Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tye Soon (SGX:BFU). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Tye Soon

How Fast Is Tye Soon Growing Its Earnings Per Share?

Tye Soon has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Tye Soon has grown its trailing twelve month EPS from S$0.061 to S$0.065, in the last year. That's a fair increase of 7.2%.

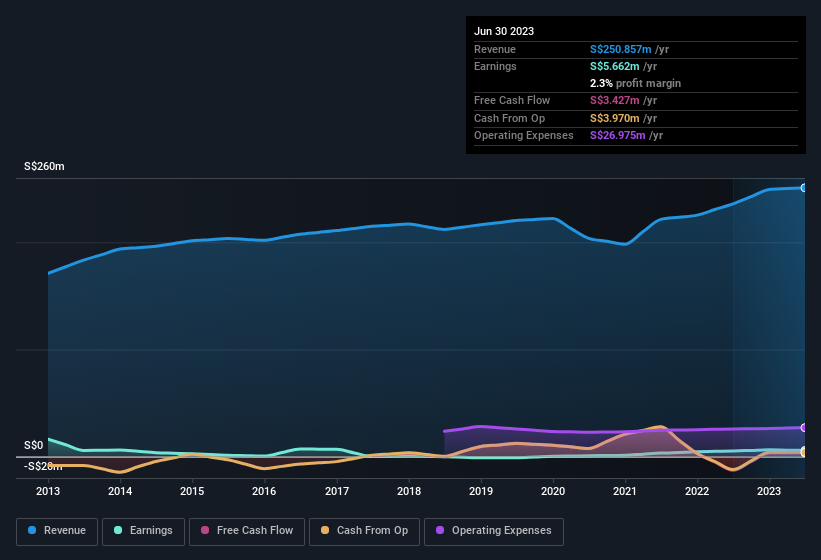

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Tye Soon maintained stable EBIT margins over the last year, all while growing revenue 6.3% to S$251m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Tye Soon isn't a huge company, given its market capitalisation of S$21m. That makes it extra important to check on its balance sheet strength.

Are Tye Soon Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Tye Soon top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the S$69k that MD & Executive Director Tek Yew Chong spent buying shares (at an average price of about S$0.40). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Should You Add Tye Soon To Your Watchlist?

One positive for Tye Soon is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Tye Soon seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. However, before you get too excited we've discovered 4 warning signs for Tye Soon (2 shouldn't be ignored!) that you should be aware of.

The good news is that Tye Soon is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tye Soon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BFU

Tye Soon

Imports, exports, and distributes automotive spare parts in Singapore, Malaysia, Australia, Thailand, Indonesia, Hong Kong/China, South Korea, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives