- Australia

- /

- Healthcare Services

- /

- ASX:IDX

April 2025's Top Undervalued Small Caps With Insider Action In The Asian Market

Reviewed by Simply Wall St

Amid heightened global trade tensions and economic uncertainty, Asian markets have been significantly impacted by the recent U.S. tariff announcements, with small-cap stocks facing particular challenges as evidenced by declines in key indices. In this environment, identifying promising small-cap opportunities requires a keen focus on companies with strong fundamentals and strategic insider action that could signal potential resilience or growth despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.8x | 1.1x | 38.24% | ★★★★★★ |

| New Hope | 5.3x | 1.5x | 37.86% | ★★★★★★ |

| Atturra | 26.2x | 1.1x | 42.82% | ★★★★★☆ |

| Puregold Price Club | 8.6x | 0.4x | 12.39% | ★★★★☆☆ |

| Dicker Data | 18.6x | 0.6x | -31.97% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.75% | ★★★★☆☆ |

| PWR Holdings | 34.7x | 4.8x | 24.71% | ★★★☆☆☆ |

| Zip Co | NA | 1.8x | -29.36% | ★★★☆☆☆ |

| Integral Diagnostics | 149.7x | 1.7x | 43.99% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.6x | 43.39% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Integral Diagnostics (ASX:IDX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Integral Diagnostics operates diagnostic imaging facilities and has a market capitalization of approximately A$1.15 billion.

Operations: The company generates revenue primarily from operating diagnostic imaging facilities, with the latest reported revenue at A$491.32 million. Over recent periods, the gross profit margin has shown a slight decline to 31.66%. Operating expenses and non-operating expenses have been significant factors affecting net income, which recently turned positive after several quarters of losses.

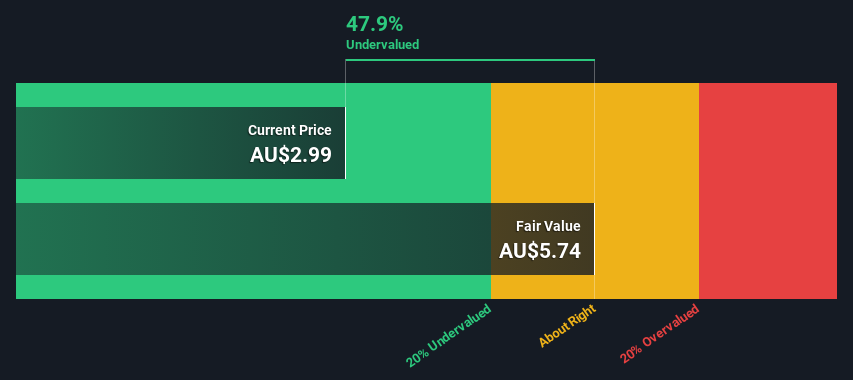

PE: 149.7x

Integral Diagnostics, with a market value of A$837 million, is attracting attention from private equity firms after recent share price declines. Despite this, insider confidence is evident as an individual purchased 36,000 shares for A$78,840 in early 2025. The company reported half-year sales of A$252.87 million and a net loss reduction to A$0.396 million from the previous year's A$66.76 million loss. Earnings are projected to grow by 40% annually, indicating potential future growth despite current challenges in covering interest payments through earnings alone.

PWR Holdings (ASX:PWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PWR Holdings specializes in the design and manufacturing of advanced cooling solutions for the automotive and motorsports industries, with a market capitalization of A$1.16 billion.

Operations: The company's primary revenue streams are from PWR C&R and PWR Performance Products, with total revenues reaching A$138.074 million in the latest period. The gross profit margin has fluctuated over time, with a recent figure of 79.69%. Operating expenses have increased to A$82.945 million, impacting net income which stands at A$19.108 million for the same period.

