Global markets have shown mixed performances recently, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, while others such as the Russell 2000 experienced declines. Amid these fluctuations, investors are increasingly looking at diverse opportunities across various market segments. Penny stocks, though often seen as a relic of past speculative trends, still offer intriguing prospects for growth due to their lower price points and potential for significant returns when backed by strong financials. Here we explore three penny stocks that stand out for their robust fundamentals and potential upside in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £808.16M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £159.32M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

China Brilliant Global (SEHK:8026)

Simply Wall St Financial Health Rating: ★★★★★☆

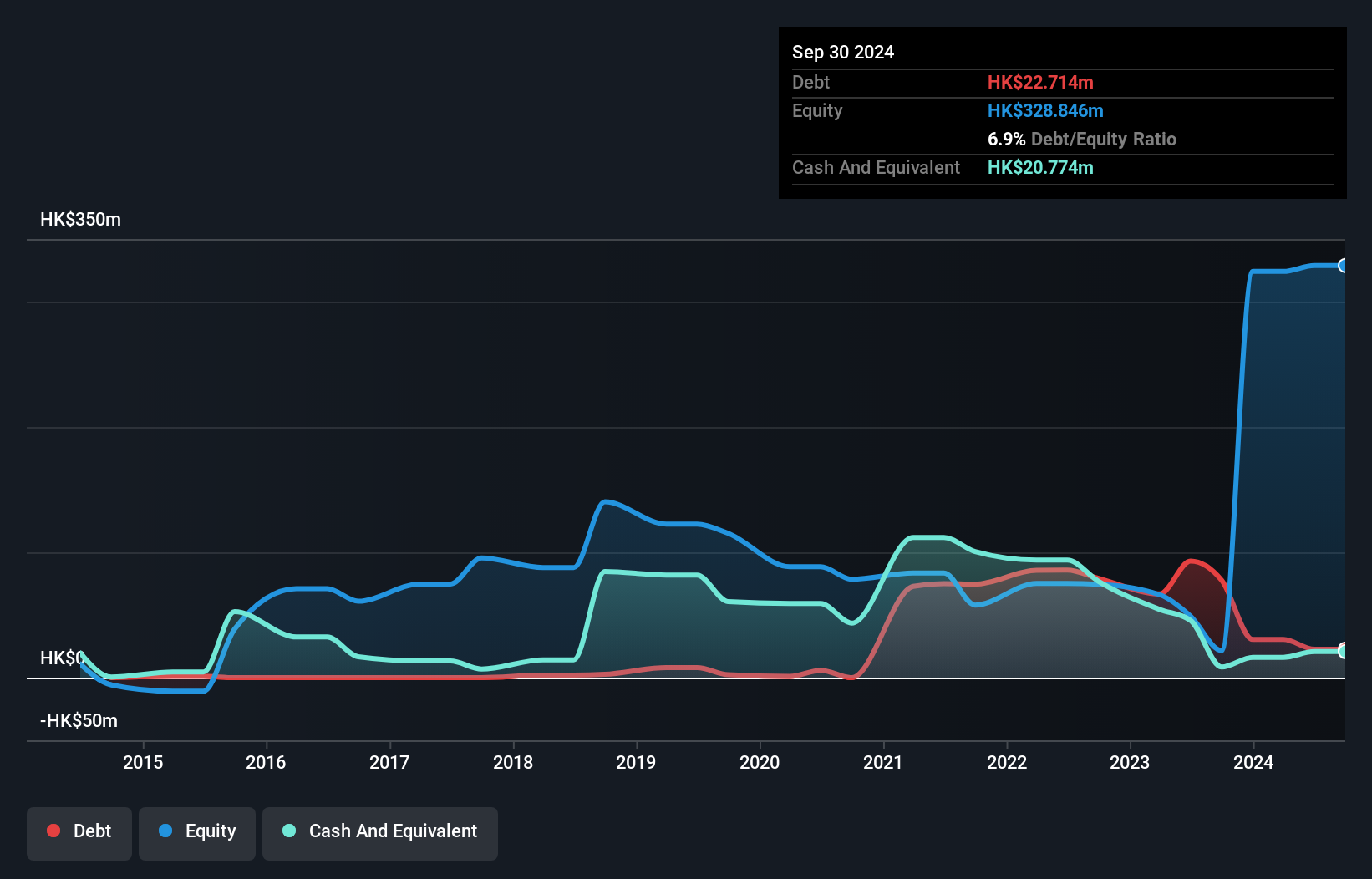

Overview: China Brilliant Global Limited is an investment holding company involved in the R&D, design, wholesale, and retail of gold and jewelry in Hong Kong and China, with a market cap of HK$502.75 million.

Operations: The company generates revenue from three main segments: Lending Business (HK$2.15 million), Gold and Jewellery Business (HK$78.77 million), and Property Management Services Business (HK$14.07 million).

Market Cap: HK$502.75M

China Brilliant Global Limited, with a market cap of HK$502.75 million, has shown a significant turnaround by reporting a net income of HK$4.27 million for the half year ending September 2024, compared to a loss in the previous year. This improvement is attributed to the disposal of its fintech business and profit generation across all segments, particularly from property management services and reversal of impairment losses. The company maintains sufficient cash runway for over three years despite being unprofitable previously and has not diluted shareholder value recently. However, its share price remains highly volatile.

- Take a closer look at China Brilliant Global's potential here in our financial health report.

- Understand China Brilliant Global's track record by examining our performance history report.

Grand Venture Technology (SGX:JLB)

Simply Wall St Financial Health Rating: ★★★★☆☆

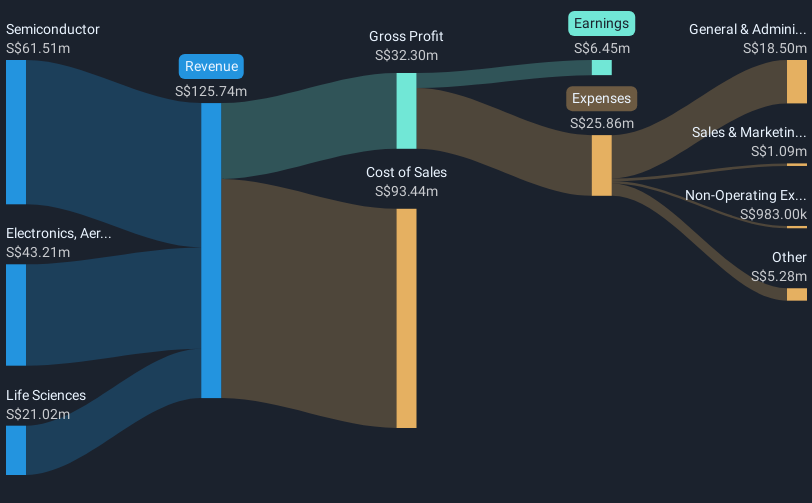

Overview: Grand Venture Technology Limited provides precision manufacturing solutions across the semiconductor, life sciences, electronics, aerospace, and medical industries globally, with a market cap of SGD193.39 million.

Operations: The company's revenue is derived from three main segments: Semiconductor (SGD61.51 million), Electronics, Aerospace, Medical and Others (SGD43.21 million), and Life Sciences (SGD21.02 million).

Market Cap: SGD193.39M

Grand Venture Technology Limited, with a market cap of SGD193.39 million, derives its revenue from semiconductor (SGD61.51 million), electronics, aerospace, medical (SGD43.21 million), and life sciences (SGD21.02 million) segments. Despite experiencing negative earnings growth over the past year and lower profit margins compared to last year, the company maintains satisfactory net debt to equity levels at 37.3%. Its operating cash flow adequately covers its debt obligations by 24.3%, although interest coverage remains slightly below ideal levels at 2.9 times EBIT. The board is experienced with an average tenure of 5.9 years.

- Get an in-depth perspective on Grand Venture Technology's performance by reading our balance sheet health report here.

- Gain insights into Grand Venture Technology's future direction by reviewing our growth report.

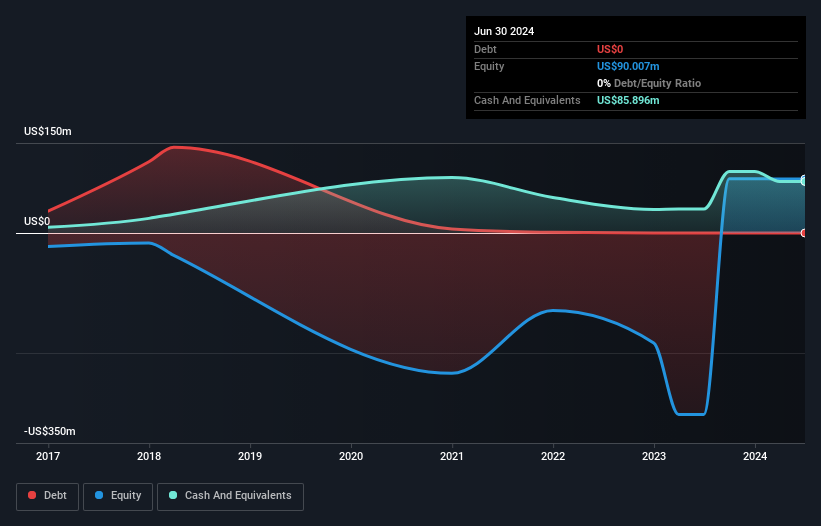

17LIVE Group (SGX:LVR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 17LIVE Group Limited operates a live streaming platform and has a market cap of SGD173.90 million.

Operations: The company generates revenue primarily from its live streaming segment, which accounts for $220.46 million.

Market Cap: SGD173.9M

17LIVE Group Limited, with a market cap of SGD173.90 million, primarily generates revenue from its live streaming segment amounting to US$220.46 million. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a robust financial position with short-term assets of US$102.6 million exceeding both its short-term liabilities (US$45.7 million) and long-term liabilities (US$2.9 million). It is debt-free and has a cash runway exceeding three years based on current free cash flow levels, though it faces challenges with an inexperienced management team and board of directors.

- Jump into the full analysis health report here for a deeper understanding of 17LIVE Group.

- Learn about 17LIVE Group's future growth trajectory here.

Taking Advantage

- Investigate our full lineup of 5,714 Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:JLB

Grand Venture Technology

Offers precision manufacturing solutions for the semiconductor, life sciences, electronics, aerospace, and medical industries in Singapore, Malaysia, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.