- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

SGX's Top Picks That Investors Might Be Undervaluing In October 2024

Reviewed by Simply Wall St

As Singapore's stock market navigates a period of volatility and economic uncertainty, investors are increasingly on the lookout for opportunities that may be overlooked by the broader market. In this environment, identifying undervalued stocks becomes crucial as they offer potential value and resilience amidst fluctuating conditions.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.67 | SGD7.33 | 36.3% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.08 | SGD1.98 | 45.4% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.825 | SGD1.43 | 42.2% |

| Seatrium (SGX:5E2) | SGD1.90 | SGD3.02 | 37.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust managing a portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, with a market capitalization of S$4.06 billion, spread across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Operations: Frasers Logistics & Commercial Trust generates revenue through its diverse portfolio of 107 industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

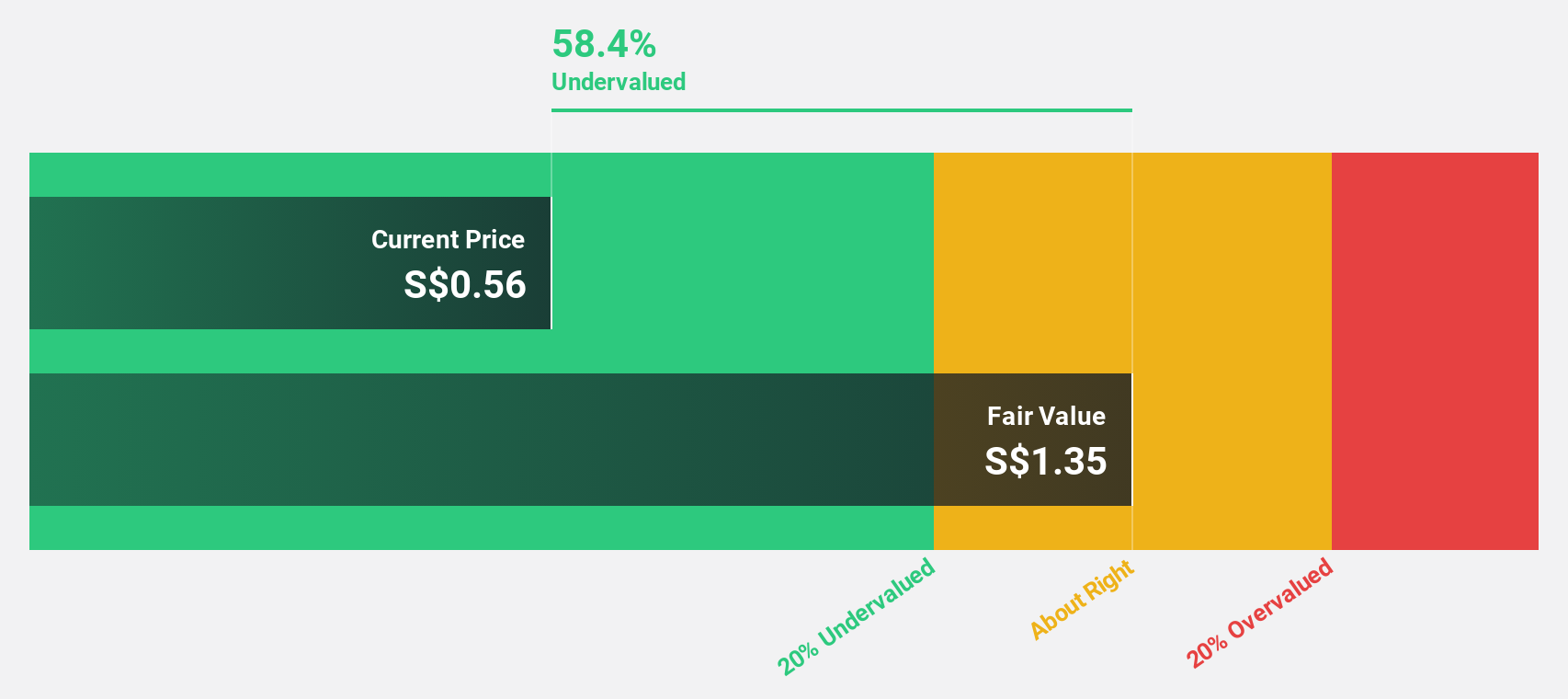

Estimated Discount To Fair Value: 45.4%

Frasers Logistics & Commercial Trust is trading at S$1.08, significantly below its estimated fair value of S$1.98, indicating potential undervaluation based on cash flows. Earnings are projected to grow annually by 40.44%, with revenue growth expected to outpace the Singapore market at 6.2% per year. However, its return on equity is forecasted to be low, and it has an unstable dividend track record, which may pose concerns for some investors.

