- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

SGX Value Picks Featuring Frasers Logistics & Commercial Trust And 2 More Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

The Singapore market has been grappling with urban congestion and infrastructure challenges, as evidenced by the proliferation of abandoned vehicles occupying valuable public spaces. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may be overlooked amidst broader economic concerns.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.81 | SGD7.33 | 34.3% |

| Digital Core REIT (SGX:DCRU) | US$0.575 | US$0.81 | 29.4% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.13 | SGD1.99 | 43.2% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.84 | SGD1.43 | 41.1% |

| Seatrium (SGX:5E2) | SGD1.98 | SGD3.04 | 34.8% |

Let's review some notable picks from our screened stocks.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust managing a portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion across Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market cap of S$4.25 billion.

Operations: Frasers Logistics & Commercial Trust generates revenue from its diverse portfolio of 107 industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

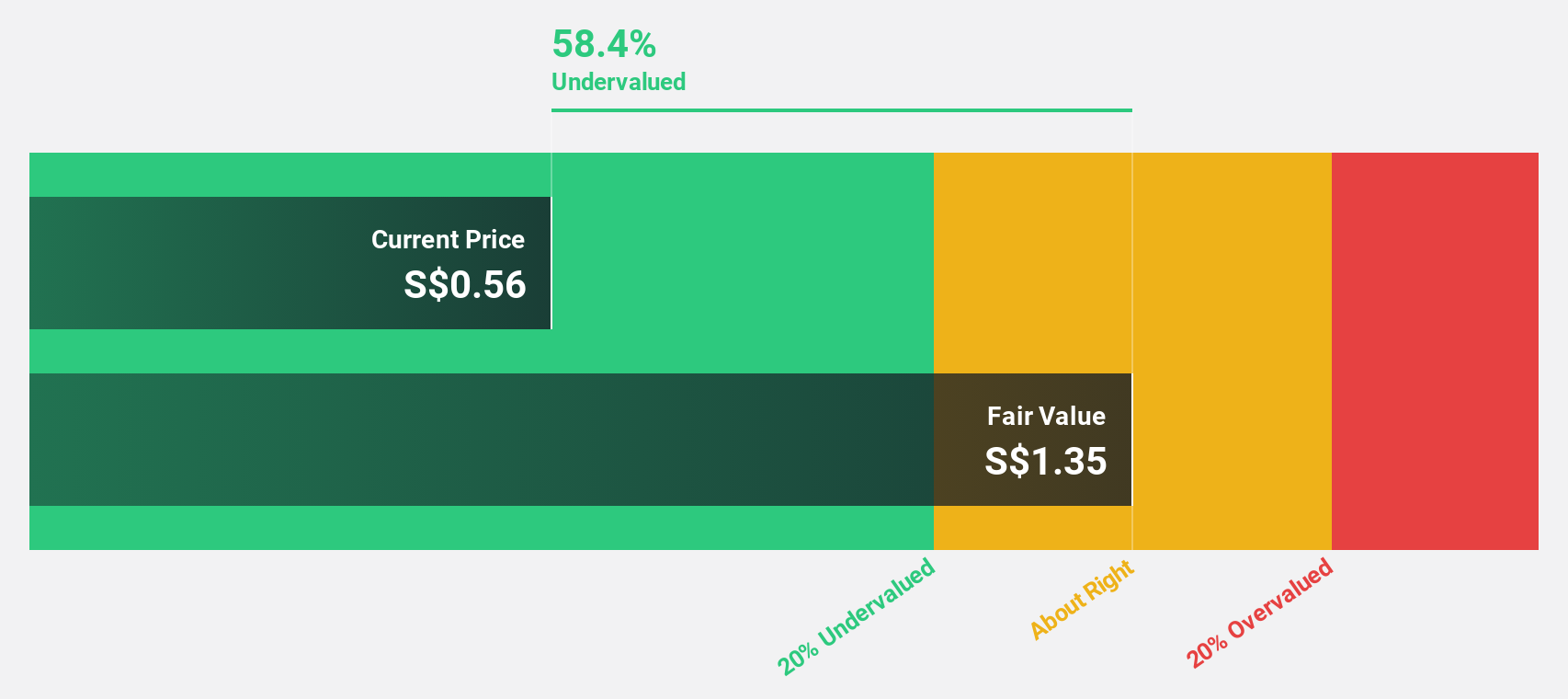

Estimated Discount To Fair Value: 43.2%

Frasers Logistics & Commercial Trust is trading at S$1.13, significantly below its estimated fair value of S$1.99, suggesting it is highly undervalued based on cash flows. While revenue growth is expected at 6.2% annually, surpassing the Singapore market's 3.7%, debt coverage by operating cash flow remains a concern. The stock's earnings are projected to grow substantially at 40.44% per year, with profitability anticipated within three years despite an unstable dividend track record and low future return on equity forecasted at 5.7%.

- Insights from our recent growth report point to a promising forecast for Frasers Logistics & Commercial Trust's business outlook.

- Dive into the specifics of Frasers Logistics & Commercial Trust here with our thorough financial health report.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD546.91 million, provides nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is primarily derived from its Advanced Materials segment at SGD153.32 million, followed by Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen contributing SGD1.40 million.

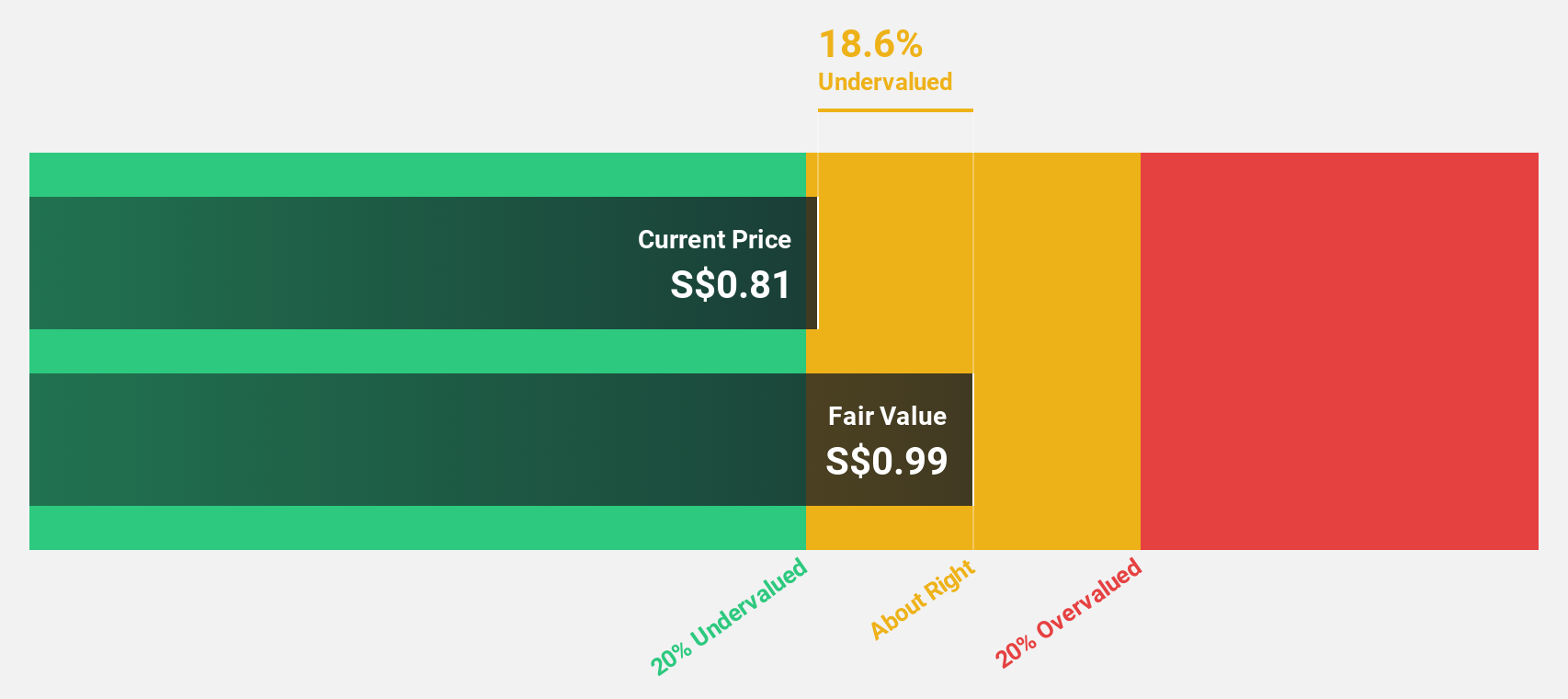

Estimated Discount To Fair Value: 41.1%

Nanofilm Technologies International trades at S$0.84, substantially below its estimated fair value of S$1.43, highlighting potential undervaluation based on cash flows. Despite a forecasted 16.1% annual revenue growth outpacing the Singapore market's 3.7%, profit margins have declined from last year, now at 3.8%. Earnings are expected to grow significantly by over 50% annually, although recent results show a net loss improvement from SGD 7.65 million to SGD 3.74 million year-over-year.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Take a closer look at Nanofilm Technologies International's balance sheet health here in our report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global company engaged in technology, defence, and engineering operations with a market cap of SGD14.99 billion.

