- Singapore

- /

- Real Estate

- /

- SGX:U14

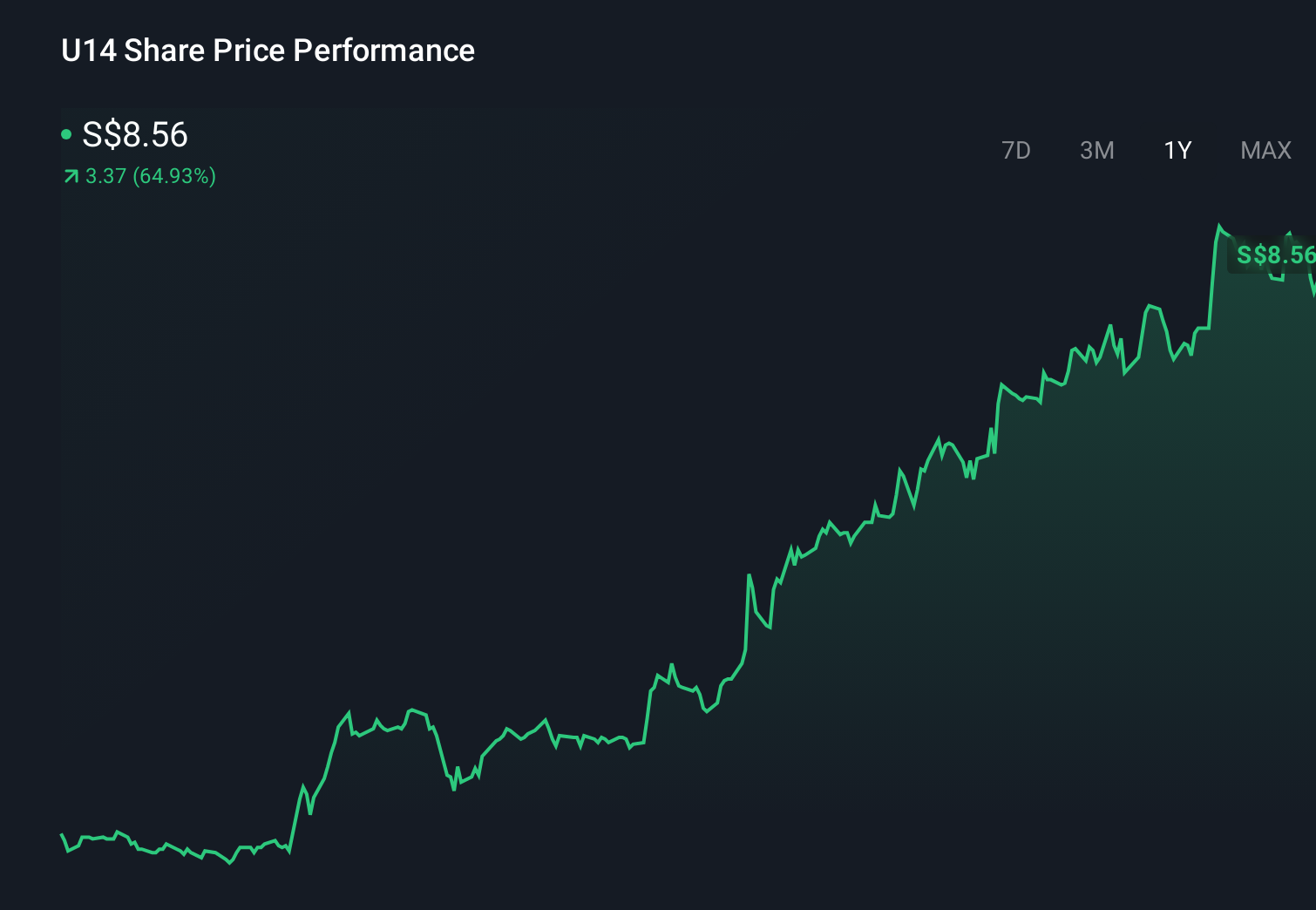

How Marina Square Redevelopment and Capital Recycling Will Impact UOL Group (SGX:U14) Investors

Reviewed by Sasha Jovanovic

- DBS Research recently issued a positive report on UOL Group Limited, highlighting the company’s active capital recycling, prudent gearing and operational momentum, including strong residential sales and competitive land bids.

- The report also underlined the progress of land consolidation at Marina Square, positioning its potential redevelopment as a key source of future value creation for UOL.

- We will now examine how Marina Square’s redevelopment prospects shape UOL Group’s investment narrative in light of this latest research commentary.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is UOL Group's Investment Narrative?

To own UOL Group, you need to believe in a disciplined property developer that can recycle capital, grow recurring income and unlock value from its landbank, even as earnings and revenue are forecast to ease. The recent DBS Research report, with its focus on active capital recycling, prudent gearing and Marina Square’s redevelopment, reinforces that story rather than changing it, but it does sharpen the near term catalyst set around asset monetisation and planning progress at Marina Square. Against a strong 1 year share price run and mixed earnings trends, the lower interest rate backdrop and first PBSA investment in Brighton may help support cash flow resilience, while risks such as low forecast returns on equity and soft revenue expectations stay firmly on the radar.

However, one key risk around future earnings trends is easy to overlook. UOL Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on UOL Group - why the stock might be worth over 4x more than the current price!

Build Your Own UOL Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UOL Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free UOL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UOL Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U14

UOL Group

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion