- Singapore

- /

- Real Estate

- /

- SGX:9CI

Reassessing CapitaLand Investment (SGX:9CI)’s Valuation After New China Sub-Fund and US$650m Ascott Vehicle Closures

Reviewed by Simply Wall St

CapitaLand Investment (SGX:9CI) has just wrapped up its second onshore China sub fund and a US$650 million Ascott lodging vehicle, underscoring how fee based capital strategies are shaping the stock’s appeal.

See our latest analysis for CapitaLand Investment.

Despite these steady fund launches and growing exposure to data centres and India, the 1 year total shareholder return is a modest 8.9 percent and the 3 year total shareholder return remains negative. This suggests longer term sentiment is still rebuilding even as near term momentum improves.

If CapitaLand Investment’s platform strategy interests you, it can be worth scanning beyond real assets and discovering fast growing stocks with high insider ownership for other ideas where growth and alignment with insiders could be stronger.

With analyst targets implying nearly 30 percent upside but three year returns still in the red, are investors overlooking CapitaLand Investment’s fee based growth engine, or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 22.9% Undervalued

CapitaLand Investment’s most followed narrative pegs fair value at around SGD3.44 versus the last close at SGD2.65, framing a sizeable valuation gap that hinges on aggressive margin expansion and earnings compounding.

Strategic expansion into the private credit sector through the Wingate acquisition, with ambitions to scale private credit from $3 billion to $20 billion to $30 billion AUM, positions the company to capture early-mover advantage in a rapidly expanding segment and significantly boost recurring fee and performance income, supporting revenue and net margin uplift over the medium to long term.

Want to see why slower top line projections still point to powerful earnings growth? The secret lies in bolder margins and richer fee income. Curious which assumptions really stretch the profit multiple behind this fair value call? Dive in to uncover the numbers driving this narrative.

Result: Fair Value of $3.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged China headwinds or integration missteps with acquisitions like Wingate could delay capital recycling, compress fee yields and undermine the margin expansion story.

Find out about the key risks to this CapitaLand Investment narrative.

Another Lens On Value

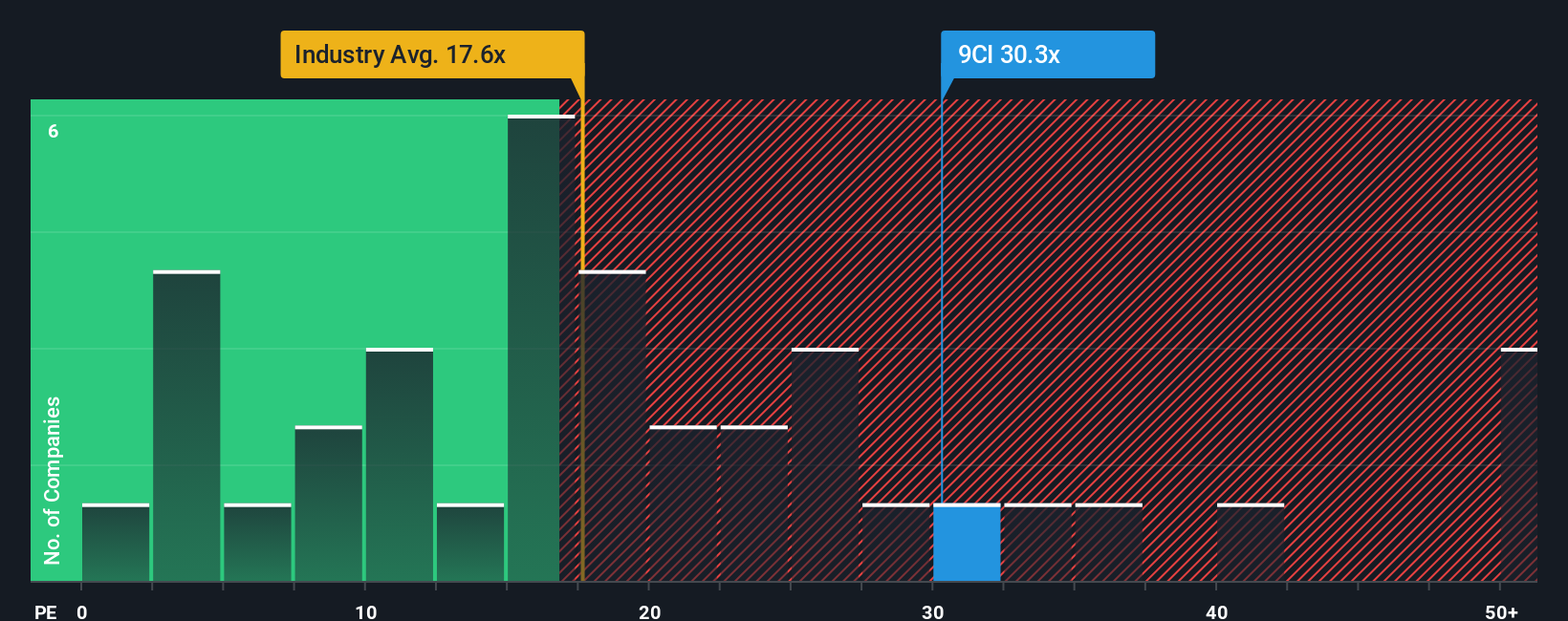

On a simple price to earnings basis, CapitaLand Investment looks far less forgiving, trading at about 30.4 times earnings versus 17.9 times for the Singapore real estate sector and a fair ratio of 21.5 times. This tilts the risk reward toward de rating rather than re rating if execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CapitaLand Investment Narrative

If you would rather test the assumptions yourself and challenge this view, you can build a fresh, data driven narrative in minutes: Do it your way.

A great starting point for your CapitaLand Investment research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunities with targeted stock ideas powered by real fundamentals, not hype, so you are never caught reacting late.

- Capture potential mispricing early by scanning these 914 undervalued stocks based on cash flows that the market may be overlooking today but cash flows suggest still have room to run.

- Ride powerful structural shifts in medicine by focusing on these 30 healthcare AI stocks that blend innovation with real world adoption and growing demand.

- Boost your income stream by reviewing these 12 dividend stocks with yields > 3% that offer attractive yields while still maintaining solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:9CI

CapitaLand Investment

Headquartered and listed in Singapore in 2021, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold.

Proven track record with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)