- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

SGX Value Picks Seatrium And 2 More Stocks Trading Below Intrinsic Estimates

Reviewed by Simply Wall St

The Singapore market has shown resilience amid global economic uncertainties, with the Straits Times Index reflecting steady performance. In this environment, identifying undervalued stocks like Seatrium and others trading below their intrinsic estimates can offer significant investment opportunities.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.61 | SGD7.37 | 37.5% |

| Digital Core REIT (SGX:DCRU) | US$0.575 | US$0.82 | 29.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.82 | SGD1.43 | 42.8% |

| Seatrium (SGX:5E2) | SGD1.64 | SGD2.93 | 44.1% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.15 | SGD1.58 | 27.4% |

Let's explore several standout options from the results in the screener.

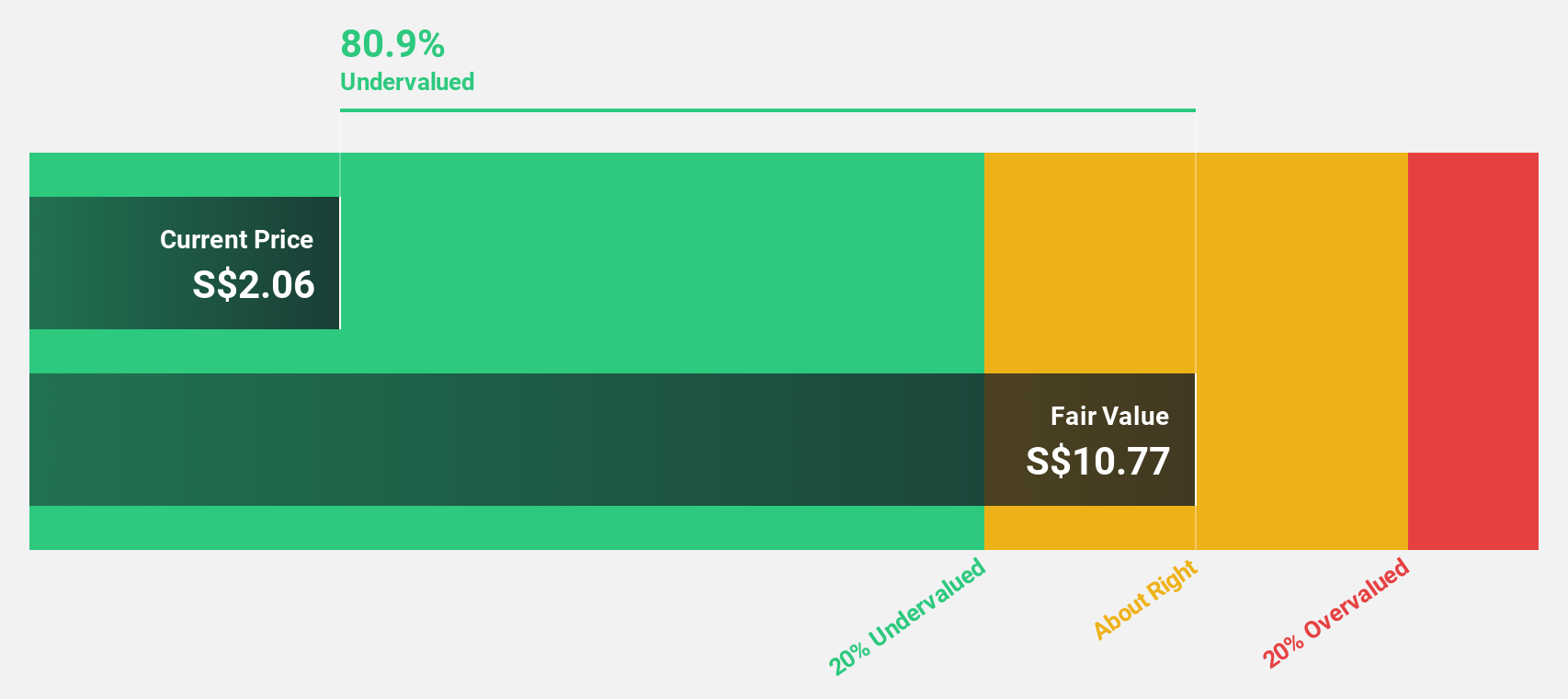

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD5.58 billion.

Operations: The company's revenue segments include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

Estimated Discount To Fair Value: 44.1%

Seatrium's recent delivery of its fourth jackup rig ahead of schedule highlights its strong project execution capabilities. The company reported a significant turnaround with net income of S$35.97 million for H1 2024, compared to a loss last year. Trading at 44.1% below its estimated fair value, Seatrium appears undervalued based on discounted cash flow analysis. However, ongoing regulatory investigations could pose risks despite the forecasted revenue and profit growth outpacing market averages.

- Upon reviewing our latest growth report, Seatrium's projected financial performance appears quite optimistic.

- Dive into the specifics of Seatrium here with our thorough financial health report.

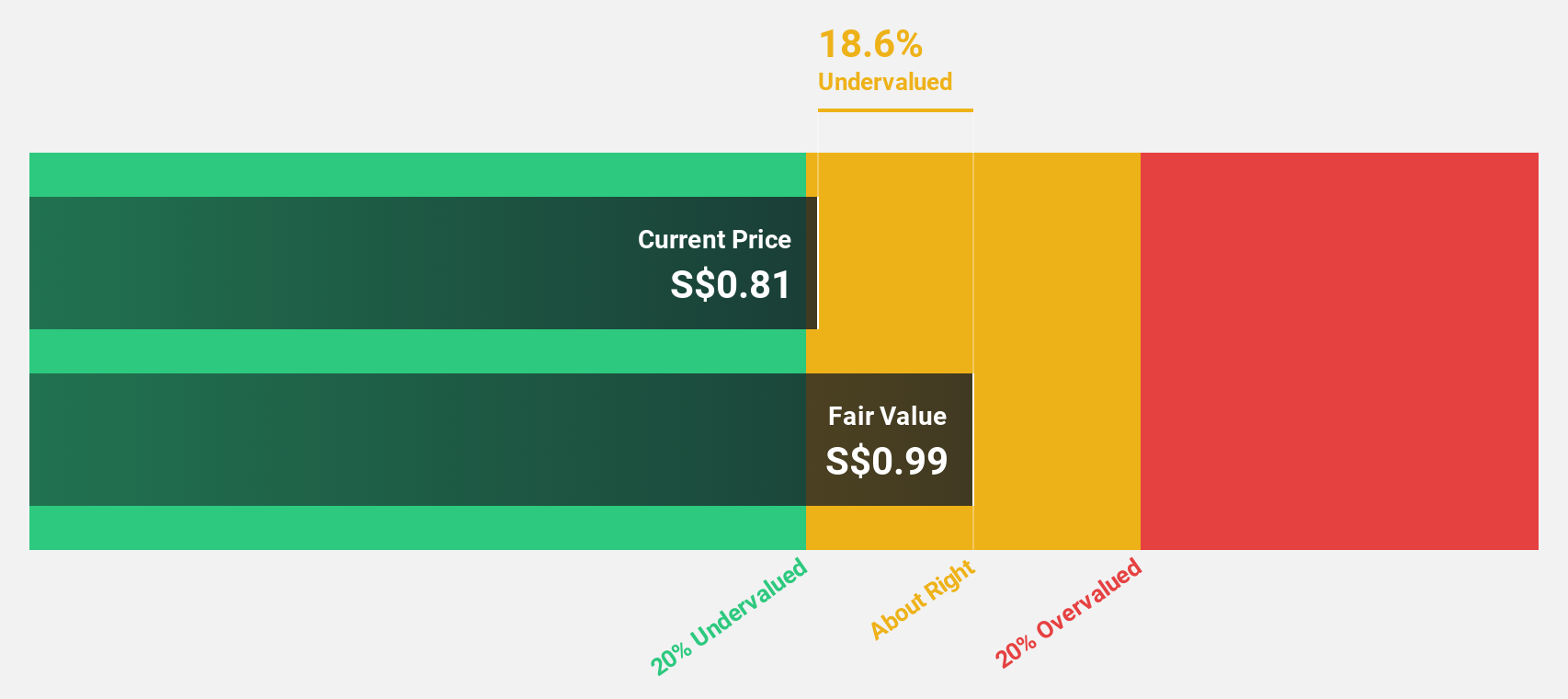

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust with a market cap of approximately S$4.32 billion, managing a portfolio of 107 industrial and commercial properties valued at around S$6.4 billion across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Operations: FLCT generates revenue from its diversified portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

Estimated Discount To Fair Value: 27.4%

Frasers Logistics & Commercial Trust (SGD1.15) is trading 27.4% below our fair value estimate of SGD1.58, making it undervalued based on discounted cash flows. Despite a low forecasted Return on Equity (5.8%) and debt not well covered by operating cash flow, its revenue is expected to grow at 6.3% per year, outpacing the Singapore market average of 3.6%. Earnings are projected to grow substantially at 39.43% annually over the next three years, with profitability anticipated within this period despite an unstable dividend track record.