Operations: The company's revenue is derived from three main segments: Commercial Aerospace at SGD4.34 billion, Urban Solutions & Satcom at SGD2.01 billion, and Defence & Public Security at SGD4.54 billion.

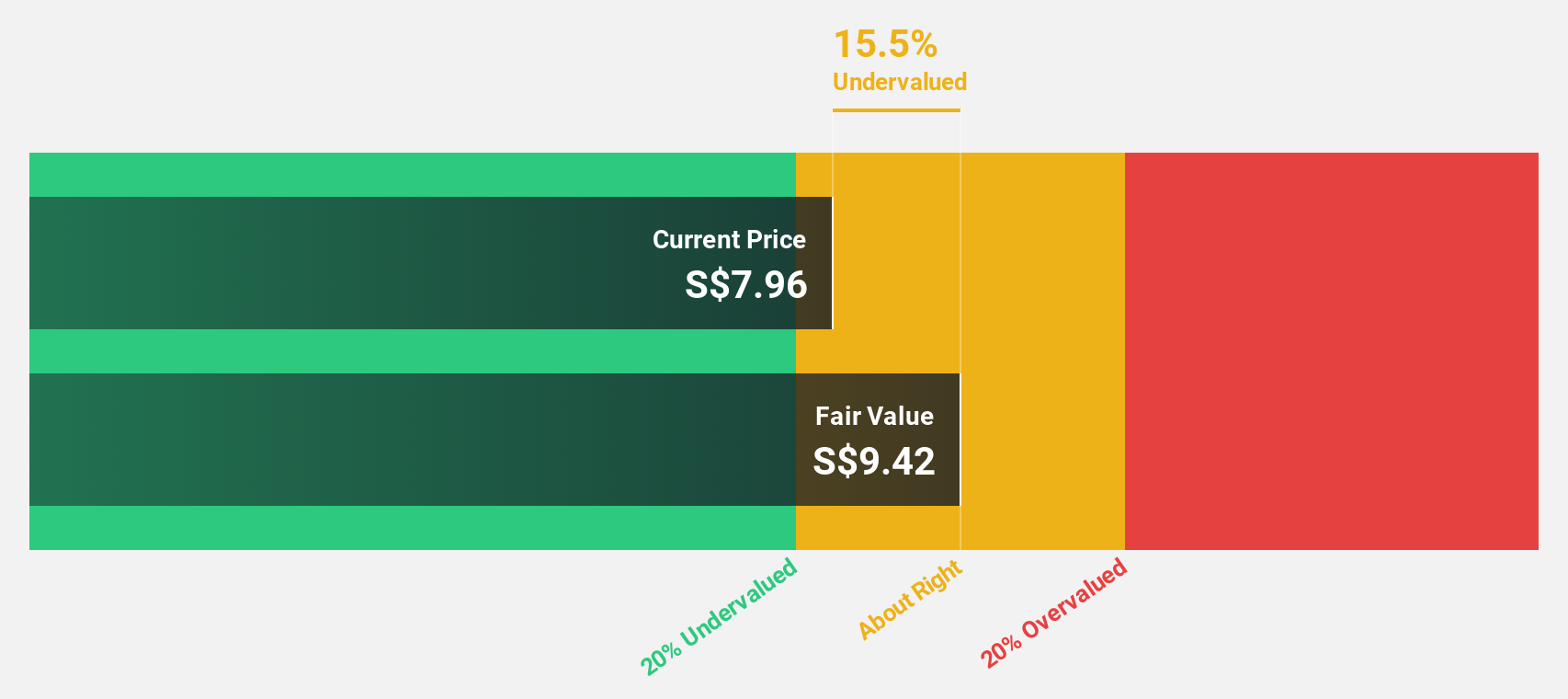

Estimated Discount To Fair Value: 34.3%

Singapore Technologies Engineering is trading at S$4.81, significantly below its estimated fair value of S$7.33, suggesting potential undervaluation based on cash flows. Earnings grew by 19.9% last year and are forecast to grow faster than the Singapore market at 11.3% annually, although debt coverage by operating cash flow remains a concern. The recent strategic alliance with Toshiba Digital Solutions aims to enhance quantum security solutions, potentially boosting future revenue streams in critical sectors across Southeast Asia.

- Our growth report here indicates Singapore Technologies Engineering may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Singapore Technologies Engineering's balance sheet health report.

Seize The Opportunity

- Get an in-depth perspective on all 5 Undervalued SGX Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record, good value and pays a dividend.