- Singapore

- /

- Real Estate

- /

- SGX:TQ5

Frasers Property Limited's (SGX:TQ5) Share Price Is Matching Sentiment Around Its Revenues

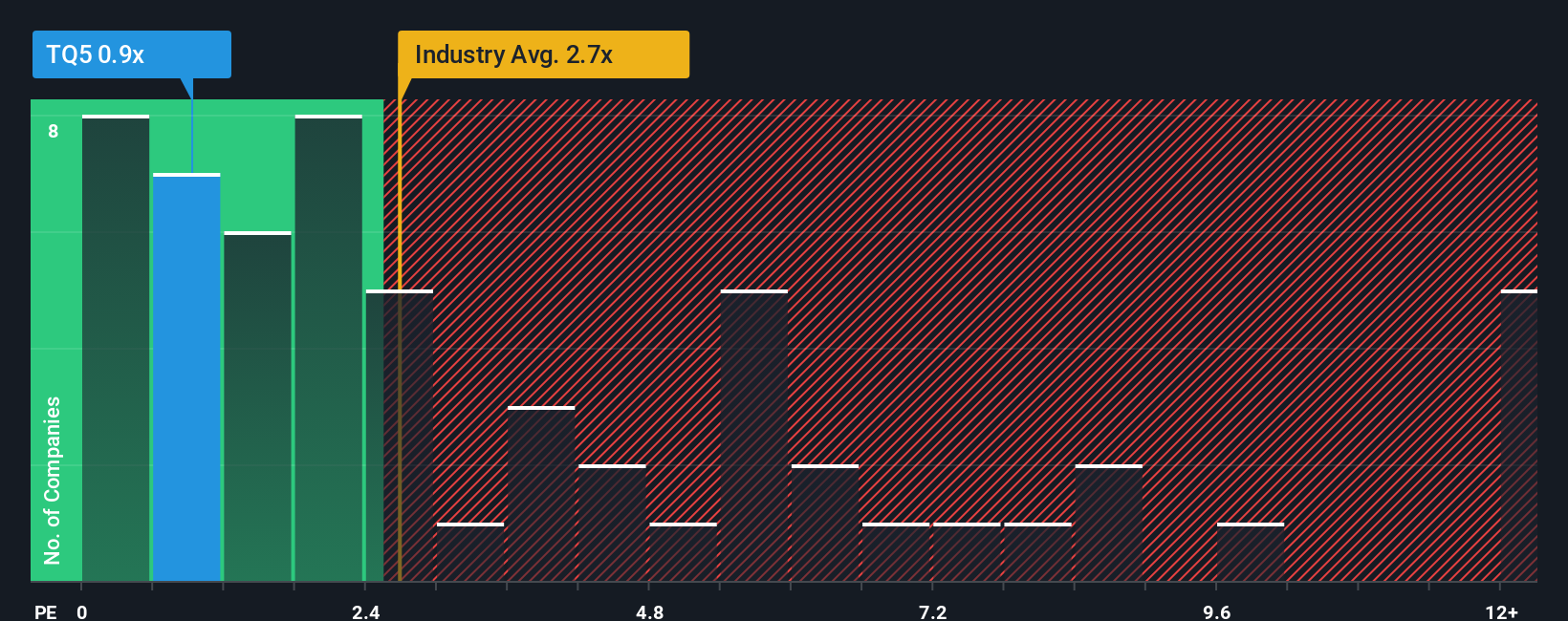

You may think that with a price-to-sales (or "P/S") ratio of 0.9x Frasers Property Limited (SGX:TQ5) is a stock worth checking out, seeing as almost half of all the Real Estate companies in Singapore have P/S ratios greater than 2.7x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Frasers Property

What Does Frasers Property's Recent Performance Look Like?

Frasers Property certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Frasers Property will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Frasers Property?

Frasers Property's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen a 9.7% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to plummet, contracting by 17% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to moderate by 3.1%, which indicates the company should perform poorly indeed.

In light of this, it's understandable that Frasers Property's P/S sits below the majority of other companies. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Bottom Line On Frasers Property's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Frasers Property's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Frasers Property (2 don't sit too well with us!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:TQ5

Frasers Property

An investment holding company, develops, invests in, and manages a portfolio of real estate assets in Singapore, Australia, Europe, China, Thailand, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.