- The growth report we've compiled suggests that Frasers Logistics & Commercial Trust's future prospects could be on the up.

- Click here to discover the nuances of Frasers Logistics & Commercial Trust with our detailed financial health report.

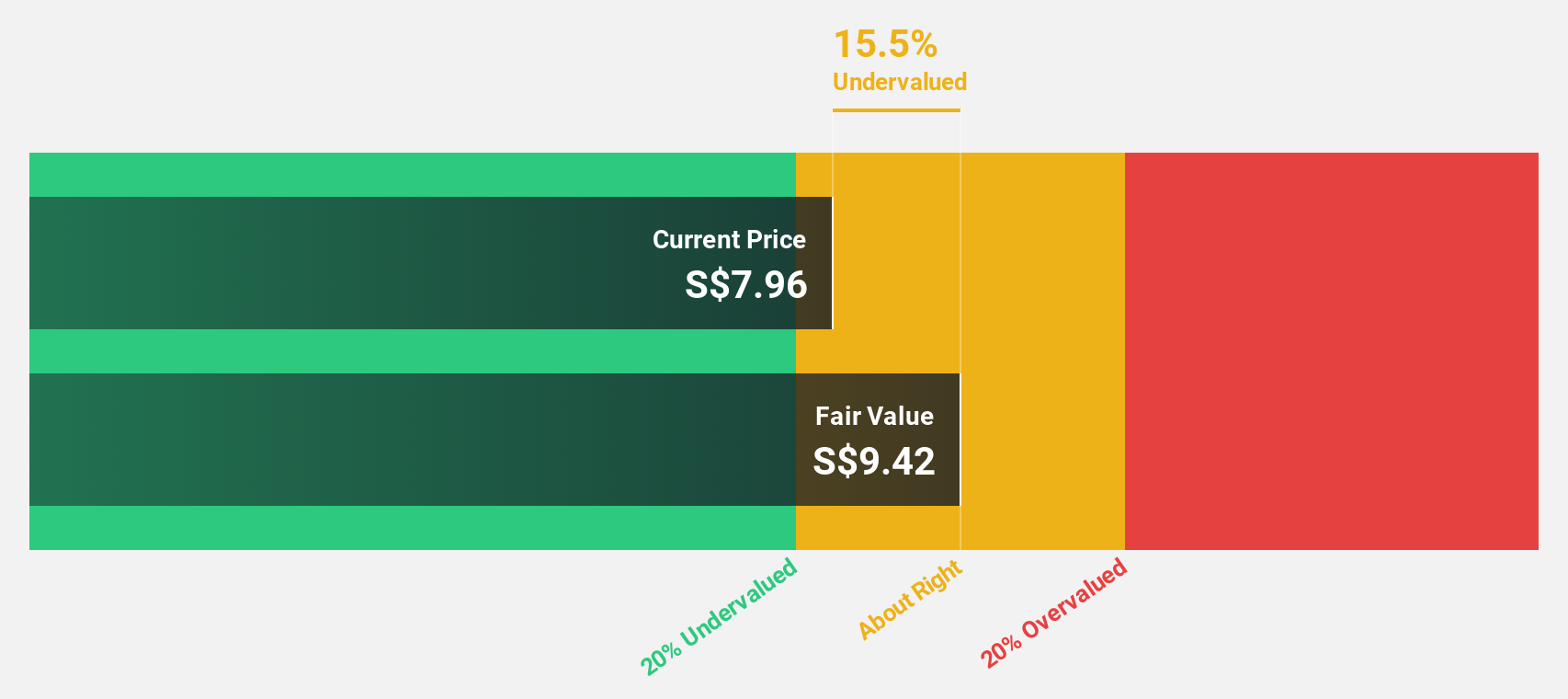

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd operates as a global technology, defence, and engineering company with a market cap of SGD14.09 billion.

Operations: The company's revenue segments are Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

Estimated Discount To Fair Value: 37.5%

Singapore Technologies Engineering (SGD4.61) is trading 37.5% below our fair value estimate of SGD7.37, indicating it is undervalued based on discounted cash flows. Earnings grew by 19.9% last year and are forecast to grow at 11.15% annually, outpacing the Singapore market average of 10%. However, its debt is not well covered by operating cash flow. Recent strategic alliances in quantum-secure communications could bolster future revenue growth and profitability in critical sectors like government and financial services institutions.

- Our expertly prepared growth report on Singapore Technologies Engineering implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

Make It Happen

- Navigate through the entire inventory of 5 Undervalued SGX Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record, good value and pays a dividend.