- Singapore

- /

- Health Care REITs

- /

- SGX:AW9U

How Much Did First Real Estate Investment Trust's(SGX:AW9U) Shareholders Earn From Share Price Movements Over The Last Three Years?

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term First Real Estate Investment Trust (SGX:AW9U) shareholders, since the share price is down 55% in the last three years, falling well short of the market decline of around 14%. And over the last year the share price fell 41%, so we doubt many shareholders are delighted. Furthermore, it's down 26% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for First Real Estate Investment Trust

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

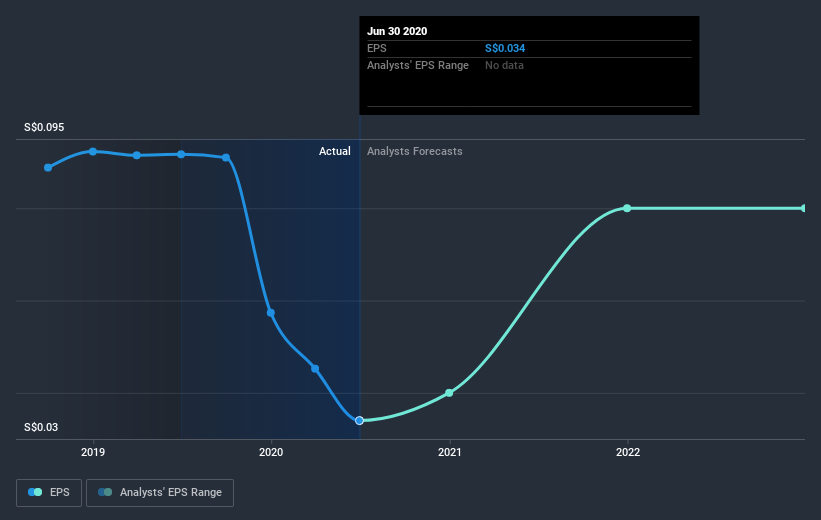

During the three years that the share price fell, First Real Estate Investment Trust's earnings per share (EPS) dropped by 15% each year. This reduction in EPS is slower than the 23% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into First Real Estate Investment Trust's key metrics by checking this interactive graph of First Real Estate Investment Trust's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for First Real Estate Investment Trust the TSR over the last 3 years was -44%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 14% in the twelve months, First Real Estate Investment Trust shareholders did even worse, losing 37% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for First Real Estate Investment Trust you should be aware of, and 1 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade First Real Estate Investment Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:AW9U

First Real Estate Investment Trust

First Real Estate Investment Trust (“First REIT” or the “Trust”), is a healthcare real estate investment trust focused on investing in diverse yield-accretive healthcare and healthcare-related real estate assets within and outside of Asia.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives