- Singapore

- /

- Specialized REITs

- /

- SGX:AJBU

Introducing Keppel DC REIT (SGX:AJBU), The Stock That Zoomed 113% In The Last Five Years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Keppel DC REIT (SGX:AJBU) stock is up an impressive 113% over the last five years. We note the stock price is up 2.5% in the last seven days.

View 3 warning signs we detected for Keppel DC REIT

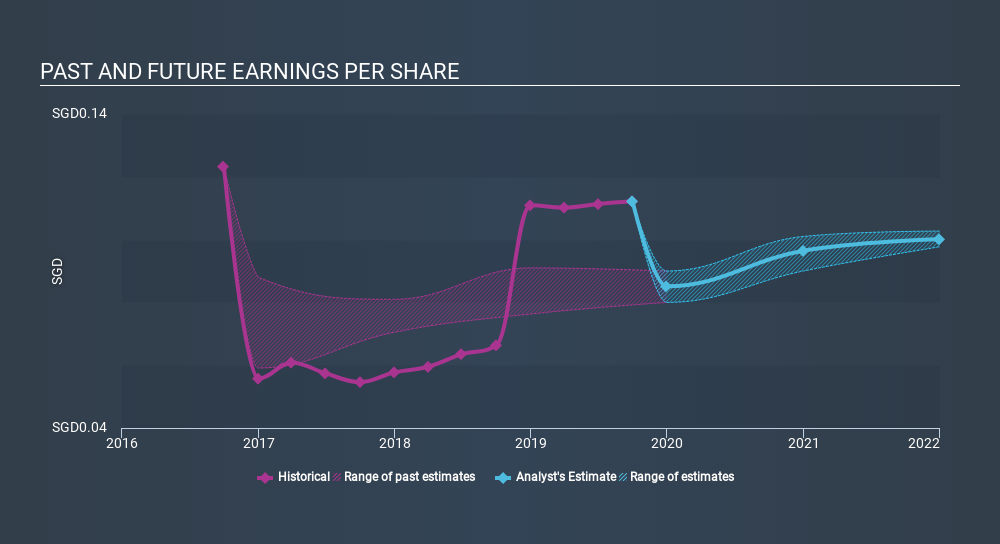

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Keppel DC REIT became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Keppel DC REIT the TSR over the last 5 years was 179%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Keppel DC REIT has rewarded shareholders with a total shareholder return of 62% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 23% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Keppel DC REIT better, we need to consider many other factors. For example, we've discovered 3 warning signs for Keppel DC REIT which any shareholder or potential investor should be aware of.

Keppel DC REIT is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:AJBU

Keppel DC REIT

Keppel DC REIT was listed on the Singapore Exchange on 12 December 2014 as the first pure-play data centre REIT in Asia.

Undervalued moderate and pays a dividend.

Market Insights

Community Narratives