3 SGX Stocks Estimated To Be 36.1% To 47.7% Below Their Intrinsic Value

Reviewed by Simply Wall St

In recent months, the Singapore stock market has been navigating a complex global landscape marked by geopolitical tensions and economic uncertainties, such as those stemming from the ongoing conflict in Ukraine. Amidst these challenges, investors are increasingly seeking stocks that offer value relative to their intrinsic worth. Identifying undervalued stocks can be crucial for capitalizing on potential growth opportunities, especially when market conditions are influenced by external factors.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.72 | SGD7.34 | 35.7% |

| Digital Core REIT (SGX:DCRU) | US$0.60 | US$1.15 | 47.7% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.08 | SGD1.98 | 45.4% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.83 | SGD1.43 | 41.9% |

| Seatrium (SGX:5E2) | SGD1.94 | SGD3.03 | 36.1% |

We're going to check out a few of the best picks from our screener tool.

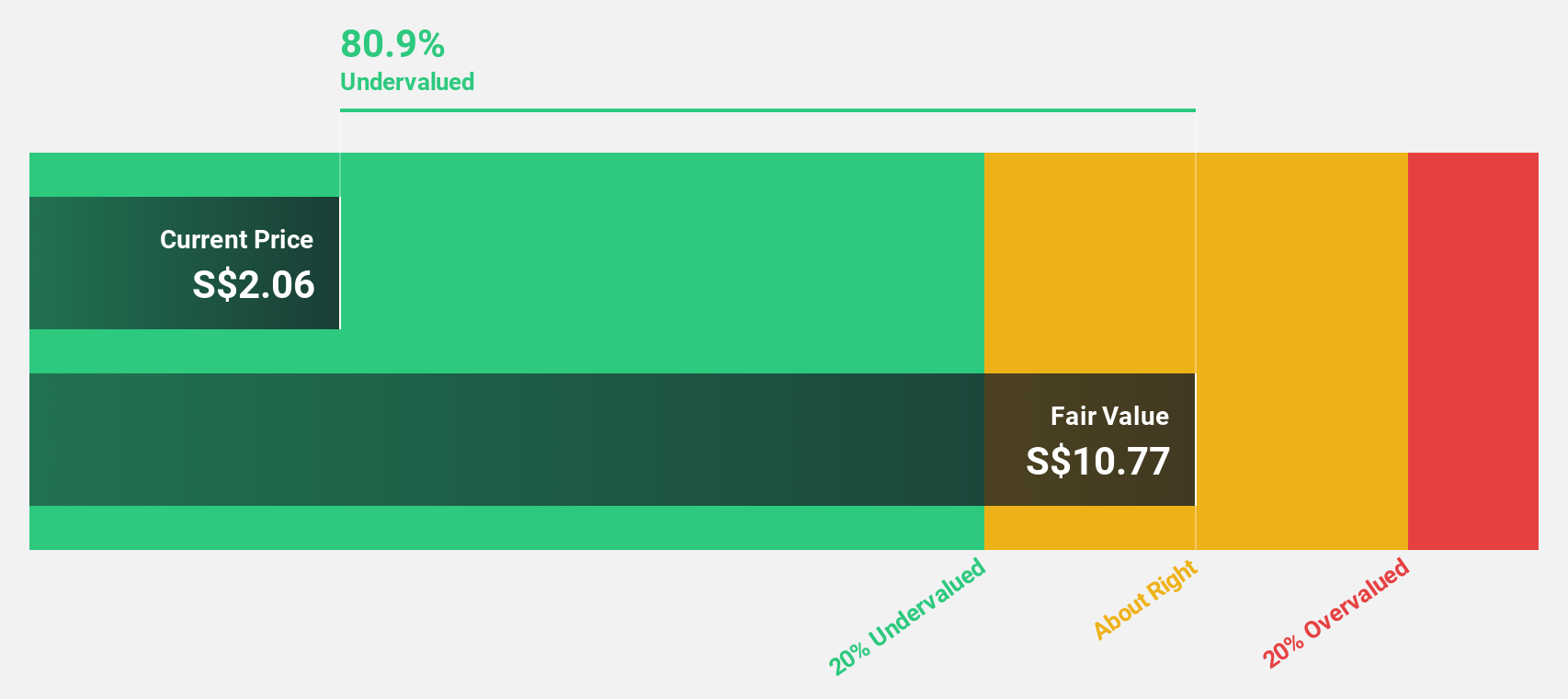

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD6.58 billion.

Operations: The company generates revenue primarily from Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding amounting to SGD8.39 billion, along with Ship Chartering contributing SGD24.71 million.

Estimated Discount To Fair Value: 36.1%

Seatrium Limited is trading at a significant discount, approximately 36.1% below its estimated fair value of S$3.03, with current trading around S$1.94. Recent earnings show a turnaround with net income of S$35.97 million compared to a previous loss, and revenue growth outpacing the Singapore market average. The successful early delivery of the Vali rig enhances its reputation for timely project execution, supporting potential future cash flow improvements despite low forecasted return on equity.

- Our earnings growth report unveils the potential for significant increases in Seatrium's future results.

- Delve into the full analysis health report here for a deeper understanding of Seatrium.

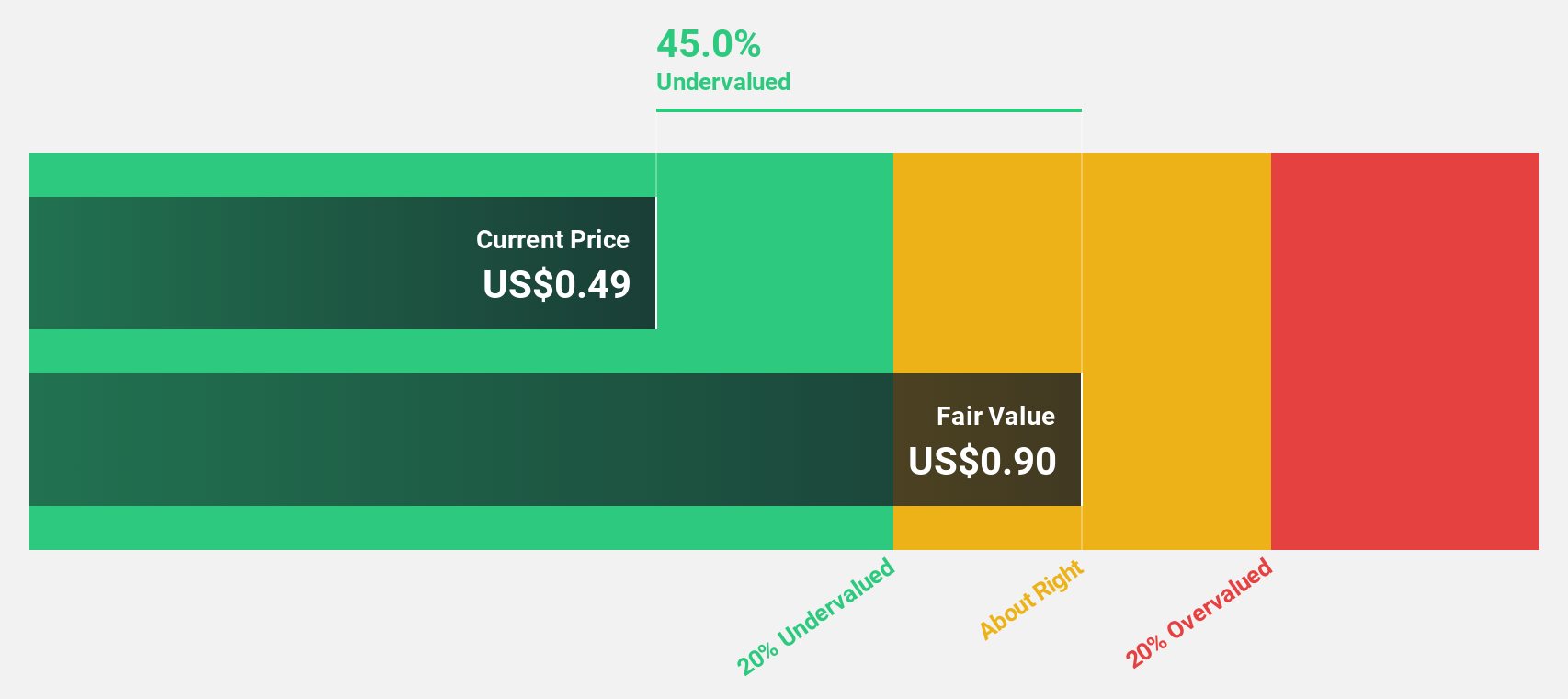

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $778.87 million.

Operations: Digital Core REIT generates its revenue primarily from leasing data centre facilities.

Estimated Discount To Fair Value: 47.7%

Digital Core REIT is trading at a substantial discount, approximately 47.7% below its estimated fair value of US$1.15, with shares currently around US$0.6. Despite a recent decline in sales to US$71.99 million for the nine months ending September 2024, net income improved to US$23.83 million from the previous year. Analysts anticipate significant earnings growth of 87.26% annually and expect profitability within three years, although past shareholder dilution remains a concern.

- In light of our recent growth report, it seems possible that Digital Core REIT's financial performance will exceed current levels.

- Navigate through the intricacies of Digital Core REIT with our comprehensive financial health report here.

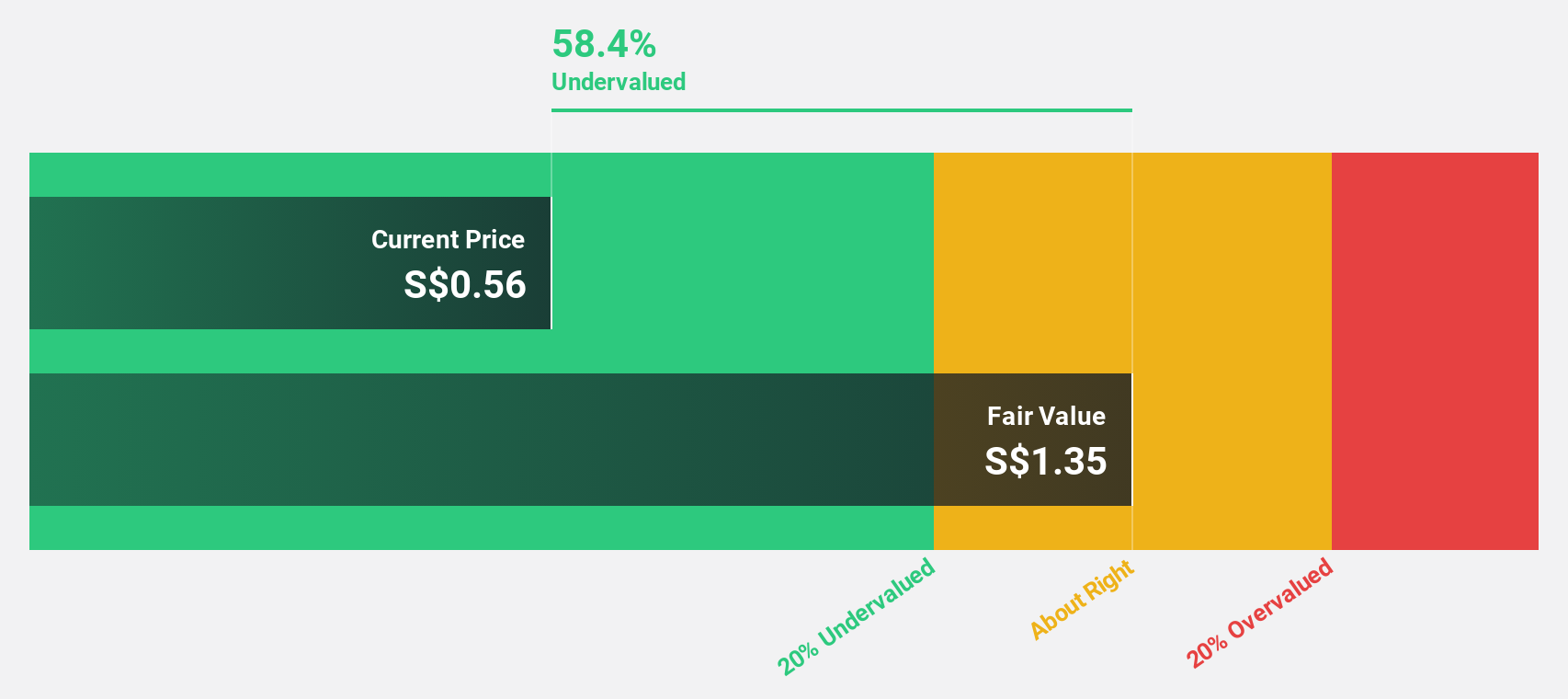

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam with a market capitalization of SGD540.39 million.

Operations: The company's revenue is primarily derived from Advanced Materials (SGD153.32 million), followed by Industrial Equipment (SGD28.71 million), Nanofabrication (SGD18.37 million), and Sydrogen (SGD1.40 million).

Estimated Discount To Fair Value: 41.9%

Nanofilm Technologies International is trading at approximately 41.9% below its estimated fair value of SGD 1.43, with current shares around SGD 0.83. Despite a net loss of SGD 3.74 million for the first half of 2024, sales increased to SGD 82.65 million from the previous year. Earnings are forecasted to grow significantly at over 50% annually, outpacing both revenue growth and market expectations in Singapore, though profit margins have decreased compared to last year.

- The growth report we've compiled suggests that Nanofilm Technologies International's future prospects could be on the up.

- Click here to discover the nuances of Nanofilm Technologies International with our detailed financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 5 Undervalued SGX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanofilm Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MZH

Nanofilm Technologies International

Provides nanotechnology solutions in Singapore, China, Japan, and Vietnam.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives