- Singapore

- /

- Real Estate

- /

- SGX:BTE

Bund Center Investment Ltd's (SGX:MQ4) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Bund Center Investment (SGX:MQ4) has had a great run on the share market with its stock up by a significant 7.7% over the last month. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. Particularly, we will be paying attention to Bund Center Investment's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Bund Center Investment

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bund Center Investment is:

3.5% = S$16m ÷ S$464m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every SGD1 of its shareholder's investments, the company generates a profit of SGD0.04.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Bund Center Investment's Earnings Growth And 3.5% ROE

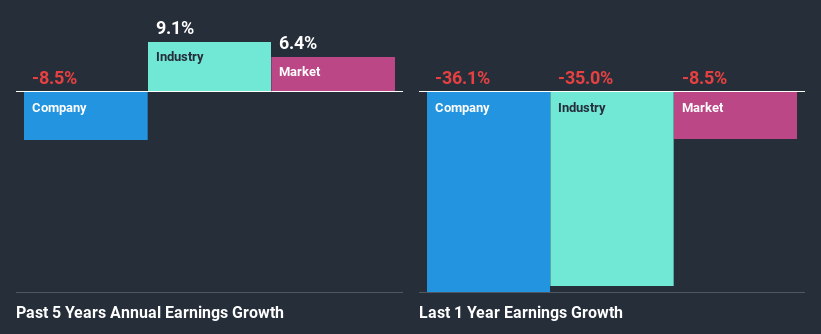

As you can see, Bund Center Investment's ROE looks pretty weak. Even compared to the average industry ROE of 4.6%, the company's ROE is quite dismal. Therefore, it might not be wrong to say that the five year net income decline of 8.5% seen by Bund Center Investment was possibly a result of it having a lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

So, as a next step, we compared Bund Center Investment's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 9.1% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Bund Center Investment is trading on a high P/E or a low P/E, relative to its industry.

Is Bund Center Investment Efficiently Re-investing Its Profits?

Bund Center Investment has a high three-year median payout ratio of 54% (that is, it is retaining 46% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. You can see the 2 risks we have identified for Bund Center Investment by visiting our risks dashboard for free on our platform here.

Additionally, Bund Center Investment has paid dividends over a period of eight years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings.

Summary

On the whole, Bund Center Investment's performance is quite a big let-down. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Bund Center Investment's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade Bund Center Investment, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bund Center Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BTE

Bund Center Investment

An investment holding company, owns a hotel, and owns and manages commercial and retail properties in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026