- Singapore

- /

- Specialty Stores

- /

- SGX:543

Is Now The Time To Put Noel Gifts International (SGX:543) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Noel Gifts International (SGX:543), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Noel Gifts International with the means to add long-term value to shareholders.

Check out our latest analysis for Noel Gifts International

How Fast Is Noel Gifts International Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Noel Gifts International has grown EPS by 41% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. This approach makes Noel Gifts International look pretty good, on balance; although revenue is flattish, EBIT margins improved from -1.6% to 0.5% in the last year. That's a real positive.

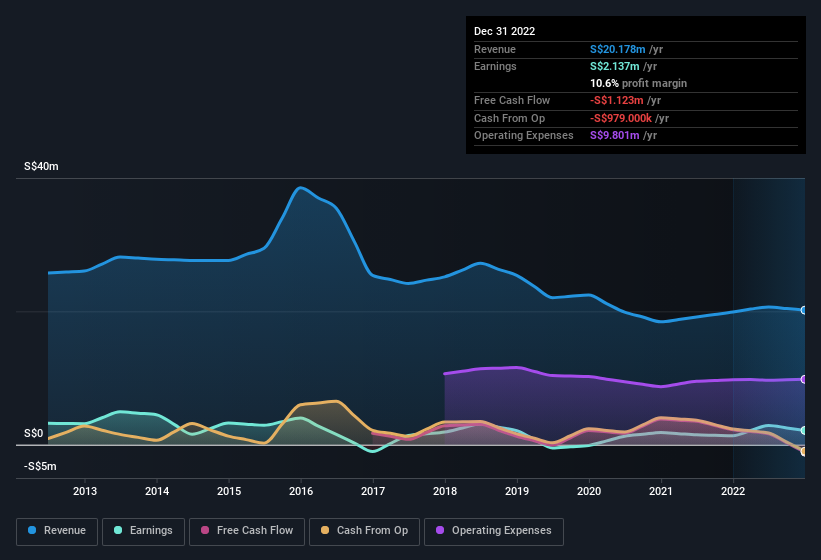

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Noel Gifts International isn't a huge company, given its market capitalisation of S$24m. That makes it extra important to check on its balance sheet strength.

Are Noel Gifts International Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Noel Gifts International will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 70% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Noel Gifts International is a very small company, with a market cap of only S$24m. That means insiders only have S$16m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Does Noel Gifts International Deserve A Spot On Your Watchlist?

Noel Gifts International's earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Noel Gifts International very closely. We should say that we've discovered 4 warning signs for Noel Gifts International (1 can't be ignored!) that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Noel Gifts International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:543

Noel Gifts International

Provides hampers, flowers, and gifts in Singapore and Malaysia.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives