.43% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.30% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.09% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.99% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.71% | ★★★★☆☆ |

| Genting Singapore (SGX:G13) | 4.82% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.71% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.55% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

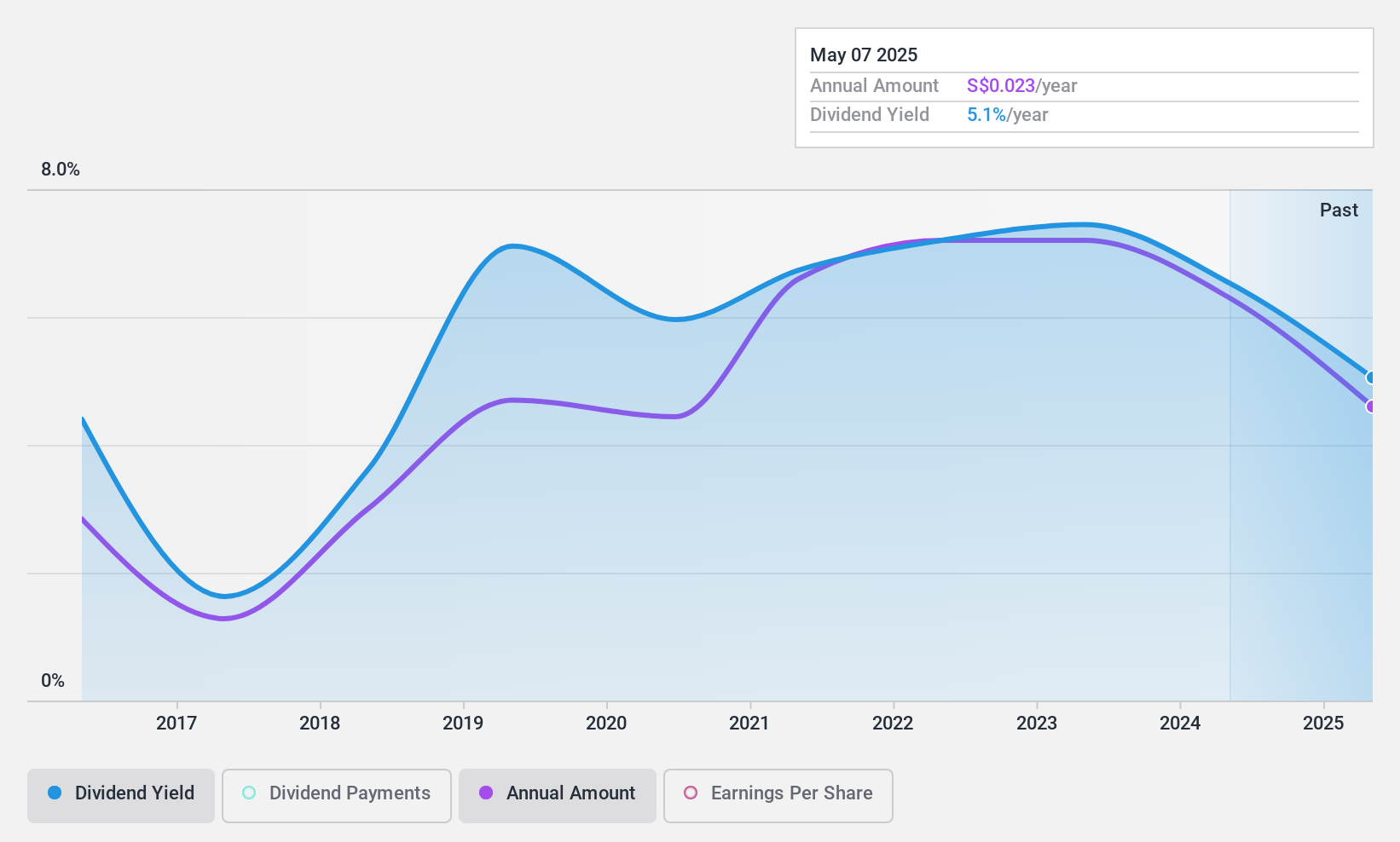

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and other international markets with a market cap of SGD145.86 million.

Operations: YHI International Limited generates revenue through several segments, including Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental income (SGD57.20 million).

Dividend Yield: 6.3%

YHI International's dividend yield is in the top quartile of Singapore's market, with dividends covered by earnings and cash flows, showcasing a payout ratio of 68.9% and a cash payout ratio of 43.3%. However, its dividend history has been volatile over the past decade. Recent earnings reports show growth in sales to S$198.61 million and net income to S$7.71 million for H1 2024, indicating potential stability for future payouts despite past volatility.

- Click to explore a detailed breakdown of our findings in YHI International's dividend report.

- In light of our recent valuation report, it seems possible that YHI International is trading behind its estimated value.

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited is an investment holding company that provides solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air and water engineering globally with a market cap of SGD143.68 million.

Operations: Nordic Group Limited generates revenue from Project Services (SGD69.93 million) and Maintenance Services (SGD83.13 million).

Dividend Yield: 4%

Nordic Group's dividend yield is below the top quartile of Singapore's market, with a payout ratio of 40% and cash payout ratio of 29.6%, indicating dividends are well covered by earnings and cash flows. Despite stable coverage, its dividend history has been volatile and unreliable over the past decade. Recent earnings for H1 2024 show decreased sales to S$76.16 million and net income to S$8.53 million, alongside a reduced interim dividend payment in August 2024.

- Navigate through the intricacies of Nordic Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Nordic Group's shares may be trading at a discount.

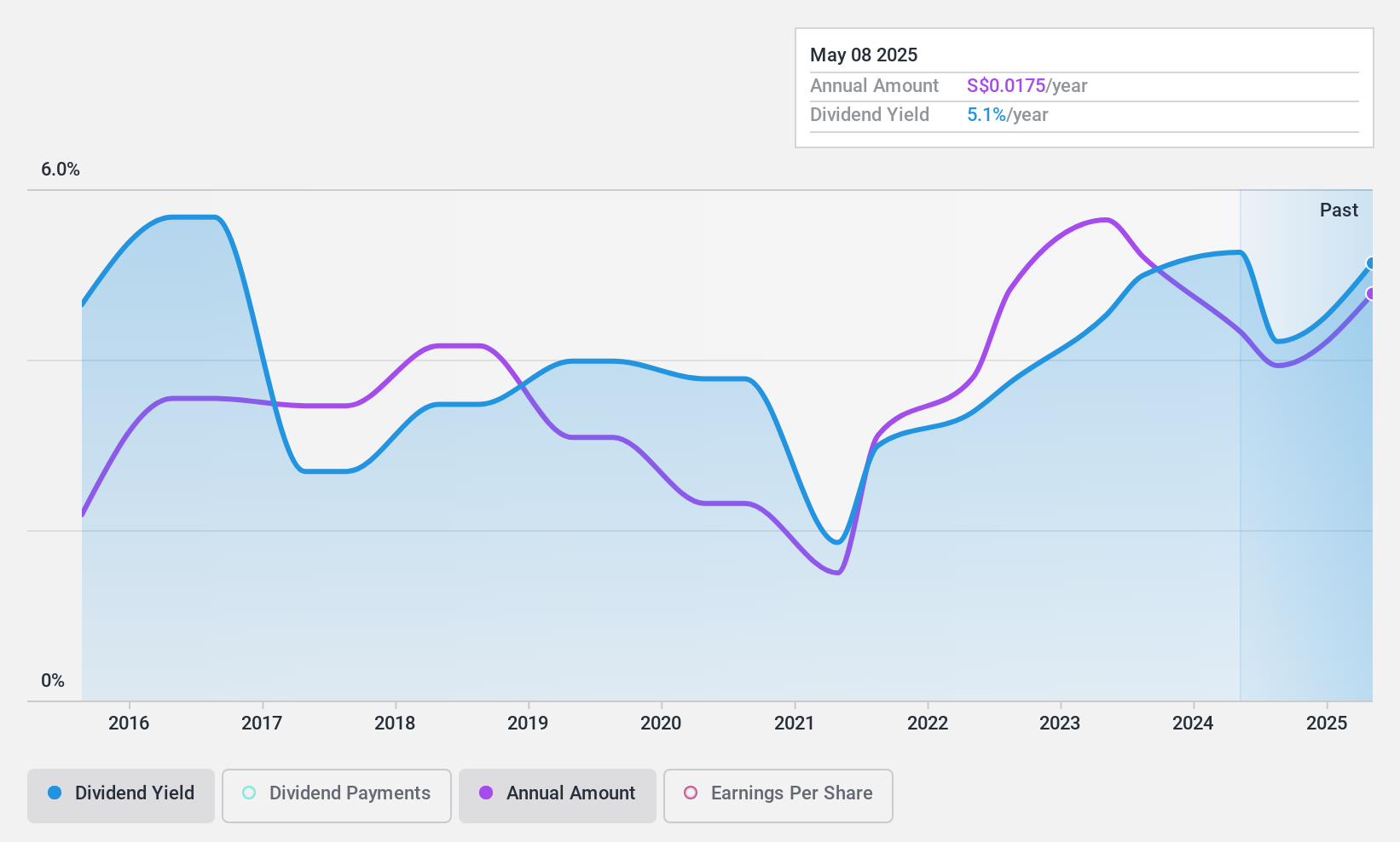

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that manufactures, markets, distributes, and sells chocolate and consumer products in Indonesia, the Philippines, Malaysia, Singapore, and internationally with a market cap of SGD531.71 million.

Operations: Delfi Limited generates its revenue primarily from Indonesia, contributing $349.57 million, and from Regional Markets, adding $183.30 million.

Dividend Yield: 6.6%

Delfi's dividend yield is among the top 25% in Singapore, yet its high cash payout ratio of 750.7% suggests dividends are not well covered by cash flows, despite a reasonable earnings payout ratio of 57.2%. Over the past decade, dividends have been volatile and unreliable. Recent H1 2024 results show decreased sales to US$260.81 million and net income to US$19.57 million, with a slight interim dividend decrease announced in August 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Delfi.

- The analysis detailed in our Delfi valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Click this link to deep-dive into the 19 companies within our Top SGX Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BPF

YHI International

An investment holding company, together with its subsidiaries, distributes automotive and industrial products in Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand, and internationally.

Flawless balance sheet second-rate dividend payer.