- Singapore

- /

- Real Estate

- /

- SGX:TQ5

Frasers Property (SGX:TQ5) Is Paying Out A Larger Dividend Than Last Year

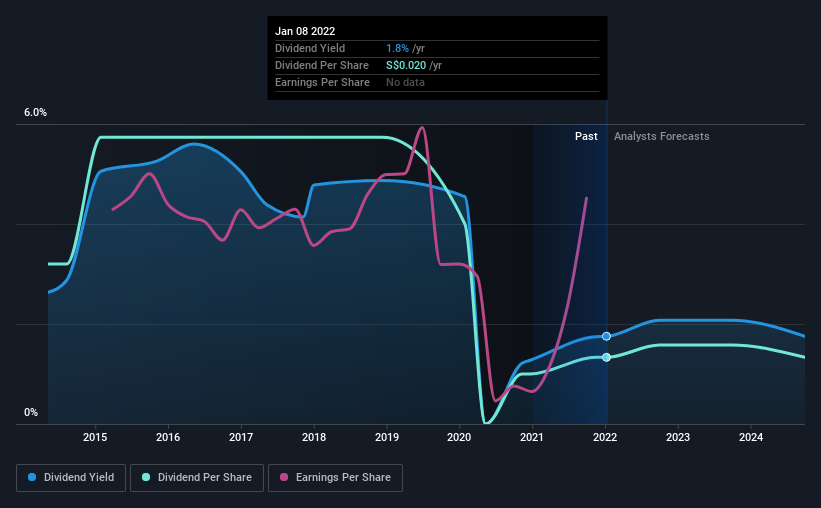

Frasers Property Limited (SGX:TQ5) has announced that it will be increasing its dividend on the 14th of February to S$0.02, which will be 33% higher than last year. Although the dividend is now higher, the yield is only 1.8%, which is below the industry average.

See our latest analysis for Frasers Property

Frasers Property's Earnings Easily Cover the Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before making this announcement, Frasers Property was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

EPS is set to fall by 72.7% over the next 12 months. Assuming the dividend continues along recent trends, we believe the payout ratio could be 31%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Frasers Property's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. This suggests that the dividend might not be the most reliable. The dividend has gone from S$0.048 in 2014 to the most recent annual payment of S$0.02. This works out to a decline of approximately 58% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Unfortunately, Frasers Property's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. While growth may be thin on the ground, Frasers Property could always pay out a higher proportion of earnings to increase shareholder returns.

We'd also point out that Frasers Property has issued stock equal to 34% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Frasers Property's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for Frasers Property (of which 2 are potentially serious!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:TQ5

Frasers Property

An investment holding company, develops, invests in, and manages a portfolio of real estate assets in Singapore, Australia, Europe, China, Thailand, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.