- Canada

- /

- Residential REITs

- /

- TSX:MHC.UN

Global Undervalued Small Caps With Insider Actions In September 2025

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of optimism and caution, with smaller-cap stocks showing resilience amid fluctuating interest rate expectations and weaker-than-anticipated U.S. labor market data. As investors navigate these dynamic conditions, identifying small-cap companies that exhibit strong fundamentals and potential for growth can be particularly appealing, especially when insider actions suggest confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Foxtons Group | 10.6x | 1.0x | 39.42% | ★★★★★☆ |

| GDI Integrated Facility Services | 18.3x | 0.3x | 4.09% | ★★★★★☆ |

| Bytes Technology Group | 18.3x | 4.6x | 8.30% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 16.11% | ★★★★☆☆ |

| BWP Trust | 9.6x | 12.6x | 16.47% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.23% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -75.09% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.4x | 7.0x | 10.48% | ★★★★☆☆ |

| CVS Group | 45.3x | 1.3x | 37.76% | ★★★★☆☆ |

| Pizu Group Holdings | 11.9x | 1.2x | 42.32% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

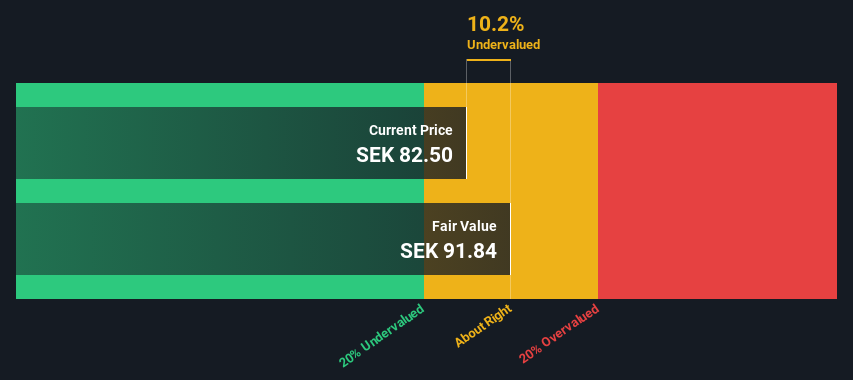

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: AcadeMedia is a leading education provider operating in various segments including adult education, compulsory school, upper secondary schools, and preschool & international services with a market cap of approximately SEK 5.8 billion.

Operations: AcadeMedia generates revenue primarily from its Preschool & International, Upper Secondary Schools, Compulsory School, and Adult Education segments. The company's gross profit margin has shown variability over the years, with a recent figure of 31.14%. Operating expenses are significant and include general and administrative costs.

PE: 11.7x

AcadeMedia, a small cap stock, shows potential with forecasted earnings growth of 12.68% annually. Recent insider confidence is evident as they increased their stake in the company between May and August 2025. For the fourth quarter ending June 30, 2025, sales rose to SEK 5.1 billion from SEK 4.9 billion year-on-year, while net income climbed to SEK 321 million from SEK 249 million. The board proposed a dividend increase to SEK 2.25 per share from last year's SEK 1.75, reflecting financial optimism despite reliance on external borrowing for funding rather than customer deposits.

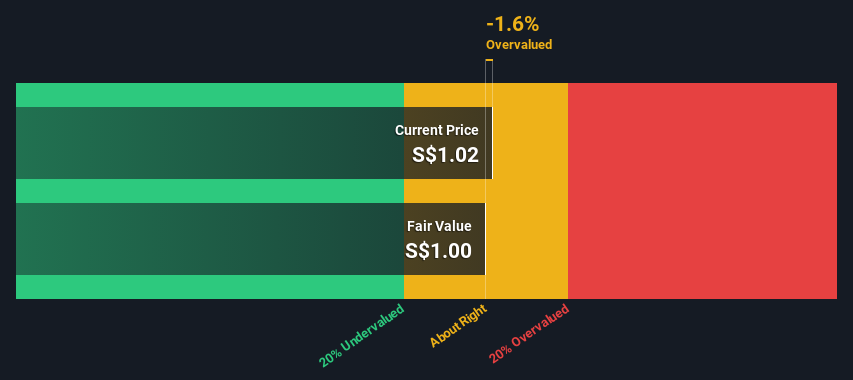

Far East Orchard (SGX:O10)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Far East Orchard is involved in property investment and various hospitality operations, including management services and property ownership, with a market capitalization of approximately SGD 1.05 billion.

Operations: The company's revenue streams are primarily derived from hospitality operations, hospitality management services, and hospitality property ownership. Over recent periods, the net income margin has demonstrated variability, reaching as high as 39.97% in June 2024. Operating expenses have consistently included significant general and administrative costs.

PE: 10.1x

Far East Orchard, a smaller company in the real estate sector, recently reported half-year sales of S$91.35 million and net income of S$19.59 million, showing an increase in earnings per share compared to last year. Despite relying on external borrowing for funding, the company's strategic leadership changes aim to bolster growth and operational excellence. Insider confidence is evident with recent stock purchases by key figures within the firm, suggesting belief in its potential amidst evolving market dynamics.

- Get an in-depth perspective on Far East Orchard's performance by reading our valuation report here.

Understand Far East Orchard's track record by examining our Past report.

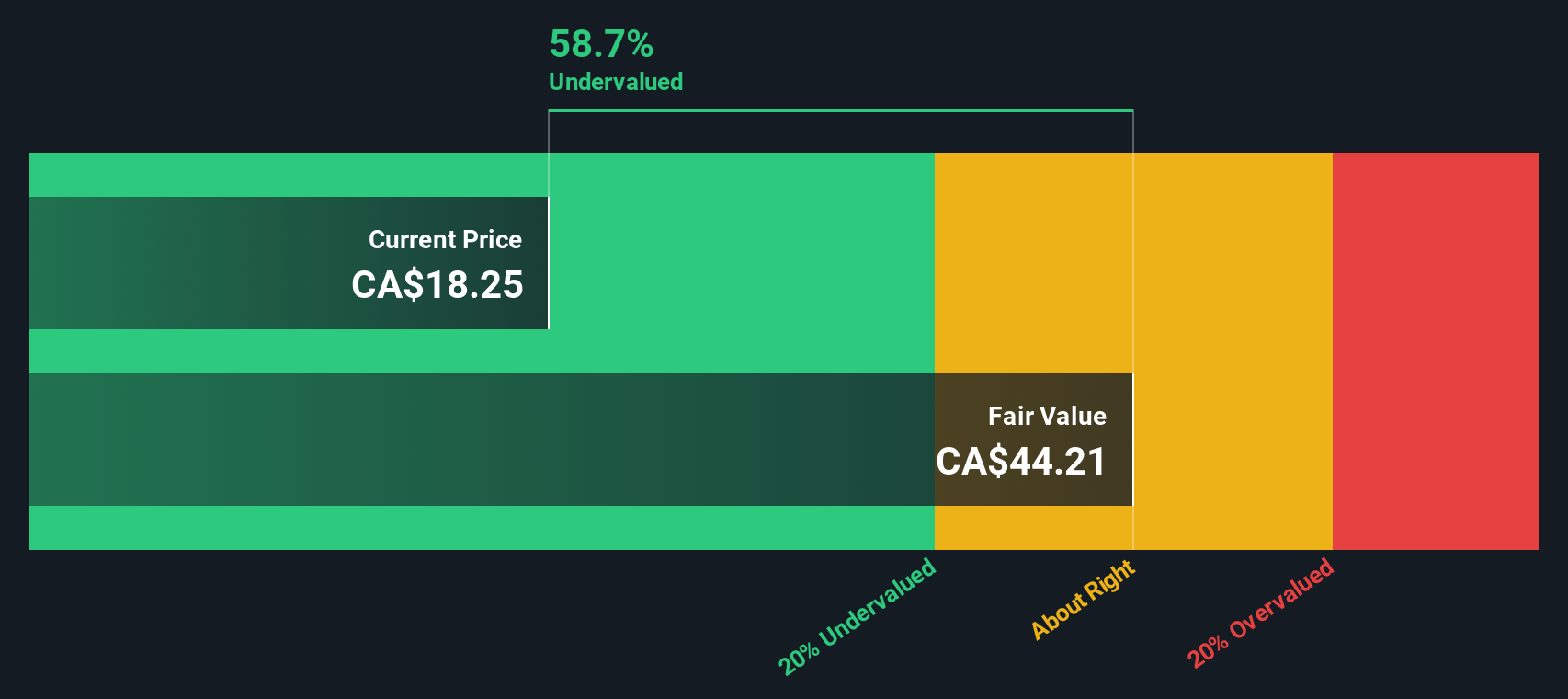

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market capitalization of approximately $0.52 billion CAD.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential real estate segment, with a recent quarterly revenue of $96.83 million. The company's cost of goods sold (COGS) was $32.70 million for the same period, resulting in a gross profit margin of 66.23%. Operating expenses, including general and administrative costs, amounted to $12.30 million, impacting net income outcomes significantly over time due to fluctuations in non-operating expenses.

PE: 3.8x

Flagship Communities REIT, a player in the manufactured housing sector, recently acquired a 504-lot community in Kentucky, poised to enhance its funds from operations. Despite facing earnings pressure with net income dropping to US$35 million for Q2 2025 from US$43 million the previous year, insider confidence is evident as an individual increased their shares by 137% in recent transactions. The company declared consistent monthly dividends of US$0.0517 per unit and continues expanding its property portfolio strategically.

Make It Happen

- Navigate through the entire inventory of 97 Undervalued Global Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MHC.UN

Flagship Communities Real Estate Investment Trust

An unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust dated August 12, 2020 (as subsequently amended and restated, the “Declaration of Trust”) under the laws of the Province of Ontario.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives