The big shareholder groups in IREIT Global (SGX:UD1U) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

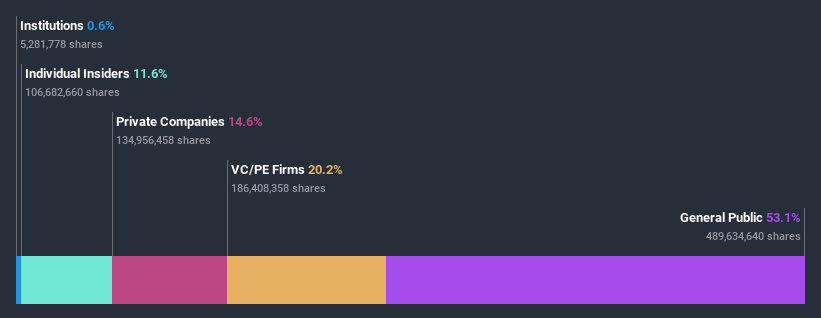

IREIT Global is a smaller company with a market capitalization of S$563m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have not yet purchased much of the company. Let's delve deeper into each type of owner, to discover more about IREIT Global.

Check out our latest analysis for IREIT Global

What Does The Lack Of Institutional Ownership Tell Us About IREIT Global?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. IREIT Global might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don't have many shares in IREIT Global. Our data shows that Tikehau Capital is the largest shareholder with 20% of shares outstanding. For context, the second largest shareholder holds about 15% of the shares outstanding, followed by an ownership of 4.2% by the third-largest shareholder.

A deeper look at our ownership data shows that the top 20 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

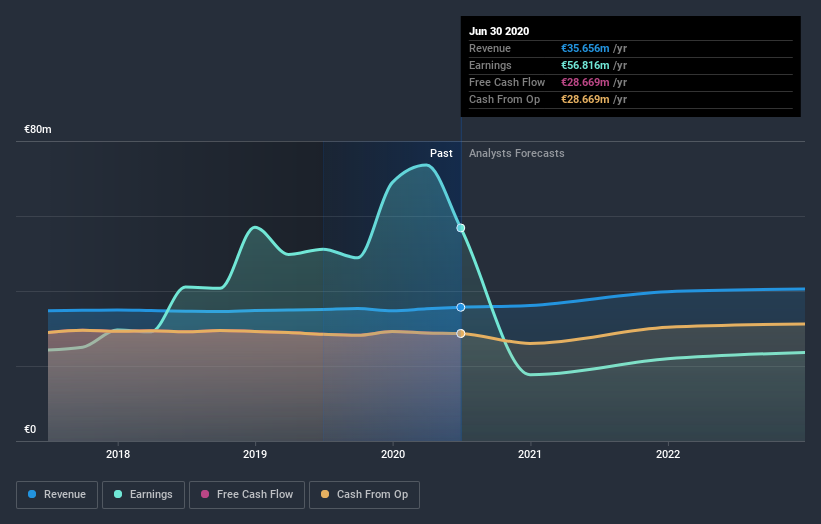

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of IREIT Global

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in IREIT Global. Insiders own S$65m worth of shares in the S$563m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public -- mostly retail investors -- own 53% of IREIT Global. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Private Equity Ownership

With a stake of 20%, private equity firms could influence the IREIT Global board. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Private Company Ownership

We can see that Private Companies own 15%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand IREIT Global better, we need to consider many other factors. For instance, we've identified 5 warning signs for IREIT Global (2 can't be ignored) that you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading IREIT Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:UD1U

IREIT Global

IREIT Global (SGX-UD1U) which was listed on 13 August 2014, is the first Singapore-listed real estate investment trust with the investment strategy of principally investing, directly or indirectly, in a portfolio of income-producing real estate in Europe which is or will be primarily used for office, retail, industrial (including logistics and business parks), hospitality, hospitality-related and other accommodation and/or lodging purposes, as well as real estate-related assets.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives