Yanlord Land Group Limited's (SGX:Z25) investors are due to receive a payment of S$0.068 per share on 6th of June. This makes the dividend yield 5.8%, which will augment investor returns quite nicely.

View our latest analysis for Yanlord Land Group

Yanlord Land Group's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. However, Yanlord Land Group's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to fall by 6.0% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 6.2%, which we are pretty comfortable with and we think is feasible on an earnings basis.

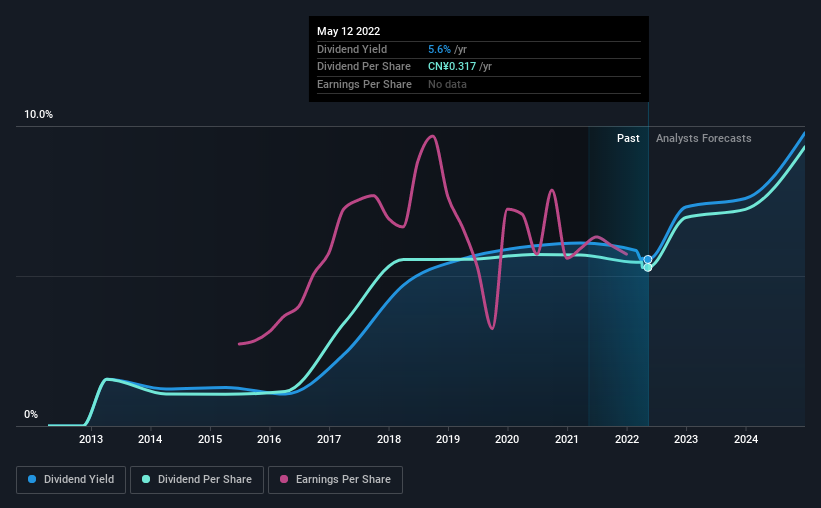

Yanlord Land Group's Dividend Has Lacked Consistency

It's comforting to see that Yanlord Land Group has been paying a dividend for a number of years now, however it has been cut at least once in that time. This suggests that the dividend might not be the most reliable. Since 2013, the dividend has gone from CN¥0.094 to CN¥0.32. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Although it's important to note that Yanlord Land Group's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Yanlord Land Group (of which 1 is concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:Z25

Yanlord Land Group

A real estate developer focusing on developing high-end fully-fitted residential, commercial and integrated property projects in strategically selected key and high-growth cities in the PRC and Singapore.

Fair value with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026