- Singapore

- /

- Industrial REITs

- /

- SGX:A17U

Is CapitaLand Ascendas REIT (SGX:A17U) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

CapitaLand Ascendas REIT (SGX:A17U) has caught the attention of many investors recently, though not because of a dramatic news event or headline-making development. Instead, it is quieter market activity and the question of what comes next that has some shareholders wondering if new value could be emerging. In the absence of a headline trigger, it can sometimes be these steadier periods that reveal as much about the REIT’s prospects as a major announcement would.

If you have been watching CapitaLand Ascendas REIT over the past year, you will know the performance has been measured but with signs of underlying momentum. After a modest gain of just under 2% for the past year and a climb of 7% over the past 3 months, its share price seems to be inching higher, outpacing the broader property trust sector and hinting that investors are gradually warming to its prospects again. Recent annual growth in both revenue and net income, up about 4% each, signals steady fundamentals beneath the surface.

So with the REIT’s price quietly ticking up and financial growth coming through, is there still hidden value in CapitaLand Ascendas REIT, or is all the upside already in the price?

Most Popular Narrative: 12.7% Undervalued

The prevailing narrative suggests CapitaLand Ascendas REIT is undervalued, trading below its estimated fair value amid a backdrop of measured yet promising growth drivers.

*Recently completed acquisitions (such as DHL Logistics Center in the US and high-yield Singapore assets) and redevelopment projects (like Geneo and 1 Science Park Drive) are set to be income-accretive, with yields of 6 to 7.6 percent. This positions the portfolio for higher future revenue and net property income as these assets stabilize and tenant contributions ramp up.*

Ready to uncover what really powers this bullish valuation? There is a bold set of financial forecasts lurking beneath the surface, including aggressive assumptions on revenue expansion, margin shifts, and future profits that break with conventional norms. Want a glimpse of the stretch goals built into this fair value? Discover the unexpected drivers that analysts believe can justify a richer price, and see if you agree with their outlook.

Result: Fair Value of $3.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in the US portfolio or higher refinancing costs could challenge projections and dampen the optimistic outlook for CapitaLand Ascendas REIT.

Find out about the key risks to this CapitaLand Ascendas REIT narrative.Another Perspective: SWS DCF Model Checks the Numbers

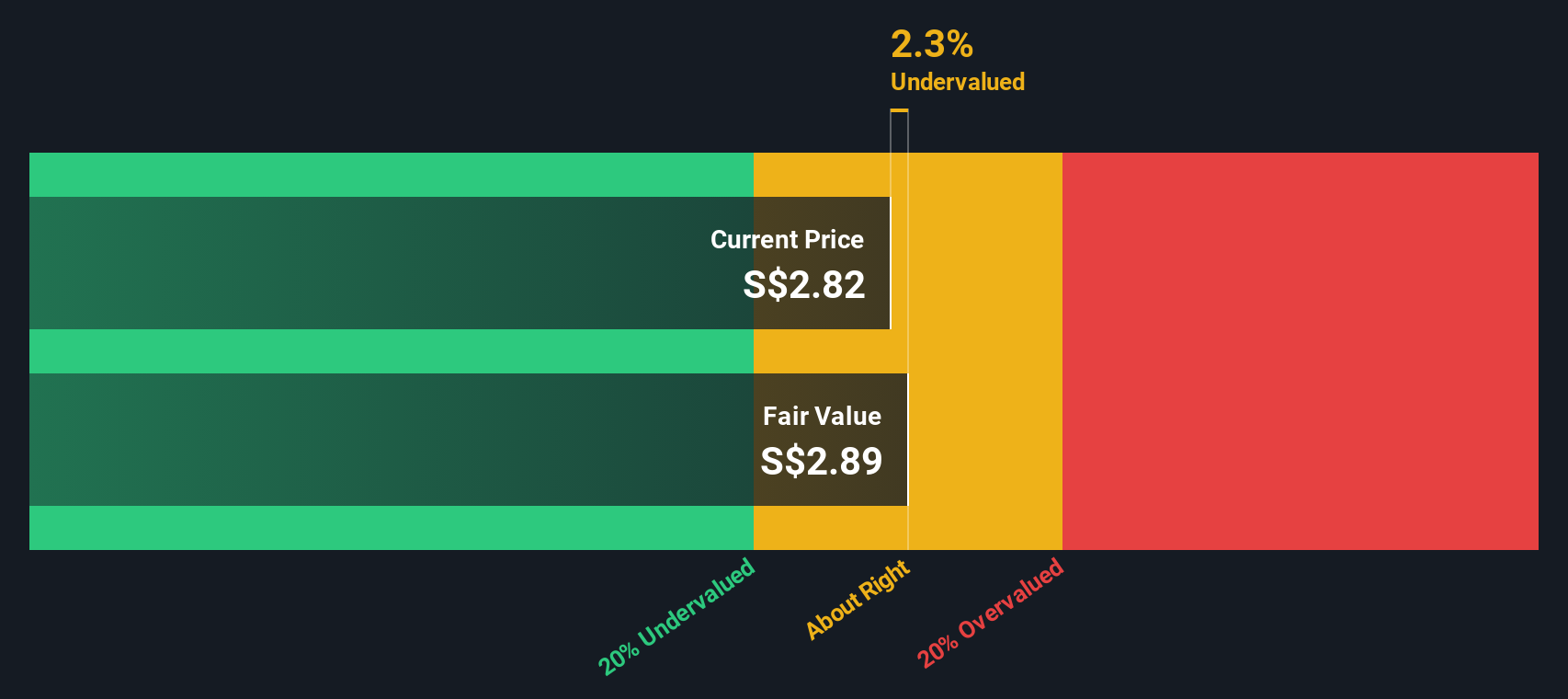

While analysts project an upside based on company growth, our SWS DCF model offers a fresh lens. It also suggests the REIT is undervalued, but it uses a different approach to valuation. How might this change your view?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CapitaLand Ascendas REIT Narrative

If you see it differently or want to dig into the data on your own terms, you can pull together a narrative in just minutes. Do it your way.

A great starting point for your CapitaLand Ascendas REIT research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investing Edge?

Do not miss your chance to uncover fresh opportunities. The Simply Wall Street Screener uncovers smart ideas you may not have considered. It is designed to help you get ahead of the crowd and make your next move count.

- Unlock the potential of future medicine by finding breakthrough innovators with healthcare AI stocks woven into their strategies.

- Boost your income potential and strengthen your portfolio by seeking out reliable companies offering dividend stocks with yields > 3% you can count on.

- Seize overlooked value plays and hunt for bargains before the market catches on, using insights into undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SGX:A17U

CapitaLand Ascendas REIT

CapitaLand Ascendas REIT (CLAR) is Singapore’s first and largest listed business space and industrial real estate investment trust (REIT).

Established dividend payer and good value.

Market Insights

Community Narratives