- Our growth report here indicates Frasers Logistics & Commercial Trust may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Frasers Logistics & Commercial Trust.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam with a market cap of SGD537.14 million.

Operations: The company's revenue segments comprise Advanced Materials at SGD153.32 million, Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen at SGD1.40 million.

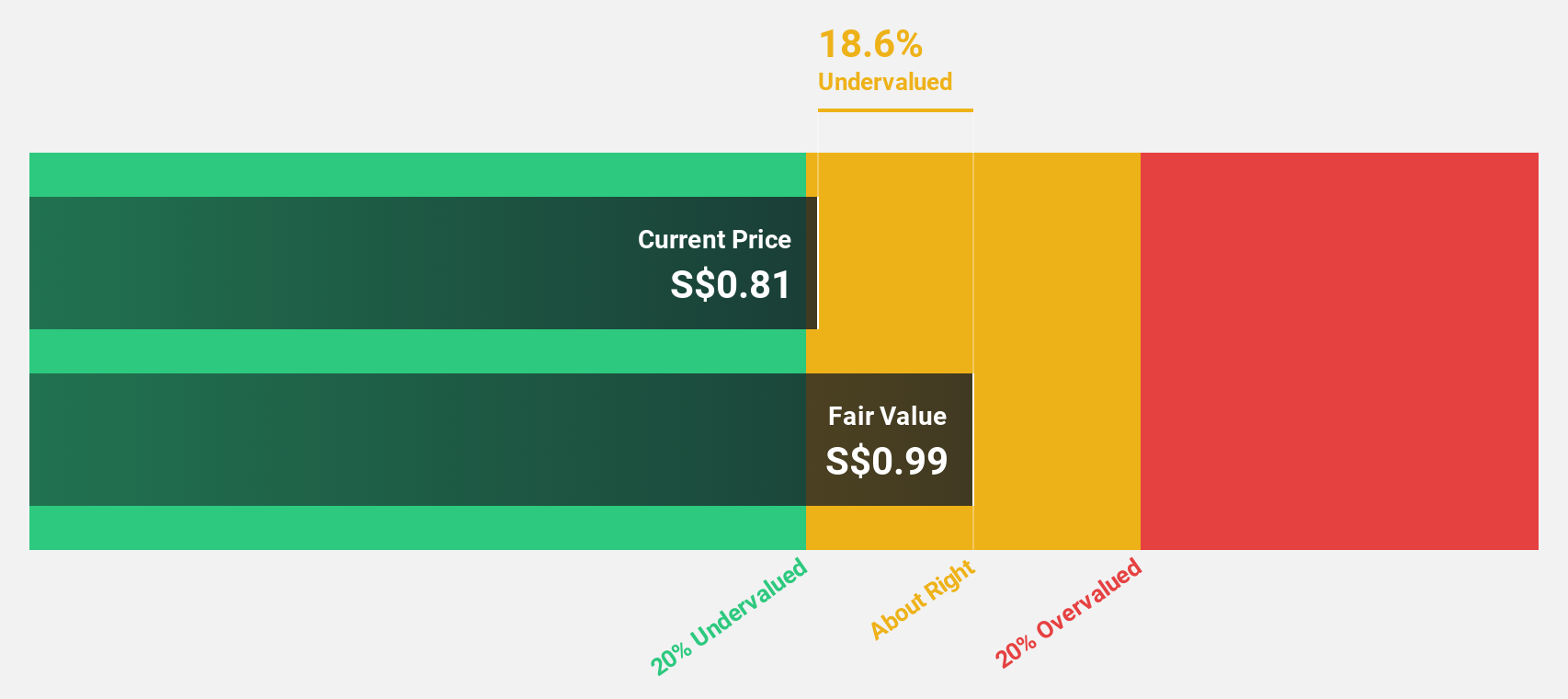

Estimated Discount To Fair Value: 42.2%

Nanofilm Technologies International is trading at S$0.83, below its estimated fair value of S$1.43, hinting at potential undervaluation based on cash flows. Despite a net loss of S$3.74 million for the first half of 2024, earnings are expected to grow significantly over the next three years. However, profit margins have decreased from last year, and projected revenue growth remains slower than 20% per year but exceeds the Singapore market average.

- The growth report we've compiled suggests that Nanofilm Technologies International's future prospects could be on the up.

- Navigate through the intricacies of Nanofilm Technologies International with our comprehensive financial health report here.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.56 billion.

Operations: The company generates revenue from three primary segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

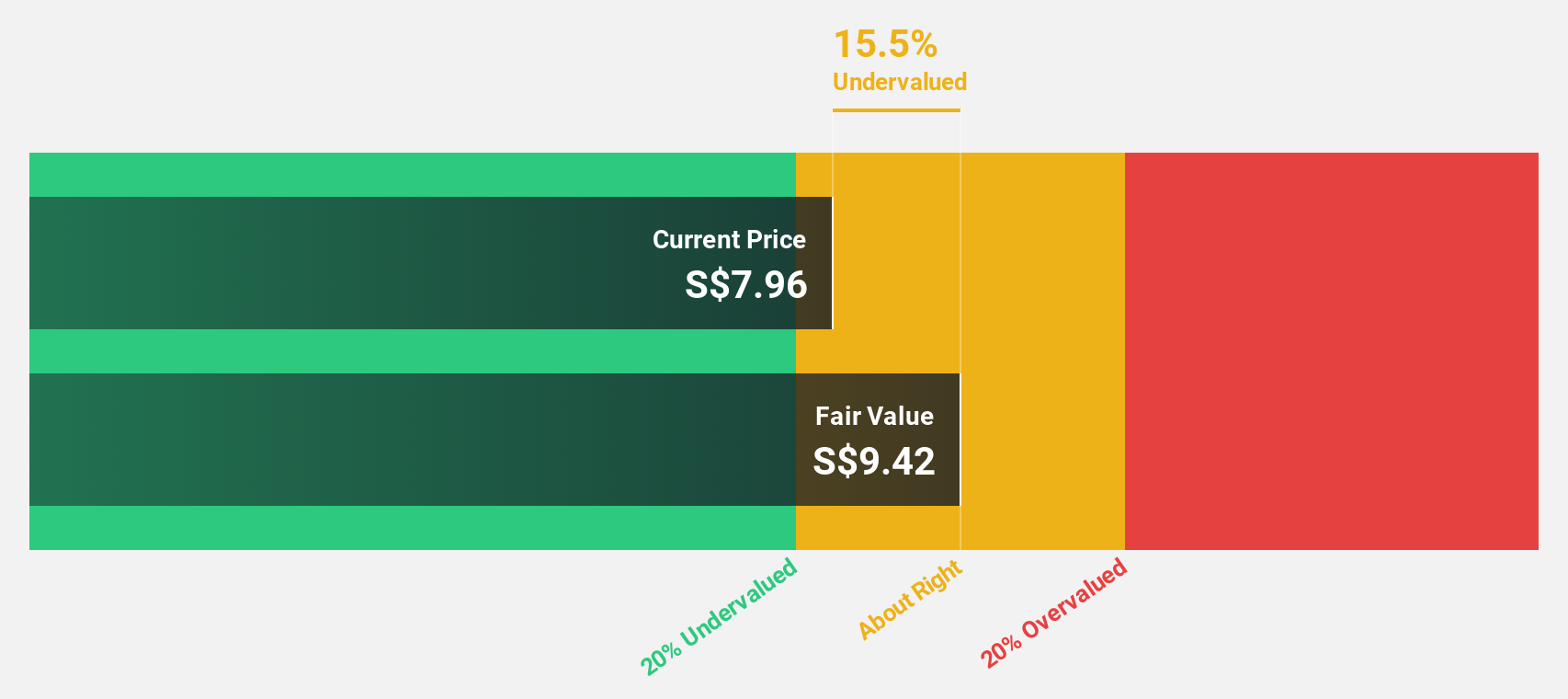

Estimated Discount To Fair Value: 36.3%

Singapore Technologies Engineering is trading at S$4.67, below its estimated fair value of S$7.33, highlighting potential undervaluation based on cash flows. Earnings grew 19.9% over the past year and are forecast to grow 11.3% annually, surpassing the Singapore market average. However, debt coverage by operating cash flow remains weak and dividend stability is uncertain. A strategic alliance with Toshiba Digital Solutions aims to enhance quantum security offerings in key sectors across Southeast Asia.

- Our comprehensive growth report raises the possibility that Singapore Technologies Engineering is poised for substantial financial growth.

- Click here to discover the nuances of Singapore Technologies Engineering with our detailed financial health report.

Make It Happen

- Explore the 4 names from our Undervalued SGX Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record with reasonable growth potential and pays a dividend.