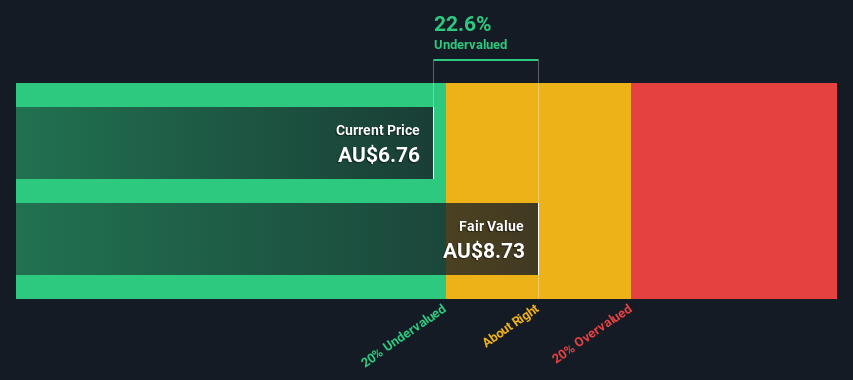

PE: 34.7x

PWR Holdings, a smaller player in Asia, shows potential despite recent challenges. The company reported A$62.9 million in sales for the half year ending December 31, 2024, down from A$64.22 million the previous year, with net income also dropping to A$4.08 million from A$9.78 million. Insider confidence is evident as they purchased shares recently, suggesting belief in future growth prospects despite current earnings pressure and a reduced dividend of A$0.02 per share announced for March 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of PWR Holdings.

Gain insights into PWR Holdings' past trends and performance with our Past report.

Far East Orchard (SGX:O10)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Far East Orchard is involved in property investment and hospitality operations, focusing on property ownership and management services, with a market capitalization of approximately SGD 0.61 billion.

Operations: The company's revenue streams are primarily derived from hospitality operations and property ownership, with significant contributions from student accommodation and management services. Over recent periods, the gross profit margin has shown a notable increase, reaching 49.60% by the end of 2024.

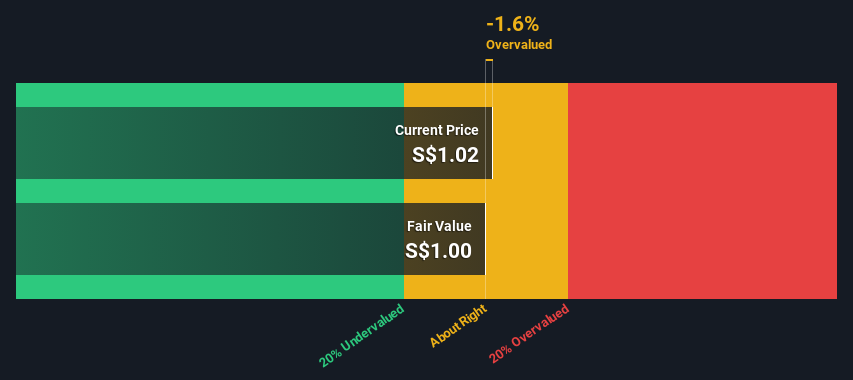

PE: 8.5x

Far East Orchard, a small-cap stock in Asia, presents an intriguing opportunity due to its current valuation. Recent insider confidence is evident from share purchases in the past year, signaling potential growth prospects. The company announced a special dividend of 1 Singapore cent per share and a final dividend of 4 cents for FY2024 after divesting RHPC. Despite its reliance on external borrowing for funding, it maintains high-quality earnings with minimal one-off impacts.

- Unlock comprehensive insights into our analysis of Far East Orchard stock in this valuation report.

Explore historical data to track Far East Orchard's performance over time in our Past section.

Key Takeaways

- Click here to access our complete index of 59 Undervalued Asian Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IDX

Integral Diagnostics

A healthcare services company, provides diagnostic imaging services to general practitioners, medical specialists, and allied health professionals and their patients in Australia and New Zealand.

Reasonable growth potential with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)