- Singapore

- /

- Real Estate

- /

- SGX:H78

Hongkong Land Holdings (SGX:H78) shareholders have earned a 99% return over the last year

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Hongkong Land Holdings Limited (SGX:H78) share price is up 88% in the last 1 year, clearly besting the market return of around 15% (not including dividends). So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 30% in the last three years.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Because Hongkong Land Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Hongkong Land Holdings grew its revenue by 8.6% last year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 88%. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

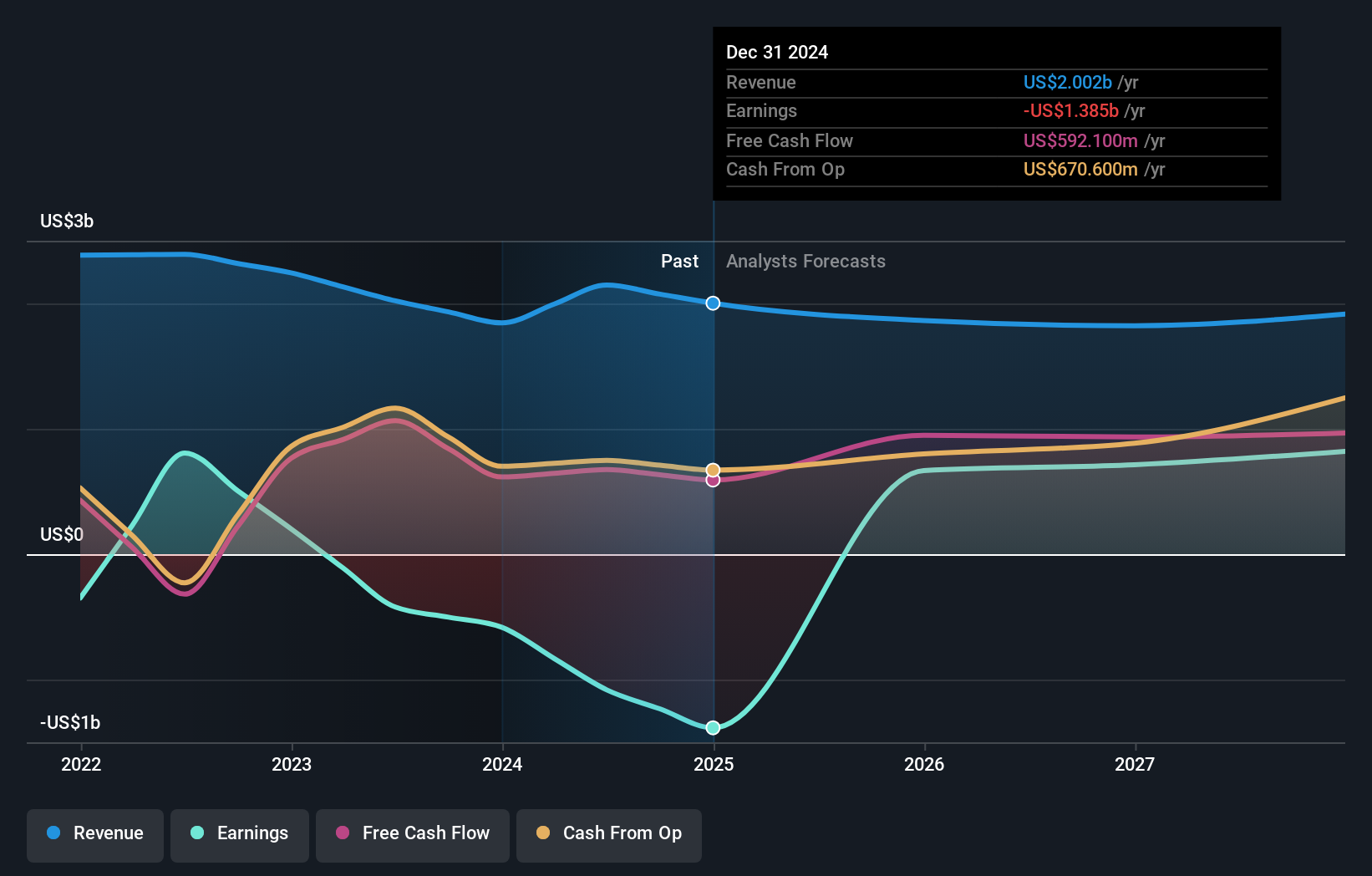

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Hongkong Land Holdings stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hongkong Land Holdings the TSR over the last 1 year was 99%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Hongkong Land Holdings shareholders have received a total shareholder return of 99% over the last year. That's including the dividend. That's better than the annualised return of 15% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hongkong Land Holdings better, we need to consider many other factors. Even so, be aware that Hongkong Land Holdings is showing 2 warning signs in our investment analysis , you should know about...

Hongkong Land Holdings is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives