- Singapore

- /

- Real Estate

- /

- SGX:U14

3 SGX Dividend Stocks Yielding Up To 9.6%

Reviewed by Simply Wall St

The Singapore stock market has been experiencing a mix of volatility and resilience, reflecting broader economic uncertainties and investor sentiment. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.02% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.44% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.53% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.69% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.58% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.44% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.05% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.69% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

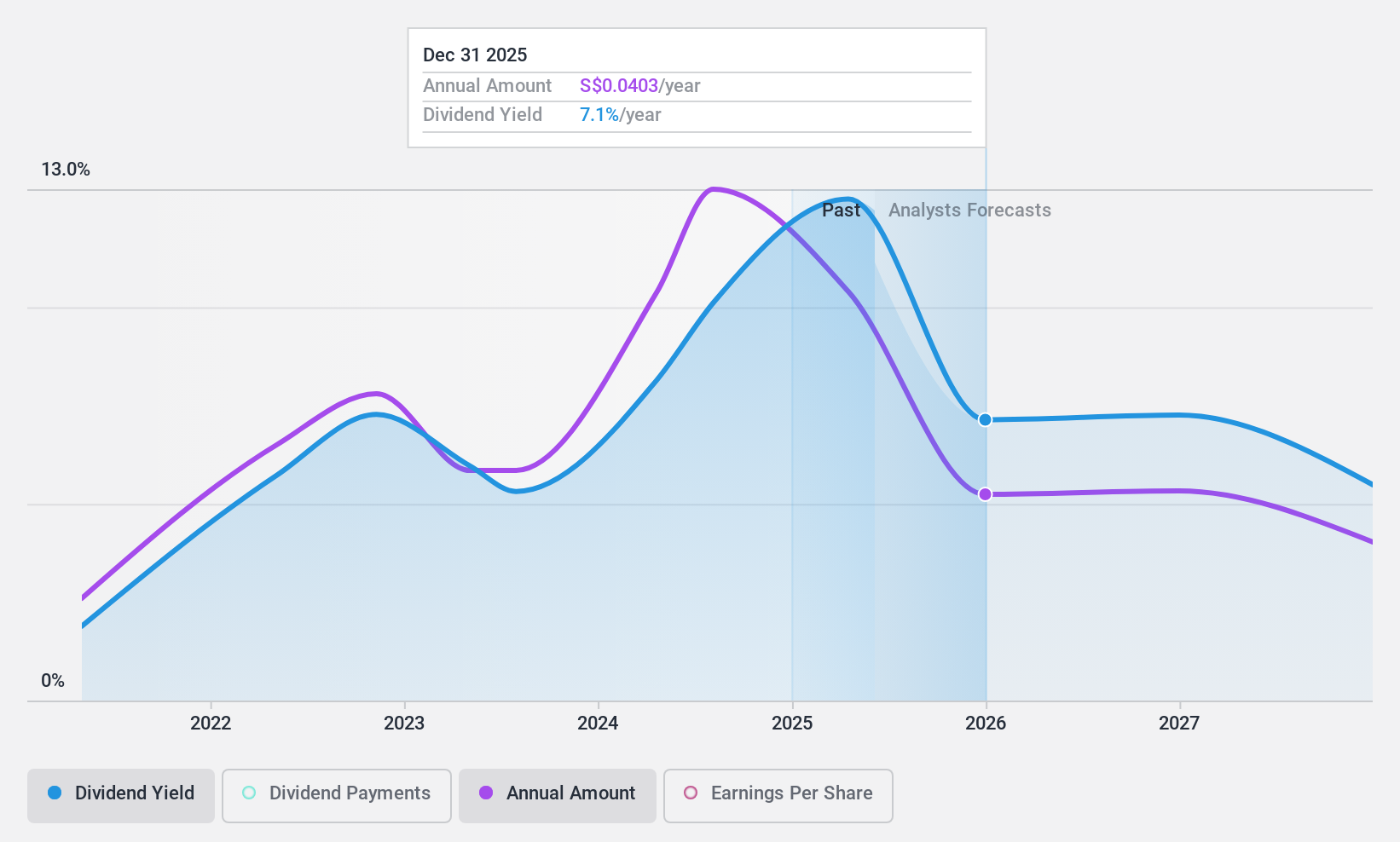

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. and its subsidiaries focus on the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets with a market cap of SGD802.83 million.

Operations: Aztech Global Ltd. generates revenue from IoT devices, data-communication products, and LED lighting products across various international markets.

Dividend Yield: 9.6%

Aztech Global's dividend yield of 9.62% places it in the top 25% of dividend payers in Singapore, though its track record is short and volatile, with payments only established for three years and experiencing significant drops. The company’s payout ratios—74.4% from earnings and 62.1% from cash flows—suggest dividends are covered but not entirely stable or reliable over time. Earnings grew by 54.3% last year, indicating potential for future stability if growth continues.

- Navigate through the intricacies of Aztech Global with our comprehensive dividend report here.

- Our valuation report unveils the possibility Aztech Global's shares may be trading at a discount.

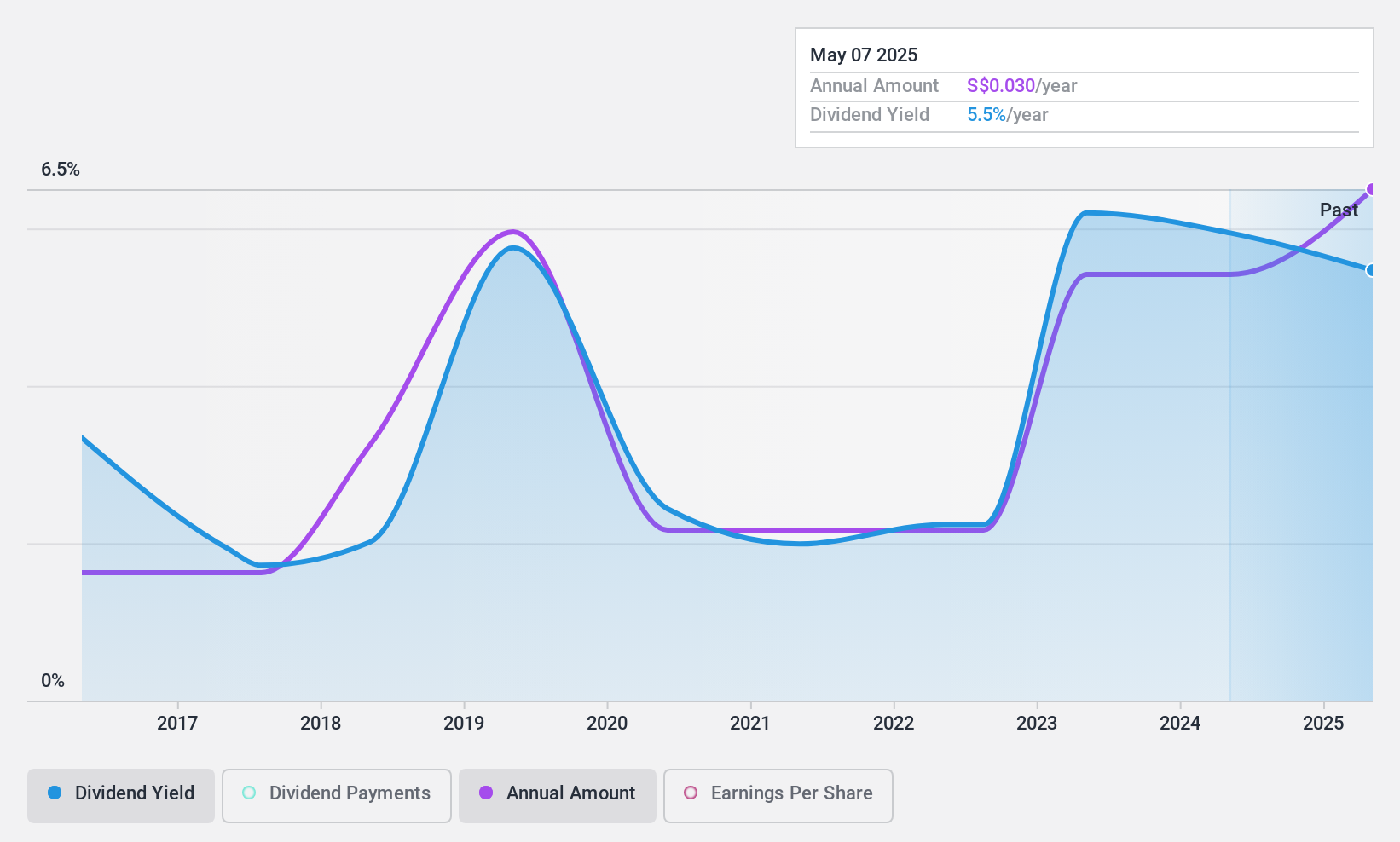

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across China, Asia, the United States, Europe, and internationally with a market cap of SGD362.96 million.

Operations: China Sunsine Chemical Holdings Ltd. generates its revenue primarily from Rubber Chemicals (CN¥4.38 billion), with additional contributions from Heating Power (CN¥221.29 million) and Waste Treatment (CN¥29.76 million).

Dividend Yield: 6.4%

China Sunsine Chemical Holdings offers a dividend yield of 6.44%, placing it in the top 25% of SG market payers. The company's dividends are well-covered by earnings (payout ratio: 20.8%) and cash flows (cash payout ratio: 30.2%), despite an unstable track record over the past decade. Recent share buybacks could signal confidence in future performance, though profit margins have declined from 16.8% to 10.7%.

- Dive into the specifics of China Sunsine Chemical Holdings here with our thorough dividend report.

- The analysis detailed in our China Sunsine Chemical Holdings valuation report hints at an deflated share price compared to its estimated value.

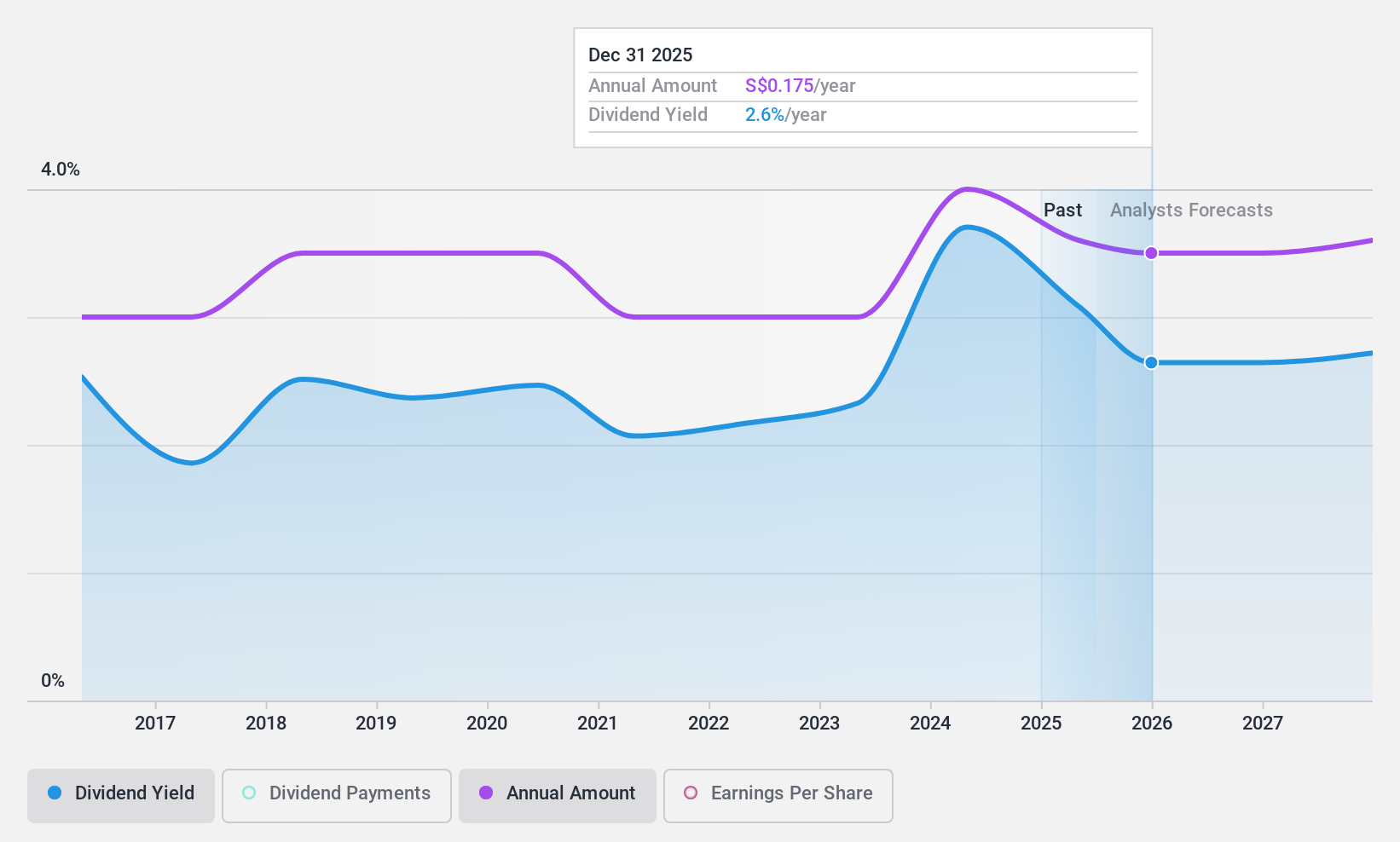

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property and hospitality sectors across various countries, including Singapore, Australia, the UK, China, and others, with a market cap of approximately SGD4.55 billion.

Operations: UOL Group Limited generates revenue from property investments (SGD518.93 million), technology operations (SGD110.08 million), hotel operations in Singapore (SGD464.93 million) and Australia (SGD125.64 million), other hotel operations (SGD172.40 million), property development in Singapore (SGD1.16 billion), China (SGD10.10 million) and the United Kingdom (SGD42.56 million).

Dividend Yield: 3.7%

UOL Group's dividend yield of 3.69% is below the top 25% of Singapore market payers but remains reliable and stable over the past decade. Dividends are well-covered by earnings (payout ratio: 17.9%) and cash flows (cash payout ratio: 59.3%). The company trades at a significant discount to its estimated fair value, despite recent large one-off items affecting financial results. A new CFO, Mr. Ng Tiang Poh, will join in June to support long-term growth strategies.

- Click to explore a detailed breakdown of our findings in UOL Group's dividend report.

- Our comprehensive valuation report raises the possibility that UOL Group is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 17 Top SGX Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U14

UOL Group

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives